Sentiment Remains Bearish

Even though equities are rallying considerably this week, sentiment has been little changed. That’s likely a function of the timing of this week’s survey and the massive volatility. 32.9% of respondents in AAII’s weekly sentiment survey reported as bullish this week. That’s little changed from 34.4% last week. Meanwhile, the percentage of equity newsletter writers reporting as bullish in the Investors Intelligence survey has continued to fall with just over 30% reporting as bulls this week. That is the lowest level since the first week of 2019. Prior to that, there have only been 29 other weeks since 1997 with lower readings.

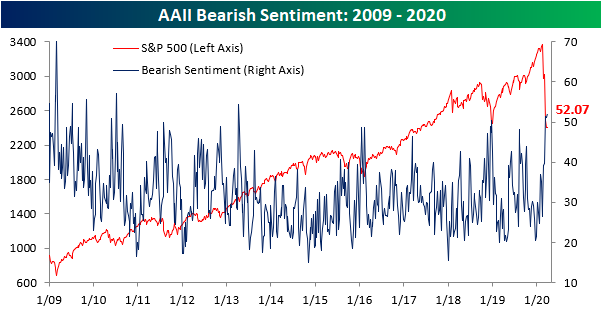

The results are similar for bearish sentiment. AAII’s survey saw bearish sentiment rise slightly from 51.1% last week to 52.07% this week. Bearish sentiment has now been above 50% for three consecutive weeks. That is the first time this has happened since March of 2009. Back then readings above 50% persisted for four weeks straight. Outside of that 2009 occurrence, the only other times that bearish sentiment remained above 50% for three weeks or more was in January, March, and July of 2008 and the late summer and fall of 1990. As for the Investors Intelligence survey, 41.7% are reporting as bearish which is the highest level since October of 2011. This week’s reading is in the 96th percentile of all readings in the history of the survey.

Neutral sentiment picked up about half of a percentage point this week to 15.03%. With the majority of investors reporting as bearish, this very low reading is in just the second percentile of all readings in the history of the survey.

Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much ...

more