Russell 2000 Needs To Break To Keep Bullish Momentum In Other Markets

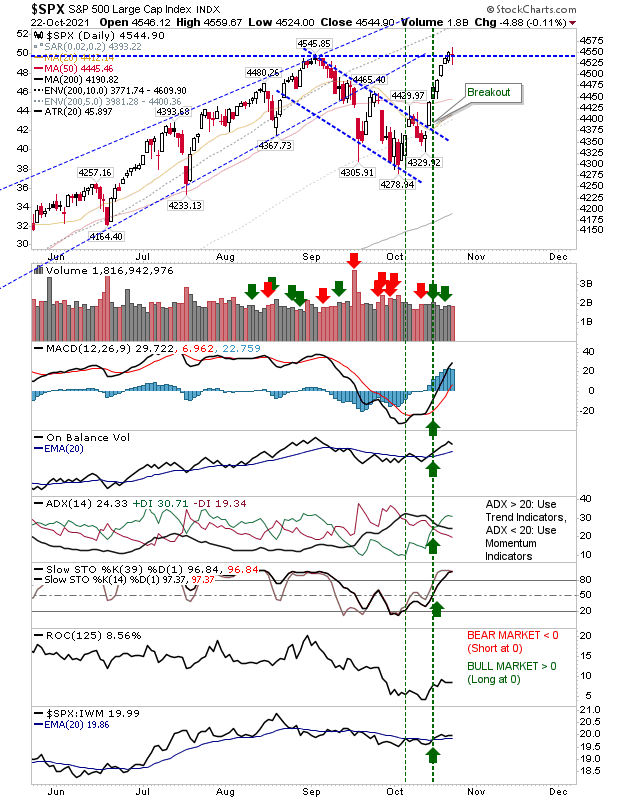

With options expiration on Friday, we got a volume spike which took some of the sting out of Nasdaq and S&P 500 losses - the latter to a lesser degree. In the case of the S&P 500, Friday's 'spinning top' candlestick marked a neutral finish. However, it occurred on resistance, which is not the best candlestick to see after a rally. This could go either way.

The Nasdaq took the largest loss on Friday, but it had already recovered resistance so Friday's down day wasn't enough to break what is now support. However, there is still the September high of 15,403 to challenge, and if there is a break of support, it will only go on to attract more sellers.

This is where the Russell 2000 comes in. As we all know, it has done little but push sideways since the start of the year, but over the last few months it has managed to create a launch pad for a potential resistance break of $227.50.

If it can manage this, then I don't expect June resistance around $233 to be much of a challenge. Technicals are improving, and soon there will be a relative performance gain to peer indices. If it does breakout, I would expect a good run from this.

For next week, keep an eye on the Russell 2000. Other indices aren't hogging the limelight and it's primed to benefit.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more