Recent Dip Providing Buying Opportunity On Ebay

When eBay (EBAY) reported earnings on April 28, the company beat on both the EPS estimate and the revenue estimate. Unfortunately, the company’s outlook disappointed investors and analysts alike and the stock has since tumbled 7.5%. The stock had also dropped in the week leading up to the earnings and report and since peaking on April 16, the stock has fallen over 11%.

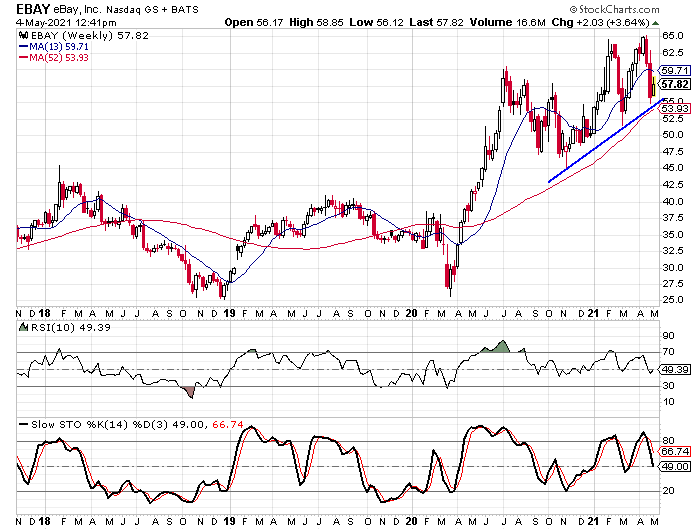

There could be good news on the horizon though. There is a trend line that connects the lows from last November and from March, and the stock just hit that trend line last week. We could see a bounce from here as the disappointment from the earnings outlook wanes in people’s memories.

As you can see on the chart, the 52-week moving average is just below the trend line and that gives the stock a dual-layer of support. We also see that the overbought/oversold indicators have moved down rather sharply after being near or on overbought territory. The 10-week RSI just dipped below the 50-level and that is about as low as it has been in the past year. None of the little dips in the past year have caused the RSI to drop below the 40-level.

The Chart Only Tells Part of the Story—the Fundamentals are Strong Too

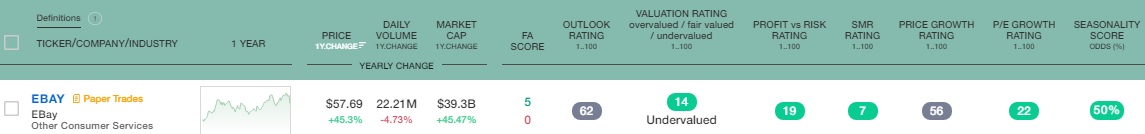

Digging in to the fundamental analysis for eBay we see that the company scores very highly in a number of different categories. In all, there are five fundamental indicators where the stock scores well on the Tickeron Fundamental Screener. The highest score of the bunch is the SMR rating and it’s a 7. The Valuation rating is a 14 and the Profit vs. Risk rating is a 19. The P/E Growth rating is at 22 and the stock also gets a positive mark for its Seasonality score.

(Click on image to enlarge)

If we look at the individual stats that make up some of these indicators, it’s easy to see why the company scores so well. eBay has seen earnings grow by 20% per year over the last three years and they jumped 58% in Q1. Analysts expect earnings to increase by 15% for 2021 as a whole.

Sales haven’t been growing as much over the last few years, in fact, they have been declining at a rate of 2% per year for the last three years. That trend seemed to reverse in Q1 when sales jumped 42%. Analysts expect sales to jump 17.2% in 2021.

From a profitability standpoint, eBay scores extremely strong marks. The return on equity is 76.3% and the profit margin is 29.3%.

On the valuation rating, the stock is trading at a very modest trailing P/E of 15.22 and a forward P/E of 14.99. Those are some very low ratings for a company that has performed so well fundamentally.

The Sentiment toward eBay is Surprisingly Pessimistic

I was surprised at what the sentiment indicators show for eBay. There are 32 analysts covering the stock right now with only 10 “buy” ratings and 22 “hold” ratings. This gives us a buy percentage of 31.3% and that is less than half of the average buy percentage. The average buy percentage falls in the 65% to 75% range. This stat becomes even more alarming when you think about it on a relative basis. Many stocks with far worse fundamental ratings have far higher buy percentages.

Please remember that I view the low buy percentage as a positive for the stock. A low buy percentage means there is far more potential for upgrades than downgrades. An upgrade from the right analyst or a series of upgrades could help push the stock higher.

The short-interest ratio is also showing greater pessimism toward eBay than the average stock. The ratio is at 3.47 currently and the average ratio falls in the 3.0 area. While this indicator isn’t nearly as pessimistic as the buy percentage, it is still suggesting that there is more bearish sentiment on eBay.

One sentiment indicator for eBay that shows greater optimism than the average stock is the put/call ratio. There are 113,670 puts open and 183,099 calls open at this time. This puts the ratio at 0.62 while the average ratio falls in the 0.9 to 1.1 range.

Breaking eBay down using all three analysis styles, I would have to say the outlook for the stock is great. The fundamentals are solid with the profitability measurements and the earnings growth being particularly strong. The valuation measurements are really low at this time and that presents a strong fundamental picture.

The chart shows the stock is trending higher over the long term and the recent decline has the stock trading just above support from the trend line I mentioned. The OB/OS indicators are down to levels where we have seen reversals in the past year and that could help as well.

The sentiment being as pessimistic as it is, well that’s yet another positive for the stock. All of those analysts that are skeptical of eBay can switch to the bullish camp and that would help push the stock higher. The higher-than-average short interest ratio can also help. If the stock rallies, it could force short sellers to cover their positions.

I can see eBay making its next move higher over the coming weeks and it should challenge the $65 level again soon. A break above that double-top level could cause a breakout for the stock and we could easily see it trading up near the $75 area by the end of the year.

Disclaimer: Although our services incorporate historical financial information, past financial performance is not a guarantee or indicator of future results. Moreover, although we believe the ...

more