Shopify Stock Analysis And Buy Signal?

**This article is a transcription of the video above.

Hi everyone, welcome to another video by Stocktrades.

Today, we’re going to look at one of the hottest stocks on the TSX Index, Shopify (TSX:SHOP)(SHOP).

It’s a company I own, a company I like, and it’s one we’re going to take a deeper dive into.

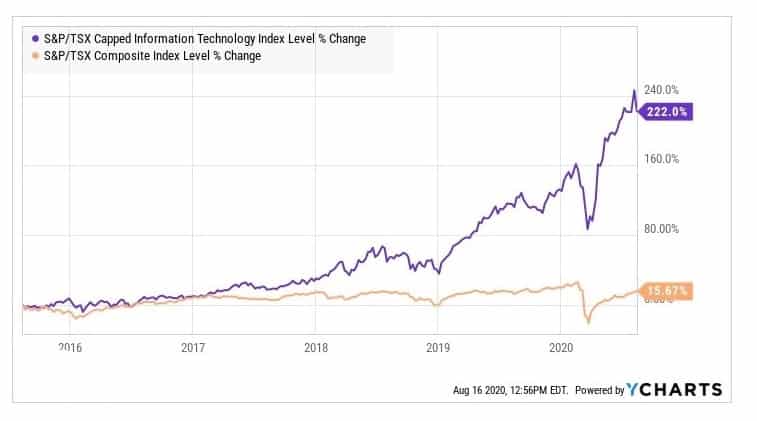

Shopify (TSX:SHOP) and other tech stocks have dominated the TSX

As you can see, if you didn’t hold tech, you’re likely going to be underperforming the Index. This is especially true over the past year, where the pandemic has accelerated growth in a lot of tech areas. Specifically software, Software as a Service, SaaS.

These companies have absolutely exploded, and among them, Shopify.

Shopify has been among the best performing stocks on the TSX Index since its IPO back in 2015.

In fact, if you look at the top 5 performing stocks on the TSX each of those years, Shopify would be among them.

So why has Shopify outperformed to such a degree? The answer is simple.

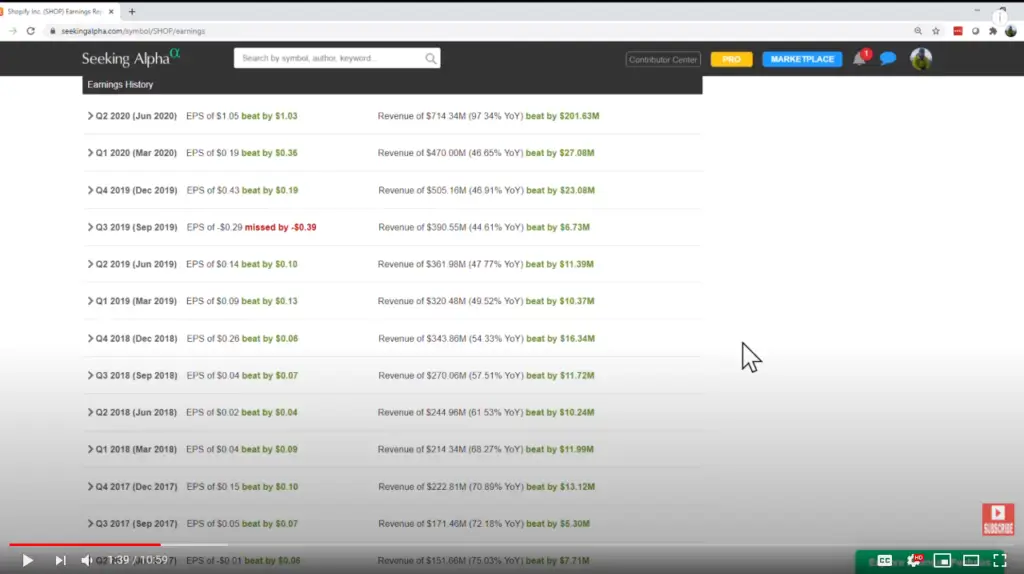

The markets and analysts continue to underestimate the company.

