Research Report: Townsquare Media

Ed. Note: This article discusses a penny stock and/or microcap. Such stocks can be easily manipulated; do your own careful due diligence.

Company: Townsquare Media, Inc.

Symbol: TSQ

Analysis As Of: 5/24/19

Analysis Price: $5.50

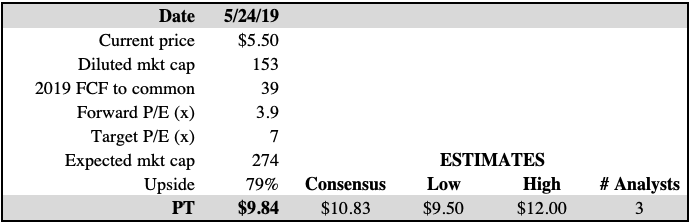

Price Target (PT): $9.84

Upside: 79%

Dividend: $0.30 (5.5%)

Recommendation: Strong Buy

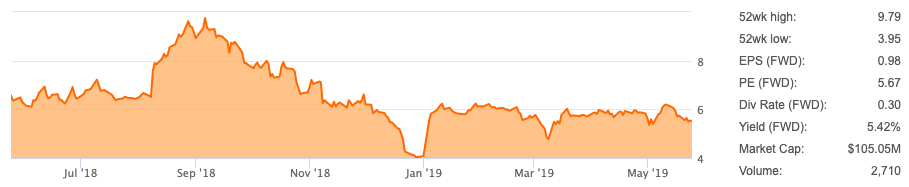

TSQ: 1-Year Chart

Source: Seeking Alpha

INVESTMENT THESIS:

In 2018, the continuing operations of TSQ generated about $44M of “adjusted EBITDA less interest, capex, and cash taxes” (a proxy for free cash flow to equity (FCFE)). Based on the results for 1Q19 and management’s 2019 adjusted EBITDA guidance, we should see about $41M of FCFE for 2019. With a diluted market cap of $153M, this gives a forward P/FCFE multiple of 4x. While two of their digital offerings (Townsquare Interactive and Townsquare Ignite) could see substantial revenue growth and each reach annual revenues of $100M in the next 3-5 years, we think the current operational results, along with the 5.5% dividend yield, make this a strong buy right now.

LIQUIDITY POSITION: Good

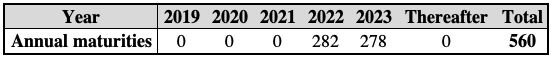

As of 1Q19, TSQ had $61M in cash and cash equivalents and $50M available to borrow on their revolver, bringing total liquidity to $111M. Since annual FCFE of $40M+ more than covers, the $8M per year spent servicing the dividend, the market’s main liquidity concern seems to be the debt load of $560M. However, they have no significant maturities until 2022, and considering their healthy earnings, they should have no problem refinancing at fair rates when the time comes.

TSQ: Annual Debt Maturities ($M)

Source: Elle Investments, 1Q19 10-Q

COMMERCIAL PROSPECTS: Very Good

Starting with 1Q19, TSQ has identified three reportable operating segments: Advertising, Townsquare Interactive, and Live Events.

Advertising

TSQ owns and operates over 300 radio stations and more than 300 local websites in almost 70 small- and mid-sized markets across the US (i.e. cities such as Albany, NY and Danbury, CT). Included in this segment is one of their two high-growth digital offerings, Townsquare Ignite, which has been developed organically over the past few years. Townsquare Ignite is a proprietary digital programmatic advertising platform which is able to hyper-target audiences for their clients. As has been discussed on the past few earnings calls, Townsquare Ignite (which is their fastest-growing product) will approach $50M in revenue in 2019, with the goal of reaching $100M in the next 3-5 years.

Townsquare Interactive

Their second high-growth product, Townsquare Interactive (TSI), targets small- and medium-sized businesses and has over 16,000 subscribers paying on average $300/month. TSI is a digital marketing solutions offering which provides services such as traditional and mobile-enabled website development and hosting, e-commerce platforms, search engine optimization (SEO), social media management, and website retargeting. The digital marketing industry is hyper-competitive, so while there is nothing proprietary about TSI, the cost seems very reasonable compared with other marketing agencies, and the size and complementary synergies within their advertising ecosystem across all segments will help it continue to grow market share. The goal is for this digital product to also reach $100M in annual revenue in the next 3-5 years.

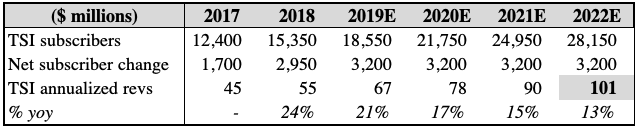

As of 1Q19, TSI had 16,200 subscribers, which equates to an annualized run-rate of $58M. Over each of the past 4 quarters, TSI has added 850 net subscribers, which equates to an annual net subscriber gain of 3,400. In the table below, we can see that if TSI can maintain a subscriber growth slightly below their current rate, management’s goal can be reached by 2022. What’s also very appealing about this segment is that even though they are expanding the headcount to support growth, they expect operating margins to remain at 30%.

TSQ: Townsquare Interactive Path To $100M ($M)

Source: Elle Investments, 4Q18 earnings slides

Live Events

Lastly, their Live Events segment plans, promotes, and produces about 200 live events each year, ranging from popular music and food festivals to craft beer and wine tastings. This segment is the smallest of the three and has gone through considerable downsizing in recent years as the company divested certain poorly performing live events. The remaining events attract over 1M attendees annually and bring in $1M-$2M in adjusted operating income per quarter.

