Retail Traders Have Lost That Stimmy Feelin'

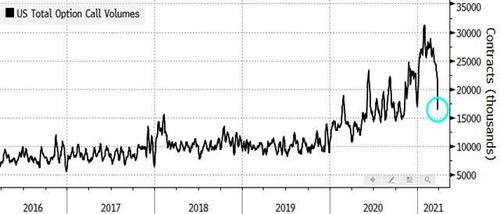

Last Friday, when previewing the month and quarter-end rebalance, Nomura's Charlie McElligott went on a brief tangent, showing the collapse in marketwide call volumes as the retail frenzy has decidedly cooled off in recent weeks...

(Click on image to enlarge)

... which McElligott attributed to three factors:

- The weight of not just the overall “stalling-out” in the broad Equities tape again — but particularly, many of these most popular speculative names meaningfully lower over the past few months and bleeding PNL, particularly in YOLO Retail trading accounts

- Retail selling ahead of tax bills coming-due, particularly with an anticipated hike in the capital gains tax from the Biden administration looking like an inevitability

- And perhaps the most salient point with a “totally-sane” macro rationale, being that as JPM found last week, the latest round of “stimmy checks” are being re-routed away from speculative assets (which were previously obsessed over during the “Work From Home” screen-time era), but now instead are transitioning back into the real world consumer economy, as we re-open and get back to work in the post-Vaccine paradigm shift

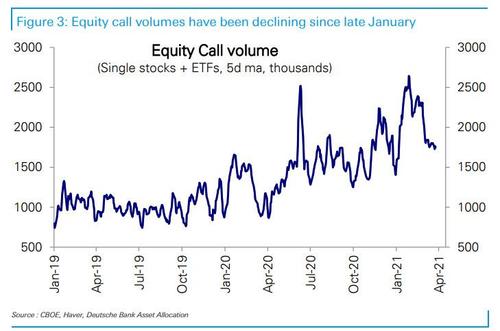

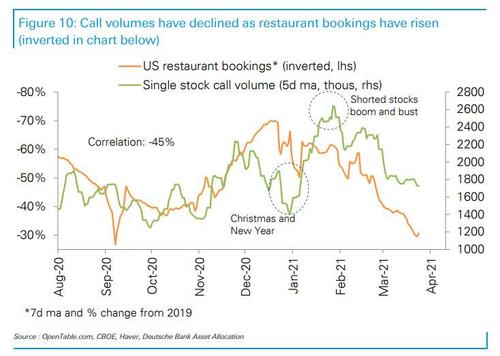

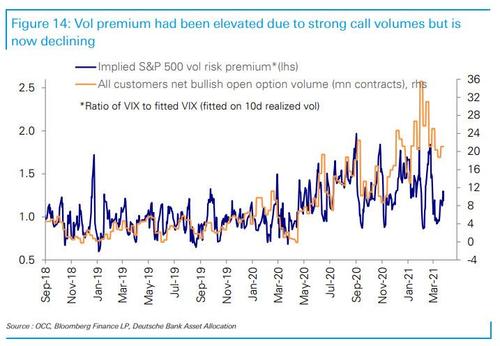

Whatever the reason, but the sudden drop off in retail participation - which as we discussed last week has also manifested itself in more QQQ put buying as even "unsophisticated" investors are now hedging their downside - has become a significant source of market tensions across other banks as well, with Deutsche Bank's flow strategist Parag Thatte also noting that after call volumes had been rising sharply for over a year, especially since November, "they soared further mid-January, but then fell sharply right after the steep climb and subsequent sell-off in heavily shorted stocks in late January. Volumes then rose briefly but have been declining again since the middle of February."

(Click on image to enlarge)

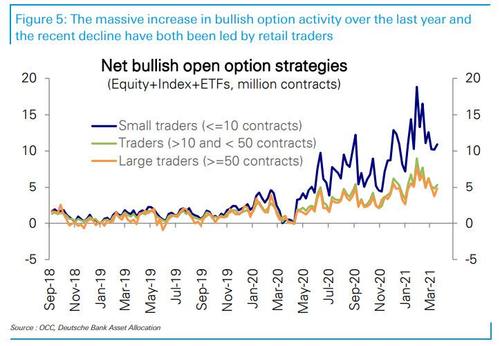

As DB further notes, the prior rise and the subsequent fall "have been both led by trades in the smallest contract sizes, indicative of retail traders."

(Click on image to enlarge)

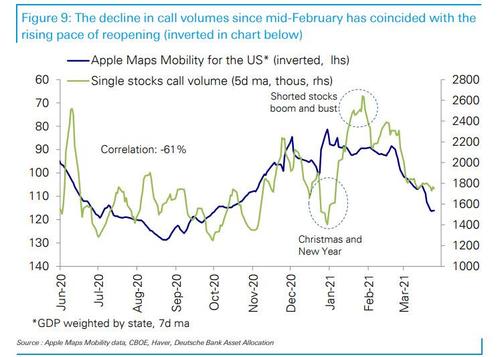

What is behind the dropoff in retail participation? Simple: the opportunity to engage in other, more social activites. As DB notes, over the last few months, call volumes have been inversely correlated with indicators of reopening, with volumes rising as stay-at-home activity rose and falling as reopening gathered pace.

Said otherwise, the economic reopening is bad news for continued gamma squeezes.

