Roku's Business Is Not What You Think

Few consumer trends of the past decade have been as pronounced as the shift away from the broadcast, "live" model of programming to the video-on-demand (VOD), or streaming, model.

Since launching its streaming service just 10 years ago, Netflix (NFLX) now boasts almost 120 million subscribers worldwide, streaming one billion hours of content every week! Amazon's Amazon Prime Video service (launched in 2011) is estimated to have about 40 million subscribers, and Hulu (est. 2007) has close to 20 million.

And this is just the subscription video services. The streaming model also applies to the "a-la-carte" channel services (Sling, PlayStation Vue, DirecTV NOW, etc.), "freemium" channel-specific apps (from the individual broadcast and cable networks), and of course, ad-supported streaming video such as YouTube and its 1.3 billion users and 5 billion video views a day.

That's a lot of video. To access these, consumers use applications for each of the different services. Applications - or "apps" - are installed on top of an operating system (OS) which the user interacts with.

Ok, so you probably knew all this right? When you want to stream Netflix, you open the Netflix app on your phone, or press a button on your TV or set-top box remote to launch the app.

But have you thought about the OS which runs the app itself? If you run Netflix on your iPhone, you are using iOS. If you run it on your Apple TV, you are using tvOS. On your Samsung TV? Probably an OS called Tizen. On a ChromeCast? You are using Android. And so forth.

I bring this concept up because understanding where the OS fits in is key to understanding the business model of today's highlight stock, Roku (ROKU), a recent IPO and a recent addition to the Quality Growth Spell. You may think that Roku just sells those set-top boxes you see in Best Buy, but that's not the case - not at all! Let's take a look at the business and see if we have an interesting investment candidate here.

Roku's Business Model Is Not What It Seems

If you are like me, when you saw Roku was going public your initial reaction was probably "Meh, a commodity hardware maker? No thanks.".

It is true that Roku gets over half (56%) of its revenue from selling its "Streaming Stick", "Roku Express", and "Roku Ultra" hardware streaming devices. It's also true that these are cutthroat commodities, with Roku earning under 10% in gross margin on them. Many competitors like Google and Amazon likely sell competing hardware at a loss. Certainly, there is no money to be made on this side of the business.

But the OS - or "platform", as the company calls it - is a different story.

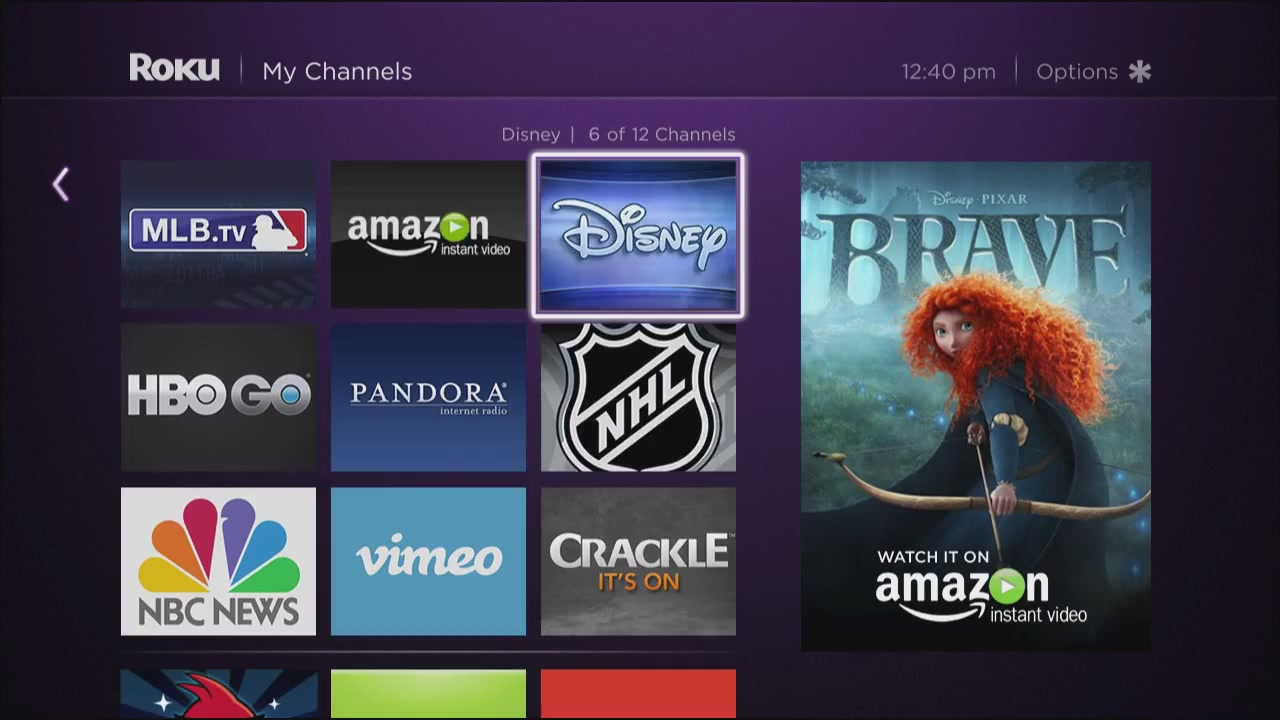

Whenever you fire your Roku box up, you land in the OS launcher screen. That area on the right there? What do you know, a nice big space to sell ads against!

That's far from the only ad inventory Roku has access to. The Roku Channel offers free-to-watch popular movies, which Roku sells ad time against. Many of Roku's "free" channels are ad supported, with Roku having access to all or some of the ad time on many of those channels (not all of them).