Let's take a quick look at the company’s performance since its IPO. You’ll see a ton of green, and not much red. In fact, the company has either met or beat expectations pretty much every quarter since it went public.

The only miss was in the third quarter of 2019. Outside of that, it has beat or met expectations in every single quarter.

Its this type of outperformance that has made Shopify a cult stock. There is nothing that seems to hold this company down. Thanks to Shopify’s outstanding performance, it is now also the most valuable publicly traded company in the country.

It is also the top weighted stock on the TSX. This is important. Why?

Because Shopify’s performance is actually magnifying the performance of the TSX Index. Through the end of July, the TSX Index lost approximately 5.4% of its value. Through that period, Shopify accounted for 4.5 points of that performance.

What does that mean? It means that without Shopify, the TSX Index as of the end of July, would be down by 9.9%. It’s performance cannot be understated, Shopify is a beast.

So where does it go from here?

First, lets take a look at the company’s latest quarterly results.

It was a blowout quarter for the company. Second quarter revenue grew by 97%, and gross merchant volume grew by 119% over the second quarter of 2019.

This surpassed even the most bullish of expectations. No one expected the company to do that well. Why did it do so well?

Not surprisingly, the rapid shift to online commerce. The pandemic has accelerated the behavior patterns of consumers who are now buying more online. The shift to eCommerce is happening, and it’s happening at an accelerated pace.

The good news for Shopify shareholders, is that the company is well positioned to take advantage.

New stores grew by 71% quarter over quarter, huge numbers.

Now, there is a little bit of warning sign if you will. And that is that the new stores that were created during the 90 day free trial, were converting to paid subscribers at a slightly lower rate than merchants that joined prior to the pandemic.

The likelihood of this is because those who joined prior to the pandemic weren’t forced to do so. It was part of their broader plan.

Those who joined during the pandemic were likely forced to do so and may not have had the support, or the know how or wherewithal to continue with online, providing online services.

It’ll be interesting to see how this proceeds moving forward.

Another weak area? Point of sale channel. This refers to companies using Shopify’s point of sale platform, in store. Not surprisingly, it declined by 29%, as several of its retail merchants were closed during the pandemic.

On the flip side, retail merchants grew their GMV by 73% in this second quarter, up from the first quarter of 2020. Once again, big growth there.

Let's look at monthly recurring revenue. This is another key metric for the company, and that was up by approximately 21%.

A little bit lower than expected, likely because of the 90-day free trial. The 90-day free trial is much longer than the previous 14-day free trial.

On the flip side, Shopify plus continues to do well, and now accounts for approximately 29% of monthly recurring revenue, up from 26% previously.

This is the number I really want to bring attention to….

Gross Merchant Volume for the second quarter was $30.1 billion dollars. Let that sink in for a second.

$30.1 billion of transactions took place through Shopify’s platform. That is a very significant amount of money, not to be understated.

Finally, it exited the quarter with $4 billion in cash and cash equivalents. Which means that the company is in solid financial position.

Next, lets look at some of the key initiatives that Shopify introduced

First, it introduced the Facebook Shops Channel. It also launched the Walmart channel. It also launched the tap and chip card reader in Canada. Which is contactless payment. And in this pandemic, is very important.

Lastly, I wanted to bring to your attention Shopify capital, which is the financial arm of the company. It loaned approximately $153 million in cash advances to merchants in the US and Canada.

And through its inception, it has loaned approximately $1.2 billion of capital to merchants with only $166 million which is outstanding as of June 30th 2020.

So that brings an end to the quick overview of its last quarterly results. Bottom line, this is a company that exceed all expectations.

Investors will need to temper their expectations moving forward. It’s unlikely the company is going to be growing at a triple digit pace moving forward.

