Richest Americans Add $195 Billion To Net Worth During Biden's First 100 Days

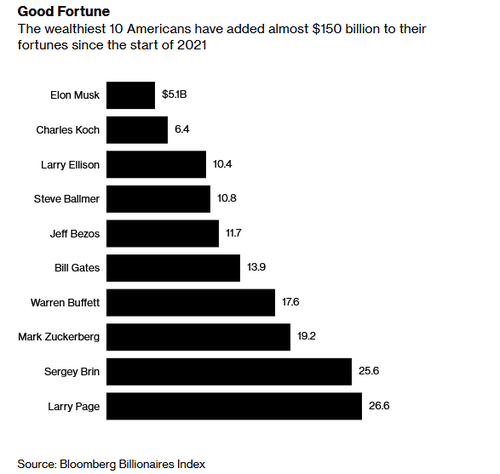

As the Biden Administration and Congressional Democrats continue to spend money like Pretty Woman with Richard Gere's credit card, the top beneficiaries of this 'froth-inducing' stimulus have been America's wealthiest 100 individuals - who've tacked on a combined $195 billion to their fortunes during President Biden's first 100 days in office, according to Bloomberg.

The most recent gains have been fueled by the continued rise of the stock market since Biden was sworn in Jan. 20, along with the vaccination program’s fast rollout and a $1.9 trillion government stimulus package. The S&P 500 and Dow Jones indexes have both climbed more than 10% during that time.

Attempts such as Biden’s to refloat the economy can boost incomes and wealth at the very top, said Mike Savage, a sociology professor at the London School of Economics.

“We’ve seen that paradox since the 2008 financial crash with quantitative easing, which has mostly benefited people with assets, inflating their value significantly,’’ Savage said. -Bloomberg

What's more, the richest 100 Americans saw their wealth grow by $267 billion before Biden's inauguration if one counts gains since the 2020 election, for a total gain of $461 billion since Nov. 4. For comparison's sake, between Donald Trump's 2017 inauguration and last fall's election, the same group of billionaires grew around $860 billion richer.

Biden's coming for it though.

In addition to raising capital gains taxes and taxing inherited wealth, the Big Guy's proposals will 'recover' trillions of dollars in wealth into government coffers after the wealthiest pay their 'fair share.'

"Sometimes I have arguments with my friends in the Democratic Party," said Biden during his first address to Congress on Wednesday. "I think you should be able to become a billionaire or a millionaire. But pay your fair share."

Under his “American Families Plan” announced Wednesday, the top rate of personal income tax would increase to 39.6% for the highest 1% of earners from the current 37%, while the capital gains rate would be raised to the same level for those earning above $1 million, wiping out the discrepancy between income and capital gains tax rates that has benefitted many of the ultra-rich.

The wealthiest 1% currently pay 40% of all federal income taxes, according to Internal Revenue Service data, an amount that doesn’t include payroll taxes. -Bloomberg

"When you ask the American people what they want, they want corporations and millionaires and billionaires to pay higher taxes," according to Erica Payne, founder of the Patriotic Millionaires, a group of progressive high-net-worth individuals. "It is politically a winner, it is economically the right thing to do and it is morally a no-brainer."

Meanwhile, the Biden administration has also floated a proposal which would raise corporate taxes to fund infrastructure spending - a move which Amazon founder Jeff Bezos, the richest (known) person in the world - supported.

"We look forward to Congress and the administration coming together to find the right, balanced solution that maintains or enhances U.S. competitiveness," said Bezos.

Conservatives, meanwhile, say the money grab is likely to backfire.

"Government investments are often sold to the public with the promise that they will improve lives and improve the economy," said Tax Foundation president, Scott Hodge, in Congressional testimony this week. "In every case, the economic harm caused by the taxes would swamp any of the benefits from the new spending, leaving taxpayers and the economy worse off."

Congressional Democrats are also gunning for tax loopholes in order to claw back gains made by America's wealthy during the pandemic, with Sen. Elizabeth Warren (D-MA) proposing an Ultra Millionaire tax - which would hit those with fortunes above $50 million with a 2% annual tax on their wealth, and 3% for those with more than $1 billion.

That said, higher taxes aren't "going to have very much effect in the long term on redistributing wealth," according to Carnegie Mellon econ and statistics professor Robert Miller. "This focus on how we’re going to get the money is a bit misplaced – we should be thinking more about how we want to help the people that need help."

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more