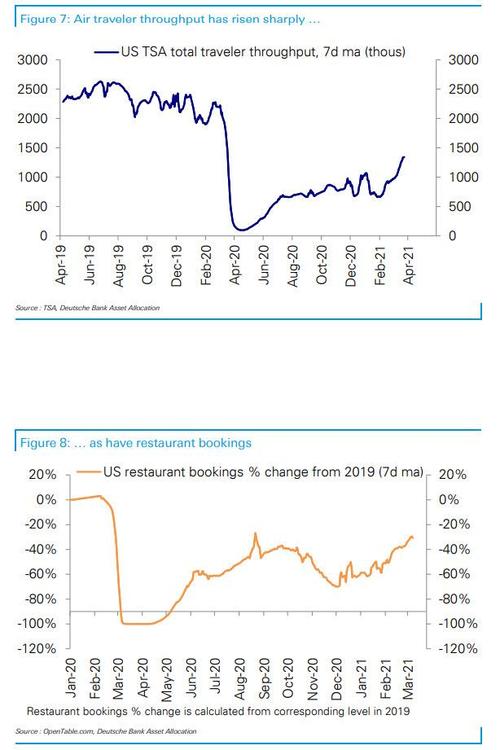

The pace of reopening has accelerated since mid-February as suggested by a variety of metrics. Mobility indicators, restaurant bookings, and air passenger traffic...

(Click on image to enlarge)

have all risen significantly and this has coincided with the decline in retail call volumes.

(Click on image to enlarge)

This jives with DB's view that "as retail investors have other things to do, the attention focused on the equity market will start to fade."

(Click on image to enlarge)

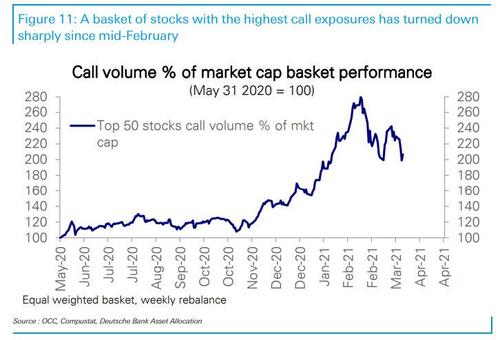

Still, putting it in perspective, DB notes that a basket of stocks with the most exposure to call volumes relative to their market cap the previous week had been rallying sharply since November, as the twin catalysts of the US election resolution and positive vaccine news unfolded. The basket rose by a massive 160% in just over three months, outperforming the equal-weighted S&P 500 by 130%. Since mid-February however, the basket is down -24%, even as the average stock in the S&P 500 is up slightly. The downturn in the basket’s performance has coincided with the abovementioned decline in call volumes since mid-February.

(Click on image to enlarge)

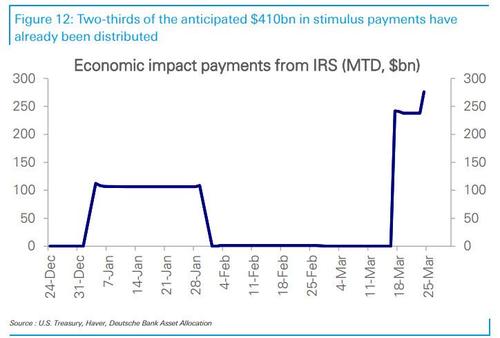

Another notable factor: whereas previously investors put a substantial portion of their stimmy checks in risk assets, this time that does not appear to be the case. According to DB, $276BN or more than two-thirds of the anticipated payments of $410bn have already been distributed as per US Treasury data. This means the incremental impact of stimulus payments should start to fade. This week also saw the first outflow from US equity funds (-$10bn) in 7 weeks, after averaging $23bn a week since early February.

(Click on image to enlarge)

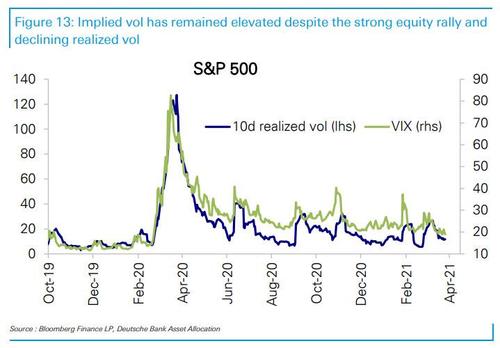

So as what went up is now coming down, vol premiums have also been declining as call volumes have fallen, which has begged the question of whether systematic strategies raise equity exposure? While JPMorgan has repeatedly scrambled to create a narrative that systematic funds can't wait to DB is also now getting on boar with this thesis writing that "a major driver of implied volatility remaining elevated despite the strong equity rally and declines in realized volatility, has been that the vol premium has been very high and that in turn has been driven by very strong bullish option volumes." As call volumes have declined, vol premiums and in turn implied vol have also begun to subside, following realized vol and daily ranges lower. "One significant implication of lower volatility is that it can then prompt systematic strategies to raise allocations to equities." Whether that happens, however, remains to be seen - consider that after banging the drum on commodities for weeks ahead of last week's quant rebalance, the day came and went and oil...plunged.

(Click on image to enlarge)

Still, according to DB's consolidated measure of equity positioning and flows which has been going sideways over the last week at very elevated levels (92nd percentile), the bank's measure of discretionary investor positioning, which is more focused on institutional investors, is already near all-time highs (98th percentile). It is currently well-supported by the strong global growth outlook but has only limited room to rise further. Systematic strategy exposure on the other hand has remained very low (39th percentile) as vol has remained elevated. If falling vol sees systematic strategies raise allocations, we could see overall positioning grind higher towards the record levels seen in early 2018.

(Click on image to enlarge)

This means that for all the doom and gloom about retail investors stepping away, their place in the capital market hierarchy will be taken by systematic and vol-control funds, whose buying will be triggered by the next sharp dropoff in VIX and realized vol as some sense of stability returns to markets even if it means a sharp decline in WallStreetBets traffic.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more