Residential Building/Employment Rebound

While I admit we are not in a recession now, my fear remains this fall…..

“Davidson” submits:

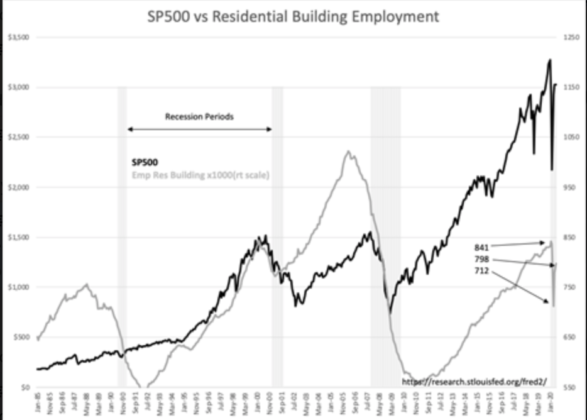

With many disconcerting headlines still confusing forecasters, there is one major theme that jumps out. That theme is one of families moving out of crowded cities where conditions have become less hospitable to suburbs and individual homeownership. A leading indicator for single-family homeownership is employment in the Residential Building sector. A chart of the SP500 vs Residential Building Employment (RBE) and Recession Periods reveals that RBE has been a good predictor of economic activity and in particular recessions with roughly a 12 months lead.

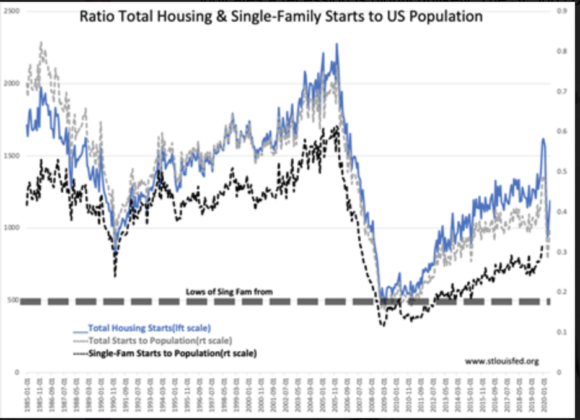

Since the beginning of 2018, there has been an persistent series of recession forecasts none of which received support from RBE. In fact, as early as Feb 2020, RBE was accelerating prior to the COVID-19 shutdown. After a sharp decline, RBE has rebounded from a low of 712,000 to 798,000 nearly fully recovering its Feb 2020 841,000 level. Single-Family Starts to US Population (BLACK DASHED LINE) likewise has spiked above trend, i.e. rebounding above the prior trend reflecting increased demand for suburban housing vs urban living.

The trend in Residential Building Employment has a good record in forecasting recessions. Its current strength indicates a recession is highly unlikely. The SP500 correlation with tops in RBE since 2000 indicates higher equity prices as recession fears ebb.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests ...

more