Short-Term Forecast For Tuesday, March 31

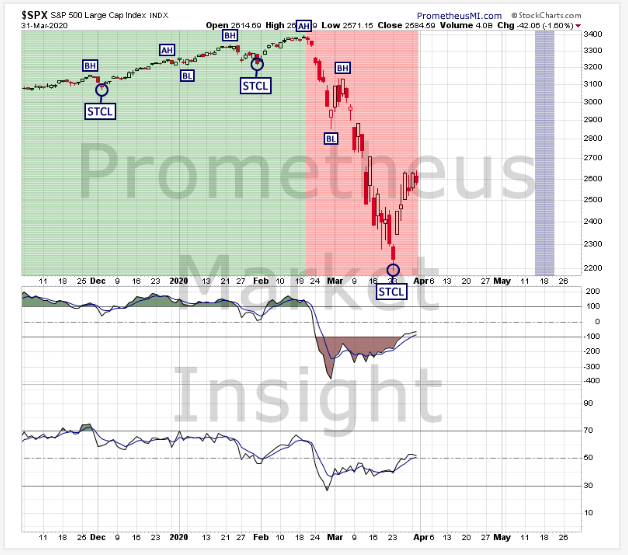

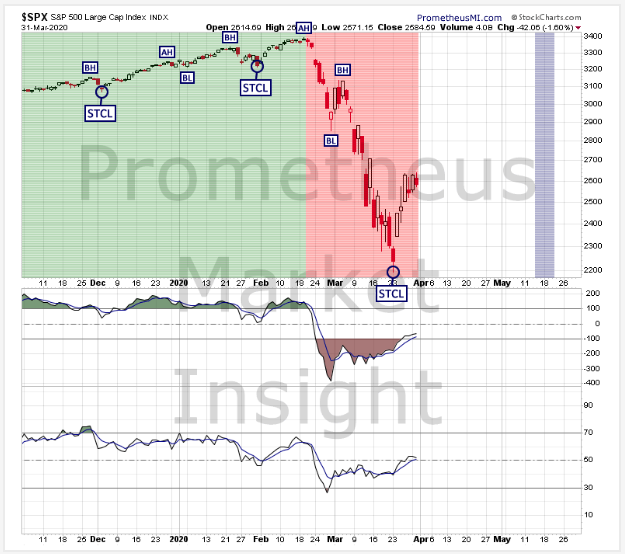

We are 6 sessions into the alpha phase rally of the short-term cycle that began on March 24. The magnitude and duration of the last beta phase decline reconfirm the current bearish short-term trend and favor additional short-term weakness during the next decline phase.

(Click on image to enlarge)

S&P 500 Index Daily Chart Analyses

The following technical and cycle analyses provide short-term forecasts for the S&P 500 index.

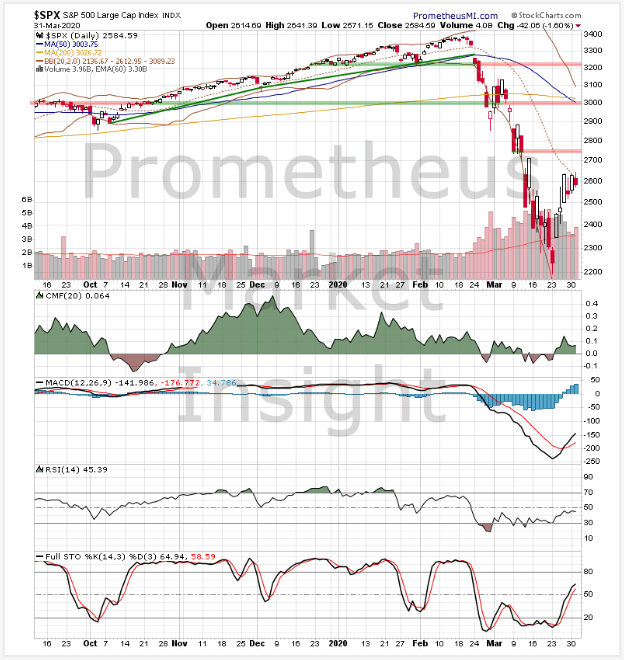

Technical Analysis

The index closed sharply lower today, retreating from recent short-term highs above previous lows of the violent downtrend from February. Technical indicators are moderately bearish overall, favoring a return to previous lows of the decline.

(Click on image to enlarge)

Cycle Analysis

We are 6 sessions into the alpha phase rally of the cycle following the short-term cycle low (STCL) on March 23. The magnitude and duration of the last beta phase decline reconfirm the bearish translation and favor additional short-term weakness. The window during which the next STCL is likely to occur is from May 4 to May 22, with our best estimate being in the May 14 to May 20 range.

- Last STCL: March 23, 2020

- Cycle Duration: 6 sessions

- Cycle Translation: Bearish

- Next STCL Window: May 4 to May 22; best estimate in the May 14 to May 20 range.

- Setup Status: No active setups.

- Trigger Status: No pending triggers.

- Signal Status: No active signals.

- Stop Level: None active.

(Click on image to enlarge)

Short-term Outlook

- Bullish Scenario: A close well above the recent short-term high at 2,630 would reconfirm the oversold reaction from last week and predict a return to congestion resistance in the 2,750 area.

- Bearish Scenario: A reversal and close below the previous short-term low at 2,237 would reconfirm the downtrend from February and forecast additional losses.

The bearish scenario is slightly more likely (~60 probable).

We will identify the key developments moving forward as they occur in our daily market forecasts and signal notifications available to paid subscribers. Try ...

more