While selling ads is the biggest piece of the company's Platform business, there are some auxiliary sales as well. See those Netflix, Amazon, Pandora, YouTube, etc. buttons on your Roku remote? The company was paid to put them there. Additionally, some TV brands have licensed the right to include Roku OS right into their television set, another source of revenue.

All told, Platform revenue is 44% of total sales, and growing rapidly. In fact, it more than doubled in 2017, and has increased more than three-fold over the past two years. Even better, Platform revenue carries a gross margin near 75%, meaning that already it makes up 85% of Roku's gross profitability. Completing the trifecta of good news, Platform sales are far more recurring and reliable in nature than hardware sales, giving the company a firmer footing from which to expand their business.

Bottom line here? Roku is not really a commodity hardware maker. It is more of a consumer digital video advertising platform.

Now, The Bad News

So, Roku's business model isn't as bad as might be feared. That's the good news.

But I wouldn't call this a slam-dunk "green dot" business model. Not by a long shot.

The main problem? Competition. The second problem? No meaningful economic moat to protect against that competition.

We've touched on this a bit already. Roku is far from the only option to access streaming content. If you like the Apple ecosystem, you can either stick to streaming from your iPhone or iPad, or you can purchase an Apple TV and stream through there. If you like Google, well, you can stream on your Android device or buy a ChromeCast. Amazon? Fire TV stick. Gamer? You can access all these streaming platforms through Xbox or PlayStation devices. Smart TV owner? A lot of these have streaming apps built right in. Cable subscriber? Xfinity and other cable platforms are increasingly offering streaming services as add-on applications.

Simply put, there is no shortage of ways to get streaming content. And all of them are fighting tooth-and-nail for users. Google and Amazon practically give away their devices to get users into their ecosystem. Many of the other ways to access are simply add-on functionality for devices many consumers already own for other reasons.

It is against this phalanx of tech giants that Roku competes for new customers, and has to guard against existing customer attrition. Against that lineup, it really has very few competitive advantages. There is no meaningful lock-in to the platform. It is really quite simple and painless for a consumer to switch from a Roku to a competing offering. Getting new customers is even more of a dog fight. What can Roku offer that its competitors cannot? The answer is: not much. A better user experience, perhaps, but that is hardly a sustainable competitive advantage.

Another strike against the company is that its most popular channels do not benefit Roku very much. For example, Netflix makes up over 30% of streaming hours through Roku's platform, but the channel provides essentially no revenue back. Same for Amazon, Hulu, and the most popular ad-supported video network in the world, YouTube. Roku relies on monetizing Roku Channel and other, less prominent content channels. However, there is nothing stopping those other channels from switching to a different ad provider, or (if they are large enough), building out their own.

Conclusion and Business Model Diligence

Roku isn't entirely what it seems at first glance. Its real business is selling ads - a far more attractive model than just selling commodity hardware boxes. Growth has been excellent, with 30% year-over-year revenue growth rates and subscribers expanding even faster than that (+45% last year). The opportunity in video advertising is just immense. In the U.S. alone, advertisers spent over $150 billion in digital and TV commercial ads last year. That is a big, BIG market to grab a slice of.

However, the competitive landscape is just too cutthroat to really consider Roku as a highly attractive company for investment.

Quick Summary

Roku is a streaming video device and platform company. 56% of revenue (but only 15% of gross profit) comes from its sale of streaming video devices like its "Streaming Stick", "Roku Express", and "Roku Ultra" set-top boxes. These allow consumers Internet-based access to various streaming platforms such as Netflix, Hulu, Amazon Prime, HBO Now, YouTube, and so forth. 44% of revenue, and 85% of gross profit, come from Roku's platform sales. These primarily consist of advertising sold on its own channels or on channels the company has access to ad inventory on. Platform sales also include commissions on subscription sales through its platform, and from offering branded buttons on its remote controls. The company has over 19 million active accounts.

Does The Company Have Recurring And/Or Rising Revenues?

Somewhat. Revenues are rapidly growing at about 30% year-over-year rates, as customers increasingly migrate to video-on-demand for their entertainment needs. Subscribers are growing at an even faster rate, +45% in 2017. This is the early stages of a mega-trend, and the addressable video ad market is enormous (over $150 billion in the U.S. alone). As for recurring revenue, obviously player revenue is not recurring. Platform revenue, on the other hand, is basically an advertising platform model that should be reliably recurring for Roku. As this is where the bulk of operating profits and cash flows originate from, we feel this gives the company a reasonably attractive revenue model.

Does The Company Have Durable Competitive Advantages?

No. Both Roku's devices and platform face substantial direct competition from tech heavyweights including Apple (AppleTV and tvOS), Google (ChromeCast), Amazon (FireTV), Microsoft (Xbox), Sony (PlayStation), major cable operators (Xfinity and Cablevision), and even TV manufacturers (Samsung, VIZIO, LG). All of these offer the same basic functionalities, and there is little preventing consumers from migrating to a competing streaming platform. Additionally, Roku relies on accessing ad inventory from its channel providers, and this inventory could decline or be withdrawn.

Business Model Rating:

We feel that Roku's business model deserves a "weak" Yellow (somewhat attractive) rating. The attractive parts are the growth potential and reasonably recurring advertising revenue model, particularly given that it plays into the massive secular trend of on-demand video. The unattractive parts are intense and strong competition, no real durable moat characteristics, and reliance on partners to build ad inventory. It's a fragile business model, but one that could prove lucrative if the firm can navigate the minefield of risks.

Disclosure: See below for our

Business Model Diligence on the firm, and check out all of our ratings with our