Record Wall Street Euphoria Triggers First BofA "Sell Signal" Since February 2020

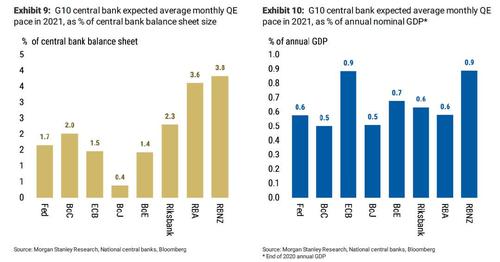

At the start of December, we showed in a handful of charts how current market euphoria had blown away past "dot com" levels and was in uncharted waters... and why not: as KLC put it, "there couldn’t be a greater bullish cocktail of recent news, with three COVID vaccines showing strong promise against a backdrop of zero interest rates, a record fiscal deficit, and an uber-dove - Janet Yellen - in charge of it all." And keeping it all going is a continued firehose of central bank liquidity which even in 2021 will amount to 0.6% of global GDP injected every single month.

(Click on image to enlarge)

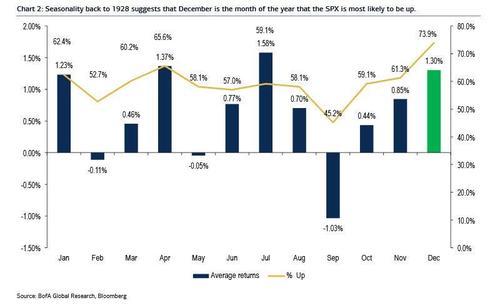

Obviously, none of this is lost on investors who have been dragged into the year-end meltup. As a reminder, not only is December the most bullish month of the year, up 74% of the time with an average return of 1.3% -but the last 10 days of the month are most bullish...

(Click on image to enlarge)

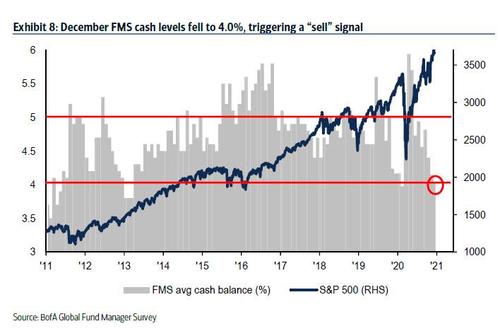

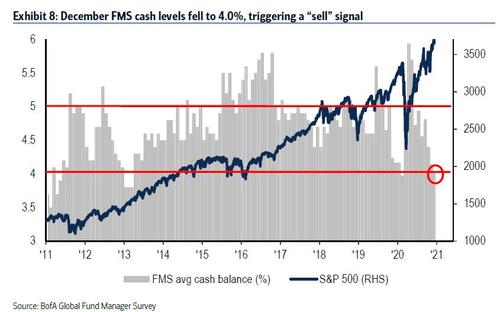

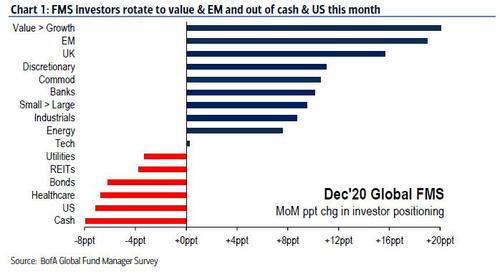

... which is probably why the latest, December, Fund Manager Survey from Bank of America reveals that investors are closing the year the most bullish all year, and perhaps in series history, with respondent cash levels now down to 4% (triggering a BofA "sell" signal) as vaccine hope induces "buy the reopening" trade.

According to the survey which polled 217 panelists with $576BN in AUM, everyone is uniformly bullish, with bulls adding exposure in consumer, commodities, EM (60% say EM best performer in ’21). According to Hartnett, equity "barbell" strategies all the rage while (the few remaining) bears note cash levels fall to 4.0%, triggering an FMS Cash Rule “sell signal”; The last time the sell signal was triggered was in February 2020 - everyone knows what happened nextx.

