Sell JOY Amid Mining Slump

Joy Global JOY reported quarterly earnings on Wednesday. The company delivered revenue of $865 million and adjusted eps of $0.43, beating analysts' expectations. JOY hit a 52-week low of $10.42 after earnings and closed on Friday at $12.13. In total Joy Global reported a net loss of $1.3 billion, driven by impairment charges on goodwill and intangibles.

Despite the earnings beat (ex-items) JOY remains a sell for the following reasons:

Bookings Are In Free Fall

Heading into the quarter I expected the company to miss on revenue due to the dismal state of Joy Global's mining clients. Such was not the case.

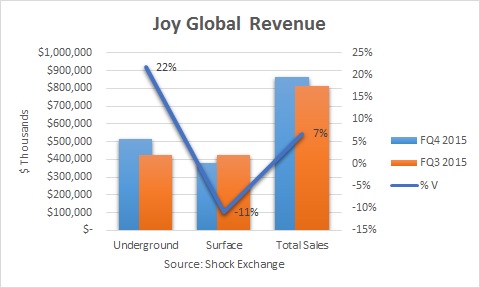

Revenue from underground equipment was up 22%, while revenue from surface equipment fell 7% sequentially; total revenue was up 7% Q/Q. My inclination tells me that revenue was derived from bookings prior to the quarter. FQ4 could be an inflection point as revenue had fallen 2% sequentially heading into the quarter.

Meanwhile, bookings have been in free fall; booking fell 17% sequentially and 21% Y/Y. The company's largest segment -- underground equipment (60% of bookings) -- was also off 17% Q/Q. Underground mining equipment is used for the extraction and haulage of coal and embedded minerals. Coal has been one of the hardest hit segments of the commodities sector. A structural shift from coal to natural gas has been problematic for coal prices; until the oversupply of coal subsides, prices may continue to fall.

That said, it may take another quarter or two before the decline in bookings negatively impacts top line growth. FQ4 revenue was encouraging, but a decline in top line growth appears to be baked in.

Dividend Cut

Heading into the quarter I believed Joy Global's dividend was in trouble. The company announced a $0.01 per share dividend, much lower than the $0.20 per share dividend in the prior fiscal year; this could save about $75 million per year. This was the prudent thing to do for the company. The move was part and parcel of the company's attempt to batten down the hatches amid the mining slump. Joy Global repaid $250 million in debt to remain in compliance with its debt covenants and assuage the rating agencies. It has also been cutting the workforce to improve profit margins.

Cash flow from operations was $187 million, and I expect nothing less next quarter as operations slow down and the company collects on accounts receivable and sells down inventory. The commodities rout is real. The Bloomberg Commodities Index is down about 26% for the year, and the slow down in China -- the world's biggest buyer of commodities -- will not help matters.

Miners will probably continue to buy less equipment so Joy Global must squirrel away as much cash as possible to meet the slow down head on. FQ4 results should help secure the company's survival. I thought the dividend cut would be disastrous but longs appear to have been assuaged by management's efforts to preserve cash flow. Given my $9 price target I still do not see a reason to own JOY at these levels.

Disclosure: I am short JOY.