Rolling The Dice For Red Rock Resorts' IPO

Red Rock Resorts Inc., (Nasdaq: RRR) expects to raise $570.8 million in its upcoming IPO. Based in Las Vegas, Nevada, Red Rock Resorts is a company that operates 21 casino and entertainment properties.

We previewed RRR last week on our IPO Insights platform.

Red Rock Resorts will offer 27.25 million shares at an expected price range of $18 to $21.

RRR filed for the IPO on October 13, 2015.

Lead Underwriters: BofA Merrill Lynch, Deutsche Bank Securities, Goldman Sachs, and J.P. Morgan Securities

Underwriters: Citigroup Global Markets, Credit Suisse Securities, Fifth Third Securities, Guggenheim Securities, Macquarie Capital, Oppenheimer & Co., Raine Securities, Samuel Ramirez & Co., Stifel Nicolaus & Co., UBS Investment Bank, and Wells Fargo Securities

Business Summary: Owner and Operator of 21 Casino and Entertainment Properties

(Source)

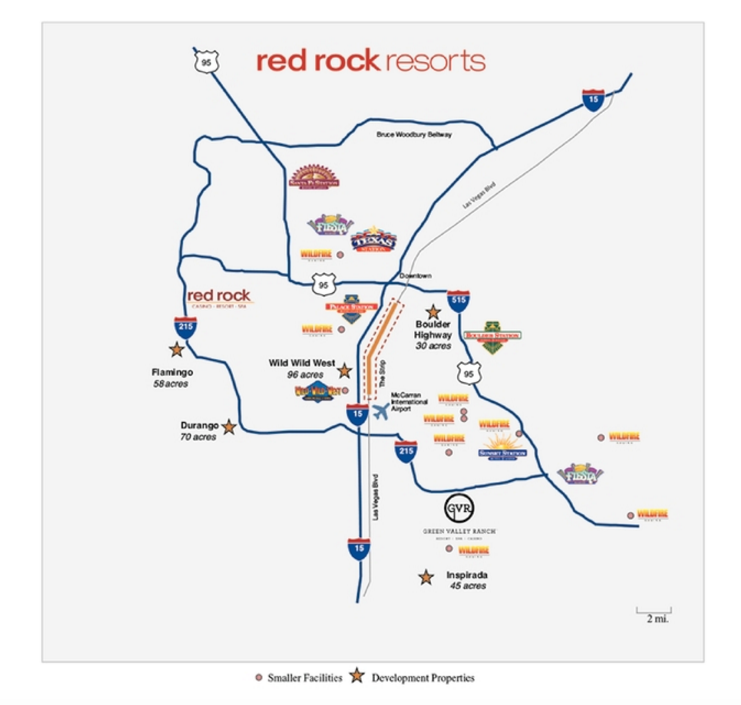

As described in RRR's filings, Red Rock Resorts is a development, gaming and management company with 21 casino and entertainment properties. The company has developed more than $5 billion of gaming and entertainment destinations primarily in the Las Vegas region.

The company was formerly known as Station Casinos, and its properties include Red Rock Casino, Green Valley Ranch, Resort, Casino and Spa, Palace Station Hotel & Casino, Sunset Station Hotel & Casino, Santa Fe Station, Texas Station, and Wild Wild West, among others.

Their portfolio in Las Vegas includes nine major gaming and entertainment facilities in addition to ten smaller casinos, with approximately 19,300 slot machines, 4,000 hotel rooms, and 300 table games. The company also has control of seven gaming-entitled sites consisting of 398 acres in Las Vegas and Reno, Nevada.

In addition to gaming properties, Red Rock Properties operates numerous restaurants, movie theaters, entertainment venues, bowling alleys, and convention/banquet space.

In its SEC filing, Red Rock Resorts noted that it became a publicly traded company in 1993. It was later taken private in 2007 in a management-led buyout and completed a restructuring in 2011. Red Rock Resort also noted that it had improved its capital structure.

Executive Management

RRR notes that CEO and Chairman Frank Fertitta has served as CEO since June 2011. He served as Chairman of the Board of Directors of Station Holdco from 1993, CEO of STN from 1992 and President of STN since 1998. He held these positions until 2011. He has held senior management positions since 1985, when he served as General Manager of Palace Station.

President Richard Haskins, Esq. has served in his position since November 2015. He served the company as General Counsel and Secretary from 2011 to 2015. His previous experience includes positions at Station Casinos, Rose Brouillette & Shapiro, and his own private legal practice. Mr. Haskins is a Member of the American Bar Association, the Kansas Bar Association, the Missouri Bar Association and the Nevada Bar Association.

Potential Competition: MGM Resorts International, Wynn Resorts and Others

Red Rock Resorts faces competition from at least 40 other gaming and resort properties in the Las Vegas area, including the largest: MGM Resorts International (MGM, MGP), Wynn Resorts (Nasdaq:WYNN) and Las Vegas Sands Corporation (NYSE:LVS). They also face competition from 146 non-restricted gaming locations within Clark County and other restricted gaming locations (those with 15 or fewer slot machines) that comprise approximately 13,800 slot machines.

Valuation: Solid Top, Bottom Line Growth

Red Rock Resorts Inc. provided the following figures from its financial documents for the years ended December 31:

|

2015 |

2014 |

|

|

Revenue |

$1,352,135,000 |

$1,291,616,000 |

|

Net Income |

$143,252,000 |

$88,587,000 |

As of Dec. 31. 2015:

|

Assets |

$2,932,111,000 |

|

Total Liabilities |

$2,358,402,000 |

|

Stockholders' Equity |

$552,924,000 |

Conclusion: Consider An Allocation

The IPO market appears to be awakening from its 2016 winter slumber, buoyed by last week's big deal, MGM Properties (MGP). Another casino stock, MGP raised just over $1B, which could bode well for RRR.

RRR notes that it does face stiff competition; additional risks include reliance on Vegas, substantial levels of debt, impending expiration of management agreements for Gun Lake Casino and Graton Resort in 2018 and 2020, respectively

We suggest investors consider an allocation; the deal is already oversubscribed several times.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in RRR over the next 72 hours.

I ...

more