Risky Stocks Go Parabolic

A Year For Retail Investors

This was an interesting year because typically individual investors have very poor returns, but in 2020 their favorites trounced the index. Retail investors barely make money on average. The concept of even matching the market is foreign to them. Few usually beat the S&P 500 which is similar to the performance of hedge funds.

As you can see from the chart below, the basket of their favorites is up 85.9% year to date which has beaten the S&P 500’s gains of 14.21%. There has been no contest. Obviously, some retail investors don’t own these stocks and some have blown up their accounts using options.

(Click on image to enlarge)

One thing is certain. This has been their best run since the 1990s. Back in the late 1990s, momentum investing was popular. Growth stocks would explode higher just because they were part of the future (the internet). In normal markets, showing a profit is important but not in the late 1990s and not this year. Retail investors are actually moving the market with their actions. Plus, value fund managers are out of business.

Growth managers run the show now. The managers who have done the best in the past few years have taken the most risks on firms with high sales growth and cared the least about valuations. Individuals chasing performance have put their money with them. It’s a virtuous cycle that pushes up the stocks with the best stories that appeal to retail investors and growth managers.

Fuel Cell Stocks Win

One of the best examples of this retail fueled bubble is fuel cell stocks. Ironically, fuel cells don’t fuel anything as the technology isn’t mature enough to work. It’s probably 10 years away from showing any meaningful sign of progress. Quite frankly, the electric vehicle revolution hasn’t even happened yet. Many don’t get what would make people think a less economical form of transportation will work. People see the potential for electric car sales and assume fuel cells will work too. That’s a major error.

(Click on image to enlarge)

As you can see from the chart above, since the start of July, Plug Power stock is up over 300% and Fuel Cell stock is up almost 450%. On Wednesday, Fuel Cell stock was up 24.9% and Plug Power was up 1.3%. The optimism on Wednesday was about money in the government’s budget for green power.

That’s all the hope fuel cell stocks have because their product isn’t economical. These stocks will all end up like Nikola which fell 10.7% on Wednesday and is down 79.7% in the past 6 months. You really need to be a terrible company to fall in the golden age for green technology stocks.

Bubble Fuel

The bubble in the speculative stocks is like a virtuous cycle that keeps growing. Investors find the hottest stocks and invest in them which pushes them higher which encourages more people to get involved. Plus, they tell their friends about how much money they are making which gets more people to buy them.

The only thing that stops the bubble is an additional supply. When these stocks start to fall, there are profit takers at the beginning. Eventually, the entire thing collapses as momentum traders have no reason to get in as the uptrend is broken.

(Click on image to enlarge)

Not everyone is buying individual companies on their own. Some are investing in Ark Invest’s actively managed ETFs. As you can see from the chart above, Ark’s innovation fund has attracted billions in the past few months. It had almost nothing in March. Ark buys these stocks which pushes them up which makes the company’s founder, Cathie Wood, look like a genius. This makes more people invest with her which pushes these stocks even higher.

Genomic fund is the most interesting because it attracts people who don’t know about biotech. Most people understand what Roku, Tesla, and Square do. However, few people have any idea what gene editing is. That’s why they invest with Ark. The problem is these firms are years away from having sales.

Their valuations are based on hot hair. For example, Crispr has a market cap of $12.3 billion. It is expected to only have $14.38 million in sales in 2021. Its TTM enterprise value to sales ratio is 139.5. It’s a bubble.

Money Losers Do Very Well

For a lot of 2020, the best place to be has been in the riskiest stocks that grow sales quickly and don’t make a profit. Firms that barely have any sales or close to a working business model have done even better. SaaS stocks with no profits weren’t risky enough for some traders, so they moved to biotech and fuel cell stocks.

This isn’t to say money-losing software and semiconductor stocks still don’t have a place in most speculators’ portfolios. These names have still done well outside of Zoom ZM and a few others tied heavily to the work from home trade. Zoom is down 32.5% from its record high as it fell 6.1% on Wednesday.

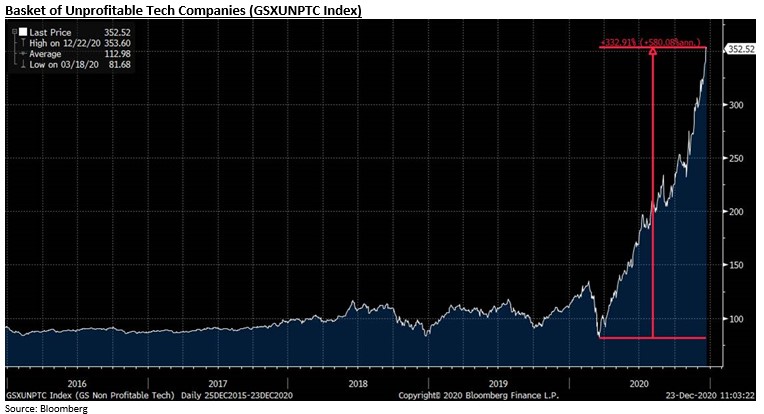

(Click on image to enlarge)

As you can see from the chart above, since the March bottom, money-losing tech stocks are up 333%. This is the original beast in the retail speculative bubble. Many of these firms have a chance at having a good business model. It’s similar to the 1990s tech bubble in that some will survive, but many will fall to zero and they are all too expensive.

Conclusion

The momentum stocks retail traders love have had a good December because December is usually good for the winners of the year and because Ark Invest is gaining huge sums of money which is going into these growth names. Money losing tech stocks have exploded. Traders decided they weren’t risky enough so they moved into gene editing and fuel cell stocks.

Quite frankly, few investors buying these stocks understand the businesses. It’s not enough to invest in Cathie Wood’s genomics fund. You still should know what the business entails. These stocks will crater hugely in 2021. It will be a bloodbath for retail speculators.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more