Russell 2000 Rout

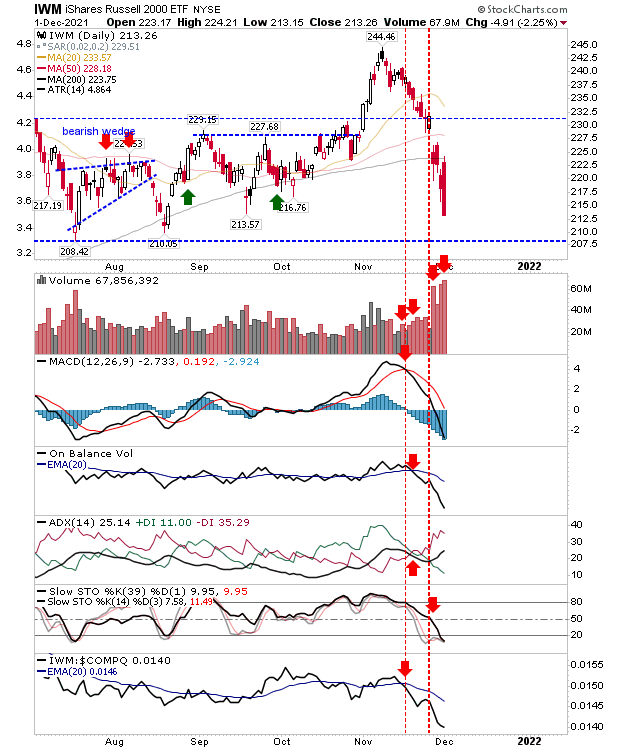

There was little doubt about who was in control of markets today. Sellers swooped in across markets but it was the Russell 2000 which took the worst of it.

There was a brief attempt to recover the 200-day MA, but aside from that it was sellers all the way. Volume rose to register as distribution, adding to the malaise in the market. Technicals are net negative, but stochastics are oversold and a rebound is not far off.

The Nasdaq rushed down to its 50-day MA, stopping right on the moving average. Trading volume did not register as distribution. It's tough to say if tomorrow will hold this support, but short-term stochastics are oversold. I would view this level as last chance support for the breakout.

The S&P undercut its 50-day MA, which also registered as an undercut of the breakout. Trading volume did not register as distribution, but MACD, On-Balance-Volume, and ADX are all bearish. Despite these losses the index is sharply outperforming the Russell 2000. The next obvious target for the S&P is the 200-day MA.

With the S&P and Nasdaq both looking like they will kick away 50-day MA support we now have a final support target of the 200-day MA. The problem is that the Russell 2000 has made short shrift of this level and is tettering into a larger decline. There is still time for bulls to stop this, but for now - bears have a rare opportunity to twist the knife.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more