Renewable Energy Group - Russell 3000 Star

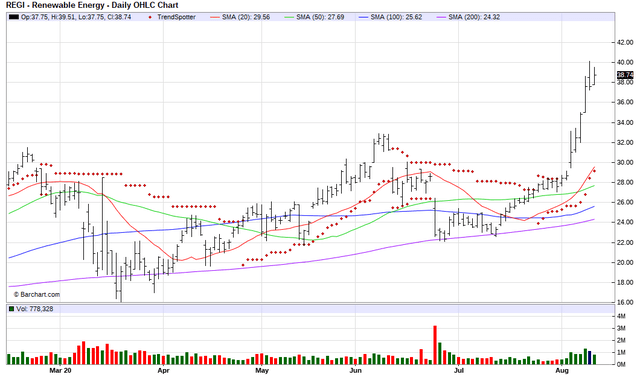

The Barchart Chart of the Day belongs to the biofuel company Renewable Energy Group (REGI). I found the stock by using Barchart to sort the Russell 3000 Index stocks first by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled buy on 8/3 the stock gained 36.26%.

Renewable Energy Group, Inc. produces and sells biofuels and renewable chemicals in the U.S. It operates through Biomass-Based Diesel, Services, Renewable Chemicals, and Corporate and Other segments. It produces biomass-based diesel from a range of feedstocks, including inedible corn oil, used cooking oil, soybean oil, canola oil, and inedible animal fat. This segment is also involved in the purchase and resale of biomass-based diesel, petroleum-based diesel, renewable identification numbers, and raw material feedstocks acquired from third parties; and sale of glycerin, free fatty acids, naphtha, and other co-products of the biomass-based diesel production process. The Services segment provides facility management and operational services to biomass-based diesel production facilities, as well as to other clean-tech companies. This segment also offers construction management services for biomass-based diesel production facilities. REG is committed to being a long-term leader in bio-based fuel and chemicals.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 10 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 230.56+ Weighted Alpha

- 215.99% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 19 new highs and up 65.70% in the last month

- Relative Strength Index 84.94%

- Technical support level at 37.82

Fundamental factors:

- Market Cap $1.47 billion

- P/E 13.06

- Revenue expected to grow 11.30% next year

- Earnings estimated to increase 64.40% next year and continue to compound at an annual rate of 15.00% for the next 5 years

- Wall Street analysts issued 4 strong buy and 1 buy recommendation on the stock

- The individual investors following the stock on Motley Fool voted 123 to 15 that the stock will beat the market

- 8,700 investors are monitoring the stock on Seeking Alpha

Disclosure: None.