Research Report: ODP

Company: Office Depot, Inc.

Symbol: ODP

Analysis Date: 5/28/19

Analysis Price: $2.00

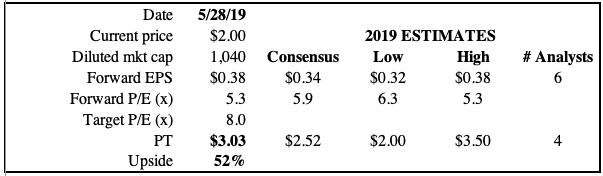

Price Target (PT): $3.03

Upside: 52%

Dividend: $0.10 (5%)

Recommendation: Buy

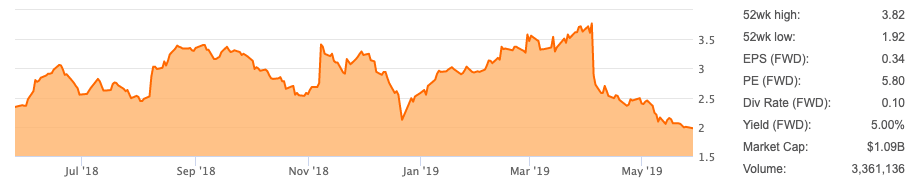

ODP: 1-Year Chart

Source: Seeking Alpha

Note: All mention of guidance refers to the midpoint of the guidance range.

INVESTMENT THESIS:

After climbing to above $3.50/share in early April, ODP has sold off almost 50%, driven by the lower than expected operating performance at the CompuCom division. Even though 2019 annual guidance was reduced following 1Q19 results, the valuation based on the lowered adjusted EBITDA guidance is still attractive, and the 5% dividend is well-covered by the $300M+ in free cash flow (FCF).

LIQUIDITY POSITION: Good

As of 1Q19, ODP had cash and equivalents of $604M, total current assets of $3.5B, and available credit of $943M. With current liabilities of $3.2B, liquidity is not a concern at this time, and we think the risk of dilution is very low. What’s more, the expected $300M+ of FCF for 2019 comfortably provides for the $50M+ that will be needed to service the dividend, as well as the remaining $90M authorized for share buybacks.

COMMERCIAL PROSPECTS: Fair

ODP’s reportable operating segments are: Business Solutions Division (BSD), Retail Division, and CompuCom Division.

Business Solutions Division

This segment sells office supplies and related products and services to customers in the US, Puerto Rico, the US Virgin Islands, and Canada. Customers in the BSD segment are served through a dedicated sales force and catalogs. For 1Q19, this segment saw modest revenue growth of 1% as well as net new customer additions.

Retail Division

ODP’s approximately 1,400 retail stores are located in the US, Puerto Rico, and the US Virgin Islands. They sell office supplies, technology products, office furniture, etc., and also offer business services such as printing, copying, and shipping. Same-store sales (SSS, also known as comps) continue to be negative, coming in at -4% for 1Q19, and driven primarily by lower store traffic. However, in certain locations (such as Austin, TX) where they have invested in improving the in-store experience, they are seeing some positive trends. They are also experimenting with co-working spaces in certain stores. While this segment is clearly shrinking and is being hit hard by the rise of online competitors, operating margins remain above 5%.

CompuCom Division

ODP announced the acquisition of CompuCom, an IT services provider, in October 2017. The strategic rationale for the acquisition was that ODP would become a one-stop shop for small and medium-sized businesses to have all of their business needs met, from office supplies to IT services. Up until recently, CompuCom had been seeing positive organic growth, but revenues declined 4% during 1Q19, as anticipated project-related revenue from existing accounts did not materialize. Costs were also not adjusted to match the lower revenues, and so the segment experienced an operating loss for the quarter. Management is taking steps to address these recent issues, as this segment will feature prominently in ODP’s growing emphasis on being a services provider.

Outlook

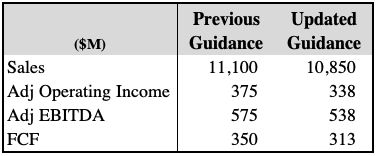

Even before 1Q19’s disappointing results, ODP was clearly not a growth stock. The reason we think it is an attractive buy is because the recent sell-off has been exaggerated relative to the news that caused it. Even with the lowered guidance, ODP will still earn over $500M in adjusted EBITDA and over $300M in FCF in 2019.

ODP: 2019 Annual Guidance ($M)

Source: Elle Investments, ODP 1Q19, and 4Q18 earnings slides

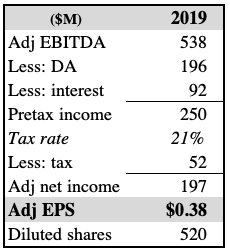

To calculate our PT using management’s guidance for adjusted EBITDA (which includes $40M in cost savings by the end of the year), we assume the following:

- Depreciation and amortization expense $196M

- Interest expense $92M

- Tax rate 21%

- Remaining $90M authorized for share repurchase is used to retire 45M shares at $2.00/share

- Diluted share count 520M

- Target forward P/E 8x

ODP: EPS Estimate ($M)

Source: Elle Investments

ODP: PT Estimate ($M)

Sources: Elle Investments, Yahoo Finance

CONCLUSION:

We think ODP is another case of a retailer that has been overly-punished from the “death of brick-and-mortar” narrative. It’s true that comps at the retail locations have been trending negative for several quarters now, but ODP is still generating lots of cash. Additionally, they are seeing some early positive results from their in-store upgrades. Early results from the stores offering co-working spaces also are positive. The store footprint is being reduced, the restructuring plan will save a full $100M per year come 2020, and the $50M+ spent on dividends (currently yielding 5%) is safely covered from FCF. We think ODP is a buy

GLOSSARY:

BSD: Business Solutions Division

SSS: same-store sales

Disclaimer: The Elle Investments portfolio is managed utilizing a “quantamental” approach where each position, while based on Fundamental Analysis, is sized as part of a larger ...

more