September 2019 Dividend Income Summary

Big quarter-end baby! September 2019 marks the official close of the 3rd quarter, as we march into the last quarter of the year. This month typically bears heavy fruit and is a great appetizer for what’s to come through the 4th quarter, especially December. Though the investment activity isn’t busy as we’d like it to be, via limited stock purchases, the dividends continue to flow and reinvest to produce additional income going forward. Without further ado, time to jump into my September 2010 Dividend Income results!

Dividend Income

I received a total of $2,184.75 of dividend income in September. A record September (never gets old), primarily based on the mutual fund dividend payments on the quarter-end and just the sheer volume of payers this month. Each month, luckily, I have been able to have a record month throughout 2019, each beating the prior year’s comparable month. Additionally, my wife earned $841.14 this month. Since we were married in October, I believe that will be the month that I will incorporate ours together and have a true comparison going forward, from a year-over-year basis. Therefore, combined, we earned almost $3,025.89 for the month!

Further, the 401(k), Health Savings Account (HSA) and all dividends are automatically invested/reinvested and helps take the emotion out of timing & making a decision.

The dividend increases add quite a bang to the portfolio, as well. As you saw from my recent post in July, dividend increases added almost $200 for the year through June! I will update this again, at the next quarter-end (middle October), to show you how critical this can be for YOUR portfolio.

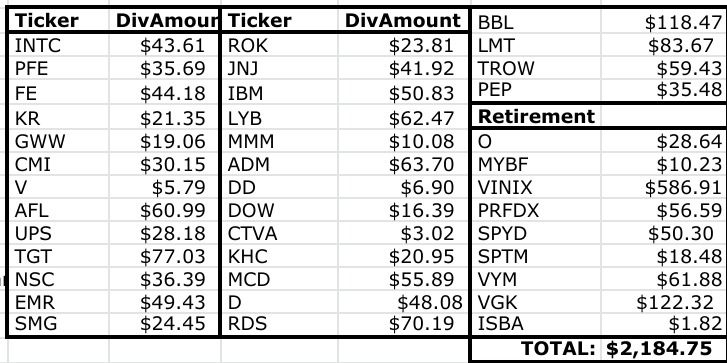

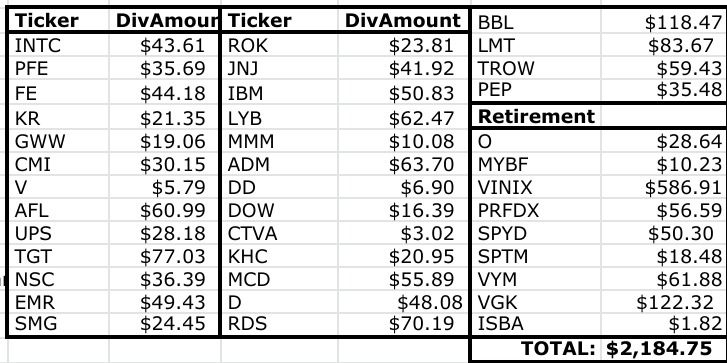

Here is the breakdown of dividend income for the month of September!

Very interesting! 30 different companies paid me within the taxable account and I had to extend/expand the upper right arena to hold them all. Obviously, this is a great problem to have. BHP Billiton (BBL) was the one taxable company that paid me a dividend over 3 digits this month, at $118.47.Further my new investments within Cummins (CMI), LyondellBasell (LYB) are really coming in with significant dividends.

Further, I had 10 dividend aristocrats that paid me during this month and that is a feat in and of itself. This is thanks to adding 3M (MMM) to my portfolio recently. Further my mutual fund from my old 401k, VINIX, almost came in with $600 for the quarter! I am nervous/anxious to see what this will look like come December. Time will show me, that’s for sure.

Here, it shows that I received a total of $935.35 (up from $757.77 last year) or 43% of my income from retirement accounts and the other 57% was from my individual taxable account portfolio. This % for retirement accounts increased by 12% from last year. Why? Larger dividends from VINIX, VYM, VGK and then my HSA was converted, with far more income than VITSX from prior year, as you’ll see below.

