Short Blue Apron Ahead Of Lockup Expiration

December 26, 2017, concludes the 180-day lockup period on Blue Apron Holdings, Inc. (NYSE:APRN).

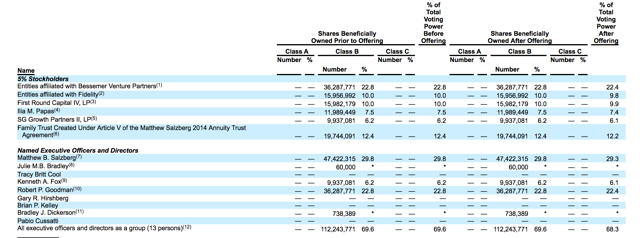

When the lockup period ends for APRN, its pre-IPO shareholders, directors, and executives will have the chance to sell their 160.7 million outstanding shares. The potential for a sudden increase in stock available in the open market may cause a significant decrease in the price of Blue Apron shares.

Currently APRN trades in the $3.50 to $4.00 range, significantly below its IPO price of $10 and lower than its first day closing price of $10 on June 29, 2017.

Business Overview: Provider of Ingredients and Recipes for Home Cooking

Blue Apron Holdings, Inc. operates an online marketplace that delivers original recipes and fresh ingredients for making home cooking accessible. It provides original recipes along with the pre-portioned ingredients to make a home cooked meal easier. The company states that its meals complement tastes and lifestyles of college graduates, young couples, families, singles, and empty nesters. The company also offers Blue Apron Wine, a direct-to-consumer wine delivery service that sells wines, which can be paired with its meals; and sells beef, poultry, and lamb products under the BN Ranch brand name. Its meal products are accompanied by printed and digital content, including how-to instructions, and the stories of its suppliers and specialty ingredients.

(Source: S-1/A)

From the beginning of the company through March 31, 2017, Blue Apron has delivered over 159 million meals to households across the United States, which represents approximately 25 million paid orders. The company offers its services through order selections on website or mobile application in the United States. Blue Apron Holdings, Inc. was incorporated in 2016 and is headquartered in New York, New York.

Financial Highlights

Blue Apron Holdings reported the following financial highlights for the third quarter of 2017 ended September 30:

-

Net revenue increased 3% year-over-year to $210.6 million in the third quarter of 2017 as a result of an increase in average revenue per customer, partially offset by a decrease in customers.

-

Cost of goods sold (COGS), excluding depreciation and amortization, increased 13% year-over-year to $164.4 million in the third quarter of 2017, and increased by 720 basis points as a percentage of net revenue from 70.9% to 78.1%.

-

Net loss was $(87.2) million and diluted loss per share was $(0.47) in the third quarter of 2017.

-

Adjusted EBITDA was a loss of $(48.0) million in the third quarter 2017 compared to a loss of $(34.6) million in the third quarter of 2016.

Management Team

President and CEO Bradley Dickerson has served Blue Apron since November 30, 2017. He previously served the company as CFO and treasurer. His previous experience comes from senior financial positions at Under Armour (NYSE:UAA), Macquarie Aviation North America, and Network Building and Consulting. Mr. Dickerson holds a B.S. degree in accounting from the University of Akron and an MBA degree from Loyola University Maryland.

Co-Founder and Executive Chairman Matthew Salzberg previously held the positions of president and CEO. His previous experience comes from Bessemer Venture Partners and The Blackstone Group. He received an MBA and a BA in Economics, summa cum laude, from the Harvard University.

Competition

Blue Apron faces significant competition from conventional sources such as other food and meal delivery companies, food retailers, the supermarket industry, food manufacturers, consumer packaged goods companies, and casual dining and quick service restaurants.

Early Market Performance

Blue Apron Holdings’ IPO priced at $10 per share, at the low end of its expected price range of $10 to $11. The original expected price range was $15 to $17, but the underwriters lowered the price range. The stock closed on the first day of trading at $10. Since that time, the stock has declined steadily. It now trades around $3.50.

Summary

When the Blue Apron IPO lockup expires on December 26, a sizable group of currently-restricted individuals and corporate entities will be able to sell their sizable restricted stakes in the company for the first time. This group of six corporate entities and thirteen insiders own more than 160 million restricted shares. If even just some of these restricted shareholders sell a portion of their shares, the marketplace could be flooded - just 30 million shares are currently trading pursuant to the offering.

(Click on image to enlarge)

(Source: S-1/A)

Risk-tolerant, aggressive investors should short shares of Blue Apron ahead of the December 26th lockup expiration and ride shares lower as the insiders and pre-IPO shareholders lighten up their stakes. Interested investors should cover these short positions late during the trading session on December 26th or during the trading session on December 27th.

Disclosure: I am/we are short APRN.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more