Granted, it should grow in line with its past performance, which is approximately 50% annual revenue growth over the next couple of years.

Next, lets talk valuation for Shopify’s stock

Shopify is one of those companies that to be frank, never looks cheap. When I bought this company a few years ago, I had to go outside of my comfort zone to buy it.

As a fundamental investor and a value investor, it wasn’t something that I was comfortable paying. However, the more I dug into the company, the more I saw its potential for growth. So, I took the plunge, and I’m glad I did.

Now today, the company is trading at 54 times sales, near an all-time high. Not quite, but very near. In comparison, its TSX listed peers are trading at approximately 20 times sales. And I’m talking about the SaaS peers.

In the US, valuations could be stretched to approximately 40 times sales. So regardless which way you slice it, Shopify is pretty expensive compared to its peers.

However, this is still a company that is growing at a 50% clip, so it deserves a premium given its consistent history of outperformance.

Is this too expensive? I can’t answer that, everyone has their own thresholds. But what I can say is that personally, I would not be adding to my position in Shopify at these levels.

However, we are getting close to where I might, and here’s why…

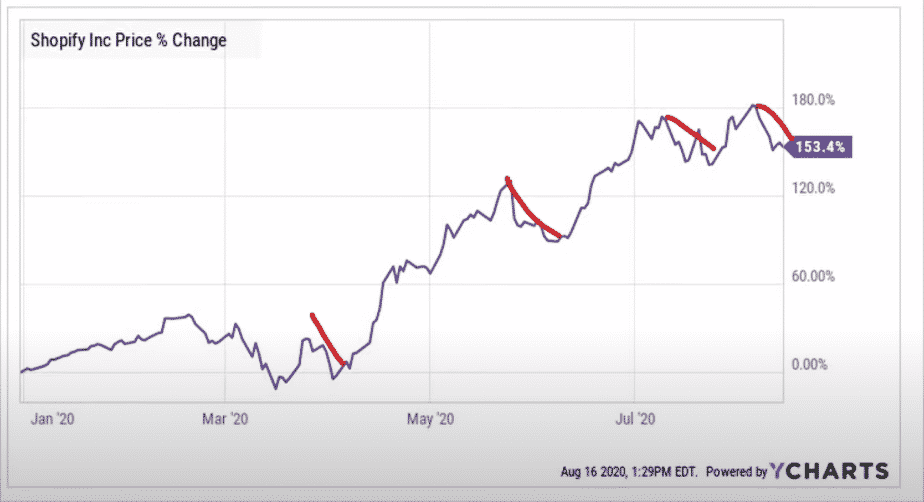

In the past few years as I’ve been watching Shopify I’ve noticed a trend. Typically, the company retreats in and around the 20% range at least a couple times a year, and that always proves to be a buying opportunity.

If you take a look at this chart from this year alone, you’ll see several times this has happened.

Lets ignore the immediate drop post pandemic, all stocks dropped. So lets ignore that one for a moment.

Today, we’re looking at approximately a dip of in an around 12% since hitting an all time high a few weeks ago.

Now, at 12%, the company still may have some downside, it’s neither in oversold territory nor is it in overbought territory. So this means that there could be some more downside to this stock.

Once the company hits that, you know, 18 to 20% mark, investors might want to consider looking at adding the company to their portfolios.

Historically, this has proven to be a buying opportunity for the company.

This is an expensive, yet unique company

So in closing, Shopify is really a unique company. It is trading at a pretty significant premium, but in large part that premium is deserved, based on its historical performance. This is a company that is continuously underappreciated and the markets always underestimate its ability to execute.

Given this, the company is a strong add-on dips of double digits or more. I would say anywhere between 15-20%, investors can start looking at taking a position. It has proven to be a buying opportunity in the past, and is likely to be a buying opportunity moving forward.

Disclaimer: You can read our full disclaimer here.