Dividend Income Year over Year Comparison

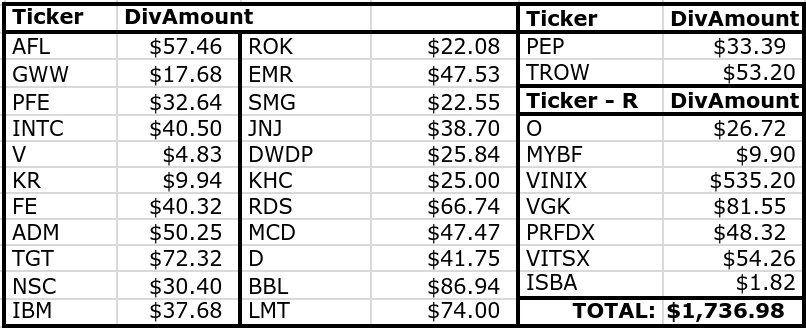

2018:

2019:

A dividend increase, year over year, of $448… This is a staggering 26% growth rate from prior year. This is happening at THIS LEVEL. I cannot believe it, but I know it’s true. In the words of Kurt Angle, “It’s Damn True”.Well, first, there are 30 companies from my taxable account, versus 24 in the prior year. That alone would set the stage for high dividend income.McDonald’s (MCD) has been growing that dividend steadily, as well as many others within the portfolio, outside of one cut from Kraft (KHC).

In addition, I mentioned earlier the mutual/exchange-traded fund income has been extremely powerful and strong, compared to prior year. The dividend increases are really making an impact across the board.

New investments, versus prior year, are 3M (MMM), UPS (UPS), Cummins (CMI), LyondellBasell (LYB), the breakup of DowDuPont into Dow (DOW), Corteva (CTVA) and DuPont (DD). Talk about a mouthful. Dividend income is coming through all sorts of crevices this time around.

In total, this September was higher by $448 or 26%. At this rate, $2,750 for next year? Is this possible? Yes, as last year’s growth was 28%. Therefore, this has been consistent and I believe I can achieve these 2020 dividend income results.

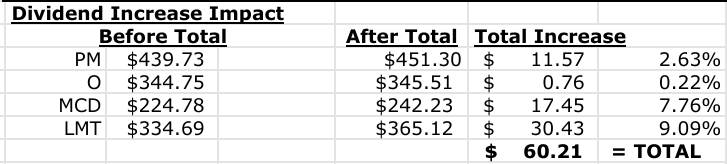

Dividend Increases

September may not have as many dividend increases for me, like other months, but September makes it up in IMPACT. The Dividend Growth Rate is real, folks.4 dividend increases, added $60 going forward. Look at that and all 4 are consistent dividend players on my team. Since owning them, they have never, ever missed a beat.

My favorite this go around has to go to McDonald’s (MCD). Why? In such a competitive industry and with the health craze occurring/getting more intense each week, McDonald's continues to do what they do best, as well as stay innovative at the same time. When in Italy, I never thought I could see so many people swarm into McDonald’s for their snack, lunch, drink or just to catch up.Utterly and beautifully amazing. The trip makes me think different (in a positive way) about McDonald’s and I am honored to be a shareholder.

Overall, $60.21 added would require an investment of $1,720 at 3.50% yield, in order to produce that result.

Dividend Income Conclusion & Summary

The name of the game is to apply what you learn through financial education. The next steps are to maximize every dollar for investment opportunities and live a balanced life. My plan is to show that dividend income can be a revenue engine. A revenue engine that allows you to take back control of your life. Dividend investing, once you learn the right way, becomes easier and starts to immensely make sense!

There is a nice adjustment to my most recent monthly expenditures article. Sadly, my property taxes increased by 14%. Therefore, my new average is $1,040 per month therefore, my current dividend income would cover 200%+ of that amount. Two times over baby! In fact, this may be the first time my taxable dividends of $1,248 covers the monthly expenses! Wow.Just… wow. Dividend investing is insanely real, I can literally taste freedom.So.Damn.Good.

Accordingly, if I keep the same growth rate up, could I hit over $2,750 going forward? That should mean my other months are also catching up and this is going to be a steam engine of dividend reinvestment. Excited for the future, no doubt. Further, all of the investing from last year and moves this year shows that my aim to save 60% of my income, and making every dollar count, has allowed promising results already this year.

Disclaimer: I do not recommend any decision to the reader or any user, please consult your own research. Thank you.