Outlook

We are bullish on the growth prospects of Townsquare Interactive and Ignite and think the current performance provides enough justification to make this a good buy right now. This is because while, in recent past, the very poor performance at some of the live events have masked the healthy earnings of TSQ’s other segments, little by little, these poor performing live events have been moved to discontinued operations and are being divested.

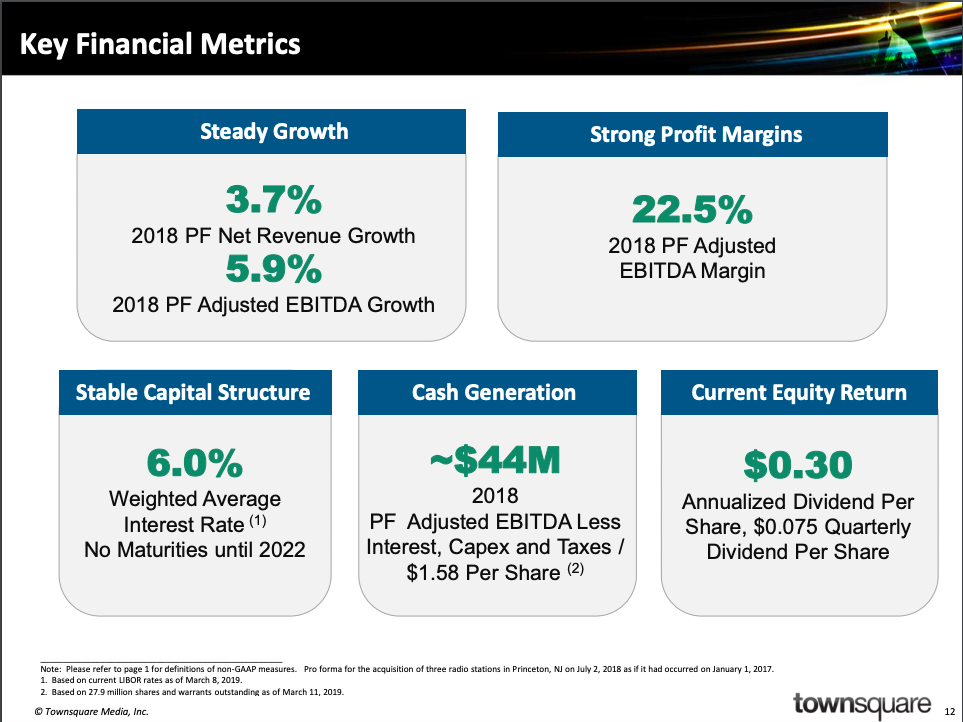

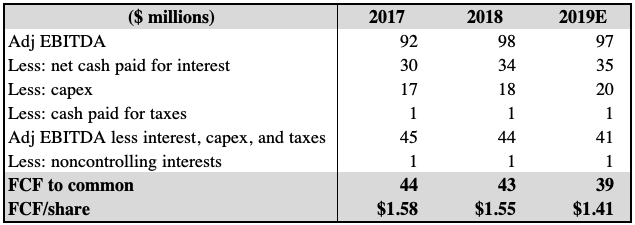

To give investors an idea of what the earnings from the underlying core business look like at the moment, management provides a metric called “Adjusted EBITDA less interest, capex, and taxes,” which we can think of as a proxy for FCFE. For 2018, this pro forma figure was $44M (out of adjusted EBITDA of $97.5M).

TSQ: Key Financial Metrics

Source: 4Q18 earnings slides

Through 1Q19, management is again guiding for annual adjusted EBITDA of about $97M, which would basically match last year’s performance. Deducting similar amounts for interest, capex, and taxes would again give us annual cash generation of over $40M (TSQ has substantial net operating loss (NOL) carryforwards and does not expect to be a material cash taxpayer until 2023). To arrive at our PT of $9.84/share, we assume the following:

- Net cash paid for interest $35M

- Capex $20M

- Cash paid for taxes $1M

- Diluted share count 27.9M

- Target forward P/E 7x

TSQ: 2019 FCF Estimate ($M)

Source: Elle Investments, TSQ filings

TSQ: PT Estimate ($M)

Source: Elle Investments, Yahoo Finance

CONCLUSION:

We don’t believe TSQ’s seemingly large debt load is a concern. As previously discussed, no significant maturities occur until 2022, and given the strength of the underlying core business, we do not see a looming problem when it comes time to refinance. This lingering debt issue, along with the poor performance of the Live Events segment, may have been responsible for some negative sentiment. But just last September, TSQ’s stock briefly approached $10.00/share after a good earnings report. Since then it has come back down even though the core operations continue to perform on par with the results from a year ago. Again, while we are bullish on the growth prospects of their two main digital offerings, we feel that the current cash generation justifies a position. Until the market re-values this very under-the-radar stock with more favorable valuation, we are happy to collect the safe 5.5% dividend. We think TSQ is a strong buy.

GLOSSARY:

FCFE: free cash flow to equity

SEO: search engine optimization

TSI: Townsquare Interactive

Disclosure: We are long TSQ.

Disclaimer: The Elle Investments portfolio is managed utilizing a “quantamental” approach where each position, while based on Fundamental Analysis, is ...

more