Sector Leadership Traits

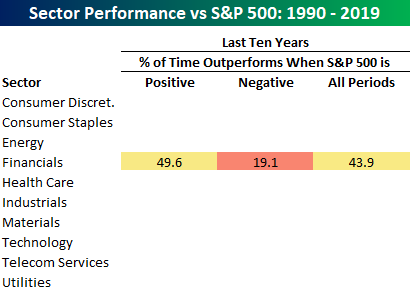

Remember the old axiom that the market couldn’t rally without the Financials? Given the sector’s role in financing the economy, the Financials sector was once considered a leading indicator of the economy and stock market. When the sector did well it was a good sign for the market while declines were an ominous market signal. While that may have been the case in another time, these days the Financials sector has little in the way of a leadership role in the market. In one section of this past weekend’s Bespoke Report, we looked at how sectors performed relative to the market during periods when the market was rising and falling. For each sector, we calculated how frequently it outperformed the S&P 500 during periods when the S&P 500 had risen or fallen in the prior six months.

Using the Financials sector over the last ten years as an example, we found that in six month periods where the S&P 500 has risen, the Financials sector outperformed the S&P 500 slightly less than half of the time (49.6%). In other words, when the market has rallied over the last decade, it has been a coin flip as to whether the Financials outperformed or underperformed the market during the rally. While the Financials sector hasn’t provided much in the way of leadership on the way up, it has certainly been a downside leader. During periods when the S&P 500 saw negative returns over a six-month period, Financials only outperformed the S&P 500 19.1% of the time, meaning it underperformed the S&P 500 over 80% of the time when equities declined! Sectors that provide no outperformance on the way up but underperform on the way down don’t provide much help to a portfolio!

(Click on image to enlarge)

The chart of the S&P 500 below helps to illustrate these trends with the Financials. In the chart, whenever the line is green, it indicates that the Financials sector outperformed the S&P 500 over the trailing twelve months. In practically all of the major market declines over the last ten years, though, green is practically non-existent. Likewise, there are a number of extended periods where the S&P 500 was rising, and there were prolonged absences of green. The market certainly hasn’t had much trouble rallying in the last ten years, and whether the Financials sector was there for the ride hasn’t mattered.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Premium to see the full table above which shows the sectors that typically ...

more