Redfin IPO, Tech Company Changing Real Estate Industry

Real estate brokerage Redfin Corp. (Pending:RDFN) filed an S-1/A with the Securities and Exchange Commission detailing its upcoming initial public offering. The IPO is expected to place on Friday, July 28. Since its launch in 2004, Redfin has grown to be the #1 visited brokerage site in the US. Through its IPO, the company aims to raise $120 million, offering 9.2 million shares at a price range of $12-14. The company has an additional 1,384,650 shares as an overallotment option for its underwriters.

Assuming Redfin prices at the mid-point of its expected price range, it would command a market cap value of $1.1 billion, making it the third unicorn to IPO this year following Snap Inc. (NYSE:SNAP) and Blue Apron (NYSE:APRN).

The underwriters for the IPO are Goldman Sachs & Co. LLC, Allen & Company LLC, BofA Merrill Lynch, RBC Capital Markets, Oppenheimer & Co. and Stifel.

We previously wrote about the company as well as outlined the details on the IPO on our IPO Insights Platform.

(Source: Company Website)

Business overview

Redfin is a real estate brokerage with the mission of reinventing the way people buy and sell homes. The company's key differentiating factor is its high-tech software. And additionally, Redfin differentiates itself from other companies which just offer the home searching platform (such as Zillow) through its team of real estate agents who customers are matched with over the platform. Through the platform homebuyers can create filtered home searches, get notifications on new listings in their area, schedule tours with Redfin agents, and even begin the process of making an offer on a property. Home sellers can list their homes, find an estimate of its value, and learn what similar homes in the area are selling for.

Redfin currently operates in 80 markets with the majority of revenue coming from its top ten metropolitan areas. In 2016, 72% of revenue was derived from: Boston, Chicago, Los Angeles, Maryland, Orange Country, Portland, San Diego, San Francisco, Seattle, and Virginia.

In 2017, the company launched two new services: Redfin Mortgage and Redfin Now. Through Redfin Mortgage, it originates and underwrites loans. The objective in launching this service was to simplify the process of closing on a home. Redfin Now is an experimental service for home sellers. Through this service, Redfin will buy homes directly from sellers and then sell them itself over the platform.

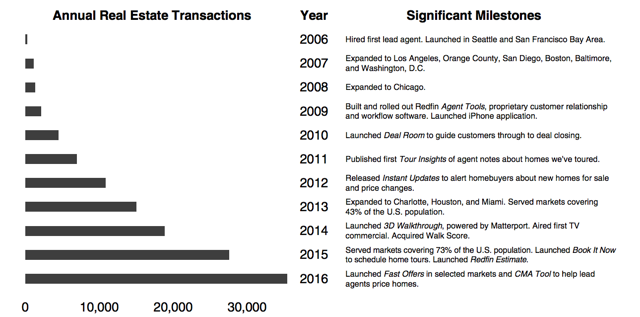

(Click on image to enlarge)

(Source: S-1/A)

Management

Glenn Kelman serves as president, chief executive officer, and board member - positions he has held since March 2006. He has steered Redfin through much of its history. He previously held several executive-level roles and was the co-founder of Plumtree Software Inc., serving as its vice president of marketing and product management from 1997 to 2004. Kelman holds a Bachelor of Arts in English from the University of California, Berkeley.

Chris Nielsen serves as chief financial officer - a position he has held since June 2013. Previously, Nielsen was the chief operating officer and CFO of Zappos.com from 2010 to 2013. Before that, he served as the vice president of the home and garden division at Amazon.com Inc. from 2003 to 2010. Nielsen holds a Bachelor of Science in industrial engineering from Stanford University and a Master of Business Administration from the Massachusetts Institute of Technology.

Financial highlights and risks

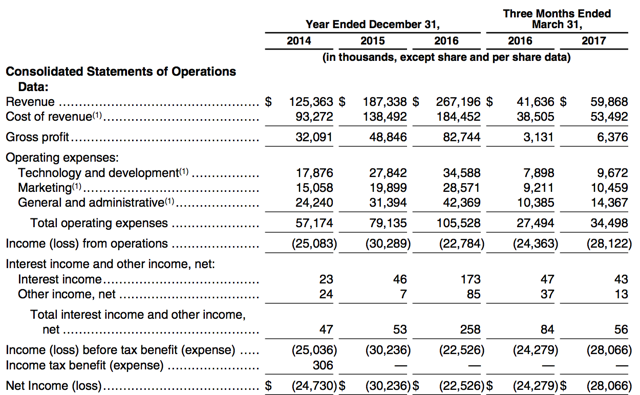

Redfin generates revenue through a 1-1.5 percent commission fee on home sales facilitated by its site. The company has grown revenue from $125.4 million in 2014 to $187.3 million in 2015 and $267.2 million in 2016. This represents YOY growth of 49% and 43% between 2014-2015 and 2015-2015, respectively. Cost of revenue has remained stable but high as a percent of revenue. Cost of revenue represented 74%, 74%, and 69% in 2014, 2015, and 2016, respectively. The company has steadily increased spending on marketing as it has launched new services and expanded to other markets. Losses were $22.5 million, $30.2 million, and $25 million in 2016, 2015, and 2014 respectively. As of its IPO, Redfin had an accumulated deficit of $613.3 million.

The company has been successful raising money through private funding. It has raised $167.8 million in nine rounds of private funding. Notable investors include Glynn Capital Management, Globespan Capital Partners, Austin Ligon, and Draper Fisher Jurvetson, among others.

In 2014, Redfin acquired WalkScore, a website which calculates the walkability of an address based on the accessibility of the surrounding area by foot.

(Click on image to enlarge)

(Source: S-1/A)

Competition

Redfin's main competitor is Zillow Group (Nasdaq:Z), which enables users to browse homes, add online listings, and obtain estimates on home prices. However, Zillow operates a very different business model in that it doesn't have real estate agent staff or generate money through commissioning of home sales. Instead, the company makes money through ad sales and charging property management companies to advertise their listings. In addition, it offers premier services for real estate agents, such as premium designs and integrated multiple listing service search for a fee of $10 per month.

Conclusion

At its proposed valuation, we are optimistic about Redfin and its future growth.

The company is growing in all of the markets it operates and provides a unique value-add in the real estate community. Its platform has quickly become the number one brokerage site, and Redfin shows its ability to continuously innovate with the additional features and services it has added. The company is growing quickly, and we predict that the capital from the IPO will help to propel it further.

We are optimistic about this deal and recommend investors consider a modest allocation.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more