School Specialty: Risky And Speculative

School Specialty (SCOO) grabbed my attention after its 10% owner, Ansons Funds Management, disclosed to the SEC, on Feb 14, 2020, that it had purchased 2.25 million shares. The stock rose to 35 cents and the rally petered out soon.

As of Mar 14, 2020, SCOO’s current stock price of $0.20 is lower than 1% of what it was a decade back. It’s been a nightmare for its loyal investors and its future depends on how it resolves its debt issues.

Image Source: Investing.com

Here are my analysis and strategy:

K–12 Enrolments & Budgets

The K–12 enrolments are expected to grow at a steady pace of 2% annually to 56.8 million by 2026. That is a flat growth and a neutral for the company’s prospects.

President Trump also cut the education budget, but ended up increasing fund allocations to sectors that are critical to SCOO’s growth, as is evident from the following:

1. Charter Schools’ budget was increased by $60 million to $500 million.

2. Education and Innovation Research’s budget was jacked up by $170 million to $300 million.

3. Vocational Rehabilitation State Grants were increased from $88 million to $3.610 billion – and that’s a huge number.

These budget increases should have helped SCOO’s science, art & craft, and special needs supplies departments. However, the company clocked lower sales as of Q3 2019 – and that’s a huge disappointment.

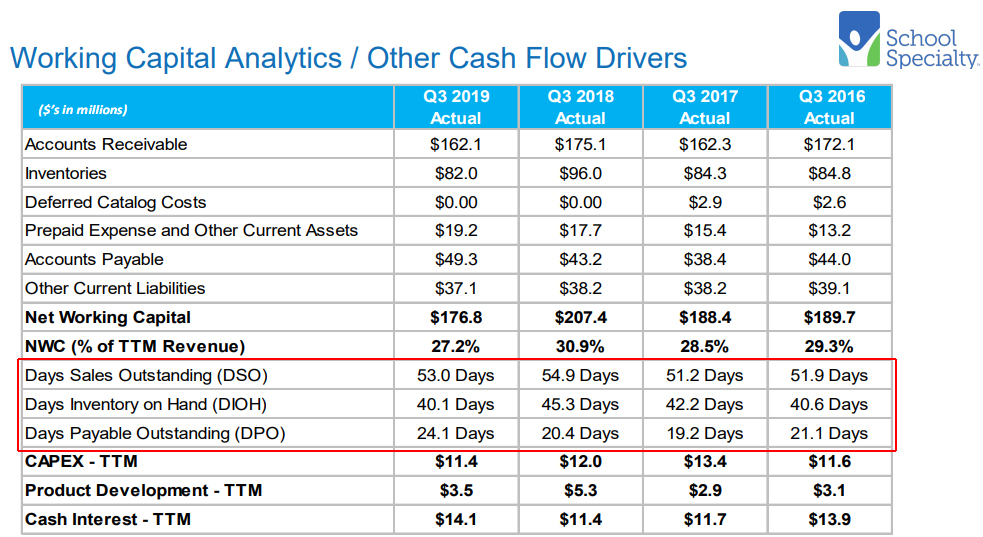

Working Capital and Cash Flow Issues

Image Source: SCOO Website

The company gives up to 53-days credit to its customers, but its suppliers give just 24-days credit to it. Working capital thus gets locked up and the company has no option but to borrow. However, it is interesting to note that it has borrowed long-term to meet its short-term requirements. This suggests that the management team does not expect the situation to improve in the medium term.

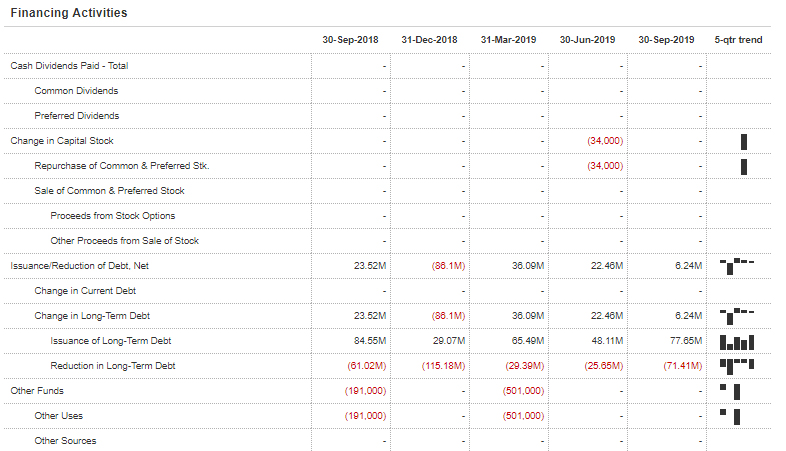

Image Source: Market Watch

For the first three quarters ended Sep 30, 2019, SCOO increased its net long-term debt by $64.79 million – it obtained new loans, repaid a part of its existing debt, and utilized the rest to meet its working capital requirements and balance the receivables shortfall.

