Sell These 3 Popular Stocks Before They Miss Earnings

These three widely-owned stocks have gradually decreased their first quarter earnings expectations over the first three months of the year signaling that business is not doing as well as hoped. This points to a high probability of missing earnings when they report next week which will lead to a dramatic decrease in price.

First-quarter earnings season hits full stride this week. While Alcoa Inc. (NYSE:AA) might fire the starter’s pistol to kick things off, bank stocks are the runners Wall Street will be watching.

Many of the most recognizable Too Big to Fail (TBtF) names are on the docket for the week of April 4th. Although the taxpayer and the Federal Reserve have the bankers’ backs, investors might be less forgiving to these three banks after their quarterly results.

Before getting into company specific details, the trio shared 100% correlation between earnings surprises and price sensitivity for the last three years. In English, when earnings-per-share (EPS) topped Wall Street’s consensus, share prices ALWAYS went up in the three days prior and after quarterly results. Conversely, fall short of the mark, and all three ALWAYS went lower.

Obviously, the trick is to be on the right side of earnings if you want to make money. In this case, my earnings model and analysts’ recent activity suggest the following banks/financial centers will miss the target and should be shorted.

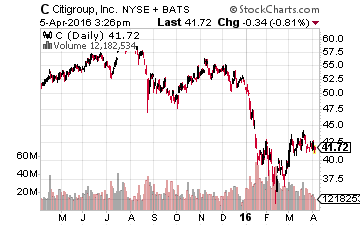

Citigroup Inc. (NYSE:C) – Trading its way Lower

Let’s start with the one that’s more often than not been better than the consensus for the last 12 quarters. Citigroup surpassed expectations seven of the last 12 quarters; consequently, shares rewarded investors a lucky seven times with an average gain of 3.9%.

However, as mentioned up top, every time C earned less than guesstimated, the stock gave ground, typically losing 3% on the five misses.

At the moment, the white starched shirt, blue/red tie crowd in lower Manhattan sees EPS of $1.15 when the company announces results on tax-day.

(On a side note, my experiences with Friday announcements tilts negative. All PR people know to get bad news out on the last day of the week as it’s quickly forgotten with weekend activities taking full mindshare.)

My estimate for Citigroup is $1.07, or 8 cents less than anticipated. Last quarter, the company had a similar miss and the stock shed 5.33% in the three days surrounding quarterly results.

In all likelihood, the financial center’s destiny depends on its trading accounts. With equity prices under duress to start the year, the question is whether traders unwound shorts and bought stocks quickly enough to make up the early 2016 red balances.

It’s unlikely if Citi’s consensus earnings trend is any indication. Ninety days ago, analysts forecast profits of $1.50 per share. That number steadily declined. And, three analysts lowered their opinions on EPS within the last month.

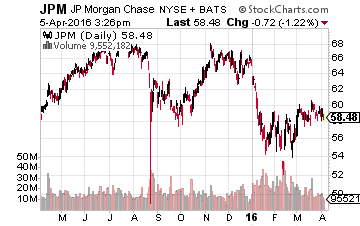

JPMorgan Chase & Co. (NYSE:JPM) – Making it 8

Unlike Citigroup, Chase’s recent earnings history favors the downside. Profits were less than forecasted in seven of the last twelve quarters. My estimate says it will be eight of the last 13. The consensus stands at $1.27, but expect somewhere around 10 cents less.

To reiterate, JPM rolled red in the days surrounding all bearish earnings surprises during the last three years. Typically, the stock pulled back 3.13% with the worst of it coming 3 months ago when the stock lost 6.41%.

Again, we find analysts losing confidence in their JPMorgan Chase estimates. At the start of the quarter, the prevailing thought was $1.55, which has fallen ever since. My estimate of $1.18 says they haven’t dipped enough.

At the risk of sounding redundant, JPM’s trading accounts are likely to be blamed if another negative surprise is the correct call on Wednesday the 13th.

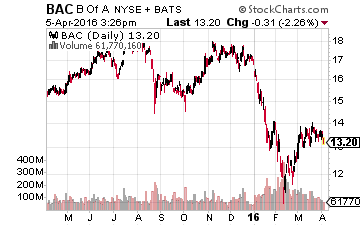

Bank of America Corp. (NYSE:BAC) – Filling Out the Losers Bracket

As you probably guessed by now, the theme for Bank of America is the same. Profits per share disappoint and the stocks slides. Yes, that was true seven of the last 12 quarters with sellers leading BAC lower by an average of 3.5%.

Cash from Investing Activities (trading) is likely to play the villain again on Thursday, April 14th. Consequently, actual results will likely be less than the consensus profit of a quarter per share. My estimate is $0.23; a mere miss of two pennies but what could be tens of millions lost in market cap.

Like the previous two names, analysts overshot on early forecasts and little by little chopped away at the original $0.33. Like estimates, don’t be surprised to see BAC head lower thanks to a bearish bottom-line.

I could get into more detail on all three, but being on the right side of the earnings announcement is all that necessary information for an earnings trade. According to my estimates, Citigroup, JPMorgan Chase and Bank of America will deliver less than expected EPS and, if recent perfect history holds, their respective share prices will get knocked lower.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more