(Click on image to enlarge)

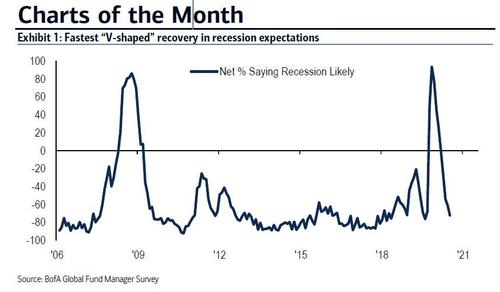

With prices setting the narrative, it is hardly a surprise that 2020 was a year utterly dominated by COVID-19 which caused the quickest economic and financial market collapse of all time. However, as Hartnett notes, "just half a year later, recovery expectations have also surpassed prior recessions in both speed and magnitude."

(Click on image to enlarge)

Additionally, continuing recent survey trends, many more investors say the global economy is in an early-cycle phase (70%, highest since January 2010) as opposed to recession (12%), which as seen in 2009 & 2012 is a key recovery milestone.

(Click on image to enlarge)

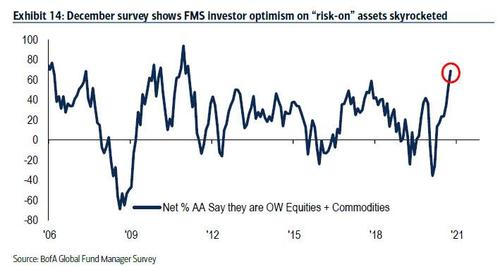

In light of the above, it is hardly a surprise that we have seen one of the fastest expansions in "risk on" optimism on record, rising to one of the highest level since Feb’11 (net 69%).

(Click on image to enlarge)

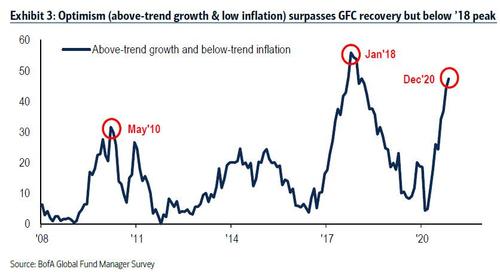

At the same time, optimism (defined as above-trend growth and low inflation) has surpassed GFC recovery levels but remains below the ’18 peak for now… consistent with an uber-Goldilocks view.

(Click on image to enlarge)

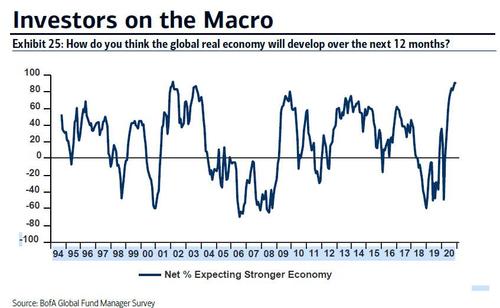

On macro, net 89% of respondents expect stronger growth in '21 (everyone knows what happens when Wall Street unanimously agrees on any one thing...)

(Click on image to enlarge)

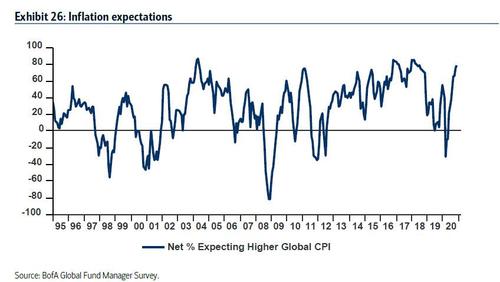

... a record 87% expect higher long-term yields, while inflation expectations jumped 4% to net 79% of FMS investors expecting higher global CPI in the next 12 months, the highest since Jul’18; only 10% say inflation will be ‘a lot higher.’

(Click on image to enlarge)

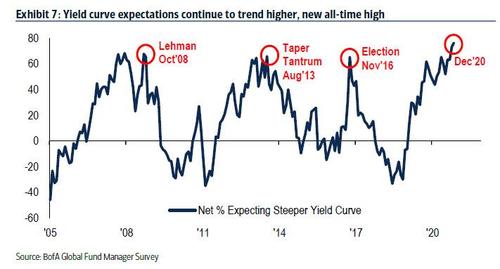

Alongside, this, a record net 76% of investors expecting a steeper yield curve; higher than the 2008 Lehman bankruptcy, the 2013 Fed Taper Tantrum & the 2016 US Election.

(Click on image to enlarge)

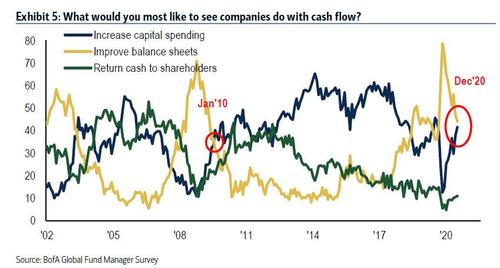

Asked what corporations should do with cash investors split between improve balance sheet (44%) & increase capex (42%) as recession fear ends.