Investors should note that the company’s sales usually peak in the last quarter and the operational cash flow turns positive. In the quarter ended Dec 2018, it repaid $115 million of long-term debt. Dec 2019 results are not yet out, and the company is likely to extinguish some part of its long-term debt.

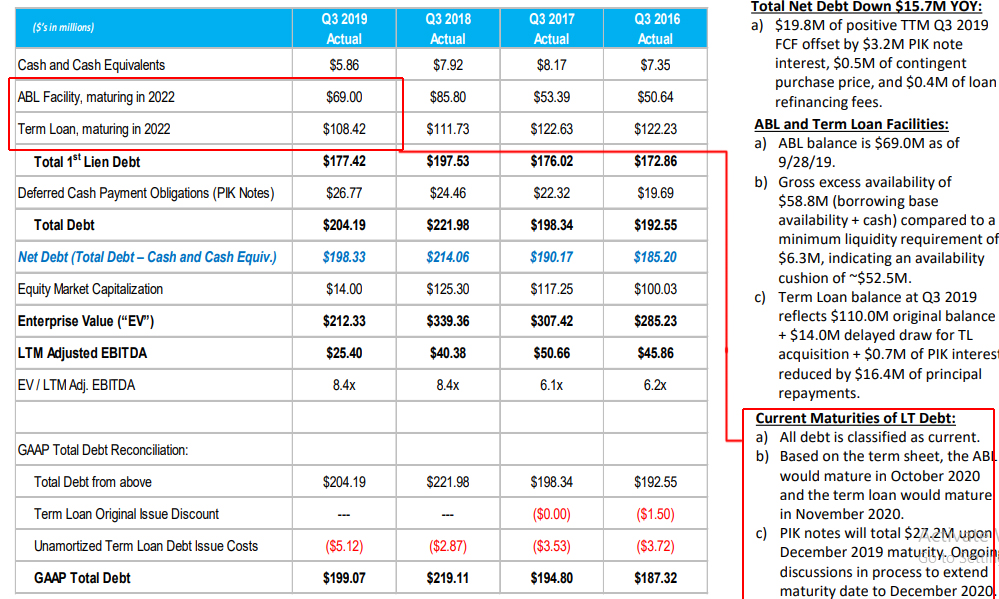

Debt Resolution

SCOO’s operations have so far been weighed down by $204.19 million in debt.

In Q3 2019, SCOO failed to comply with its financial covenants related to its debt. To stay in the game, it entered into a short-term forbearance agreement with its senior secured lenders on Dec 5, 2019. The outside date of this agreement is Mar 31, 2020, and that’s still 17 days away.

Image Source: SCOO Website

The outcome is in suspense, but if the company is unable to fulfill its obligation, it will lead to an 18% equity dilution. Investor sentiment and loyal shareholders will get turned off and the stock price will take a hit as well.

The COVID-19 Impact

Schools and universities have started telling their students to stay at home, and have launched online classes. It is obvious and natural that COVID-19 will lead to a temporary closure of educational institutions, thereby reducing the demand for school supplies.

Image Source: SCOO Website

Over 80% of SCOO’s business comes from sales of school supplies and furniture.

The only opportunity before SCOO is to aggressively market its e-learning apps. SCOO owns a knowledge bank that delivers over 10,000 instructional resources in print and online.

The knowledge bank includes teacher resources, student materials, games, and classroom libraries. Students can learn from reading intervention, vocabulary instruction, science, targeted practice, and standards-mastery for math and language arts, from the comfort of their homes.

This is an opportunity that is open. However, the question is that if the company could not take advantage of key allocations in the budget, will it be successful in exploiting its online learning model in double quick time, and that too in an intensely competitive atmosphere?

The Verdict

SCOO’s school supplies and furniture business is likely to take a massive hit because of the COVID-19 virus. A lot also depends on how the company markets its online learning programs.

If its debt issue is not resolved on Mar 31, 2020, lenders will act against it. Perhaps it may file for bankruptcy.

There also is an outside chance that it can go bankrupt.

On the flip side, if the company can resolve its debt issues and penetrate the e-learning market, its stock can jump.

My opinion – SCOO is a very risky and speculative bet right now. However, penny stock investors should track events related to its debt resolution and consider entering it only after if extinguishes debt, improves upon its working capital strategy and makes some headway in its e-learning business.

Till then, it’s an avoid.

Disclosure: I have no position in the stocks discussed, and neither do I plan to buy/sell it in the next 72 hours. I researched and wrote this article. I am not being compensated for it (other ...

more