(Click on image to enlarge)

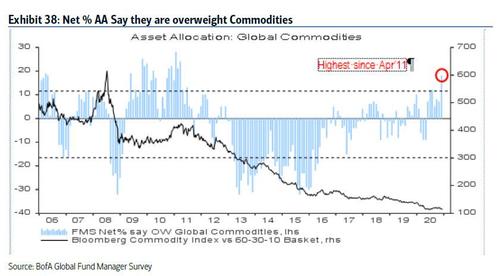

As a result of this bullish macro outlook, the allocation to commodity net overweight highest since Feb'11.

(Click on image to enlarge)

Alongside this, the allocation to EM equities is the highest since Nov'10...

(Click on image to enlarge)

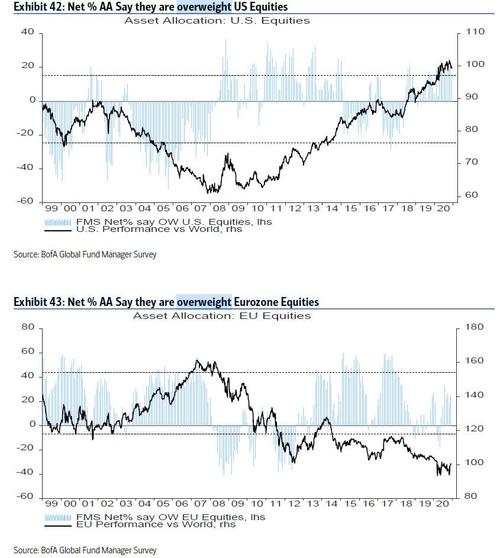

... even though investors are still OW US & EU, indicating they are just indiscriminately buying everything.

(Click on image to enlarge)

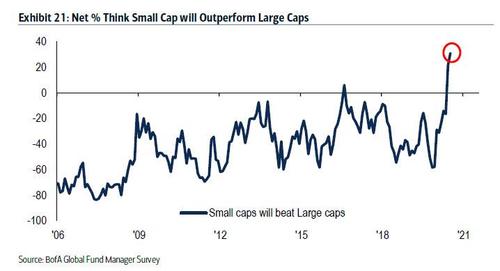

The jjump in allocation to consumer discretionary, industrials (highest since Apr'14), banks (first OW since Jan'20)… but tech remains largest OW; reopening rotation zeal best expressed via record 31% of investors long small cap vs large cap.

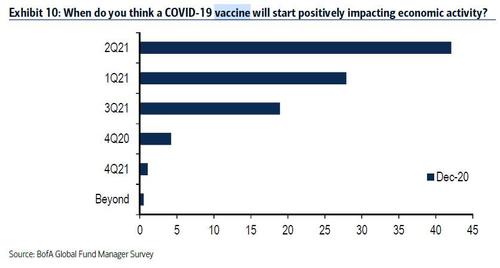

Much of this euphoria is based on optimism that a vaccine is imminent: when asked when COVID-19 vaccine will start positively impacting economy, 42% of investors replied Q2’21, 28% said Q1’21, 19% said Q3’21.

(Click on image to enlarge)

Amid this hopeful cheer where covid is almost a thing of the past, it's hardly a surprise that a record number of respondents say small caps will outperform large caps...

(Click on image to enlarge)

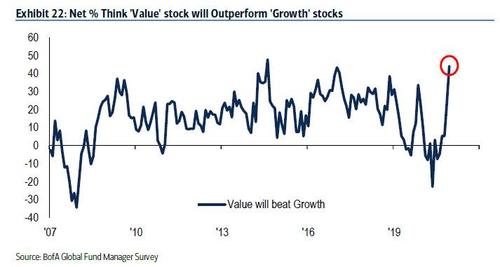

... that value will outperform growth...

(Click on image to enlarge)

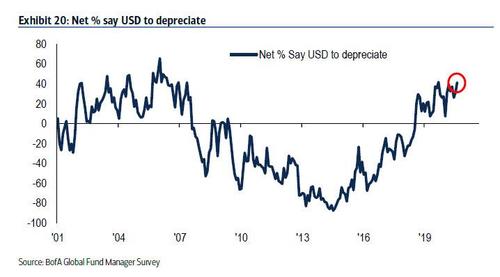

... and that the dollar will continue to drop.

(Click on image to enlarge)

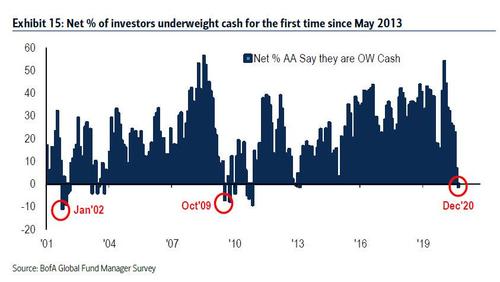

On cash & risk, as euphoria spreads and asset allocators have to dig to find incremental purchasing power, investors are underweight cash first time since May'13.

(Click on image to enlarge)

In fact, according to Hartnett, cash level have dropped to 4.0% triggering the BofA FMS Cash Rule "sell signal", which has a back-tested 1-month S&P500 return = -3.2%.

(Click on image to enlarge)

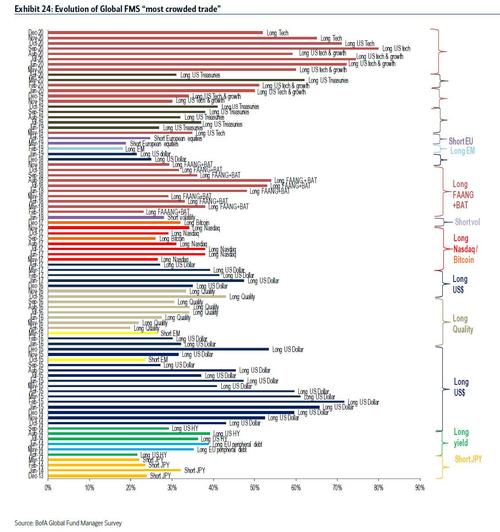

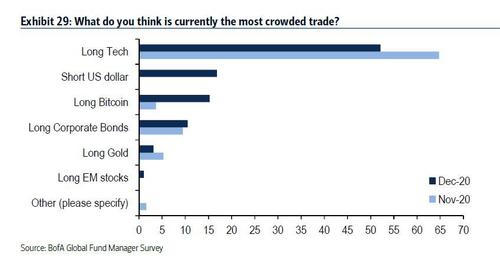

And while one can argue that everything is one massive, crowded trade, according to the survey, the most crowded trade #1 long tech (52%) for 8 consecutive months...

(Click on image to enlarge)

.... the 2nd most crowded trade is short US$ (17%), and hilariously, #3 is long Bitcoin (15%), even though virtually none of these so-called professionals can trade bitcoin in their work accounts. Maybe they are just jealous?

(Click on image to enlarge)

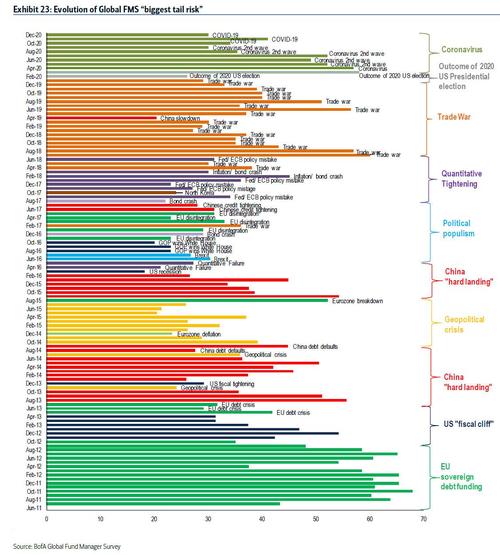

While one would be hard pressed to discuss any risks in a market where nothing can possibly go wrong - and if it does, the Fed will just inject another few trillion - the survey finds that for another month, COVID-19 remains the #1 tail risk down from 41% to 30%, but fears of inflation (24%) & fiscal policy drag (18%) rising.

(Click on image to enlarge)

As for Hartnett himself, having repeatedly said in the past month to be cautious in light of this euphoria, the BofA CIO repeats his warnings, and says that based on the FMS contrarian trades, "we say sell the vaccine 1Q21; contrarian AA trades are long cash-short stocks, long US$-short EM; contrarian equity trades are long energy/staples-short tech/industrials."

(Click on image to enlarge)

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more