Raise Cash By Selling Extended Tech Stocks: Analog Devices

With the recent strong rebound in share prices, the broad market index price is now extended but still in a downtrend. The bottom of that downtrend historically has been marked by an improvement in the gross profit margin and, so far, that is not evident.

The average gross profit margin is still unusually high and falling at the average U.S. company. Corporate growth fell in the recent first quarter 2020 financial statements, extending a declining trend that began in the last quarter of 2018. The gross profit margin has dropped for the third consecutive quarter both on average and more frequently. This is a highly correlated factor that has been a reliable predictor of the direction of share prices.

The shape, timing and magnitude of the recovery is the critical issue now. The surprise development in the first quarter was an improvement in the gross profit margin of basic industry and the decline in the gross profit margin of the technology sector. That provides a hint that the recovery leaders will be industrials and commodities.

That leadership shift might be expected in the context of huge deficit spending and disrupted global trade. Particularly important now since depressed share prices are more common among industrial companies and extended share prices are more common in technology.

Maintain Cash Reserves

Sell your falling growth companies with shares trading at premium prices and only seek rising gross margin companies with improving financial condition. Maintain a defensive cash position (20% to 30%) and take advantage of the increased share price volatility.

In the technology sector look for falling sales growth (a red trunk of the MoneyTree) and a declining gross profit margin (a red top rim of the MoneyTree pot). Sell those with premium share prices. Otos will support you to find those vulnerable stocks in your portfolio. In the industrial and commodity sectors, the issue is financial condition. It is too early to measure the shape of the recovery and the second quarter financial statements are likely to be influenced by the huge temporary stimulus spending by governments.

Analog Devices $120.50 SELL this rich company getting worse

Analog Devices, Inc. (NASDAQ: ADI) has been an exceptionally profitable company with persistently high cash return on total capital of 15.0% on average over the past 21 years. Over the long term the shares of Analog Devices have advanced by 44% relative to the broad market index.

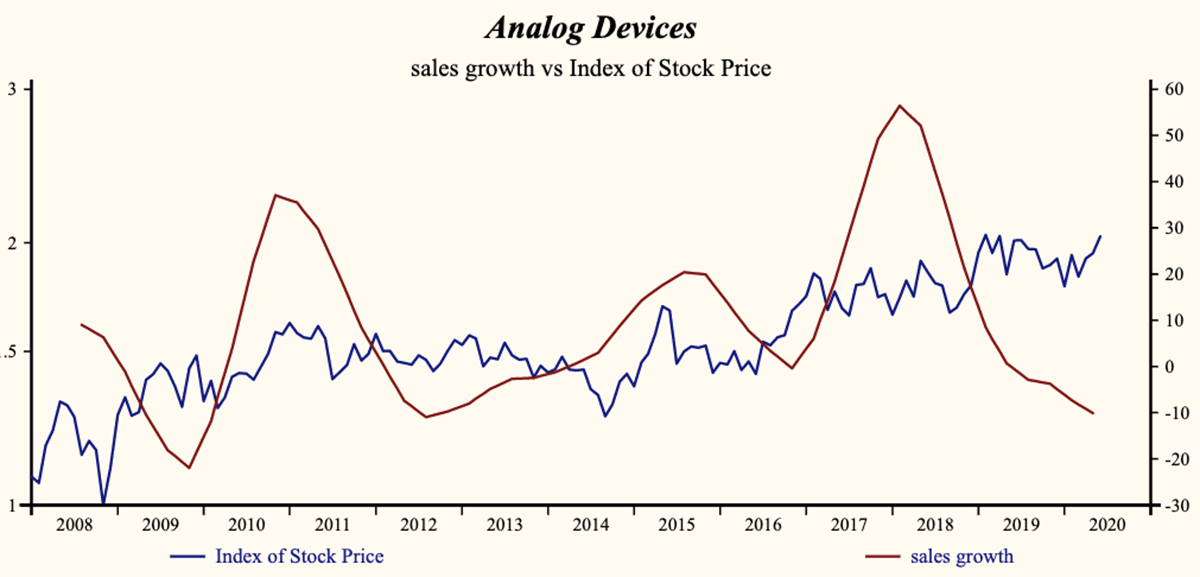

Currently, sales growth is -10.1% which is low in the record of the company and lower than last quarter. Sales growth has been 52% correlated with the share price with a five-quarter lead.

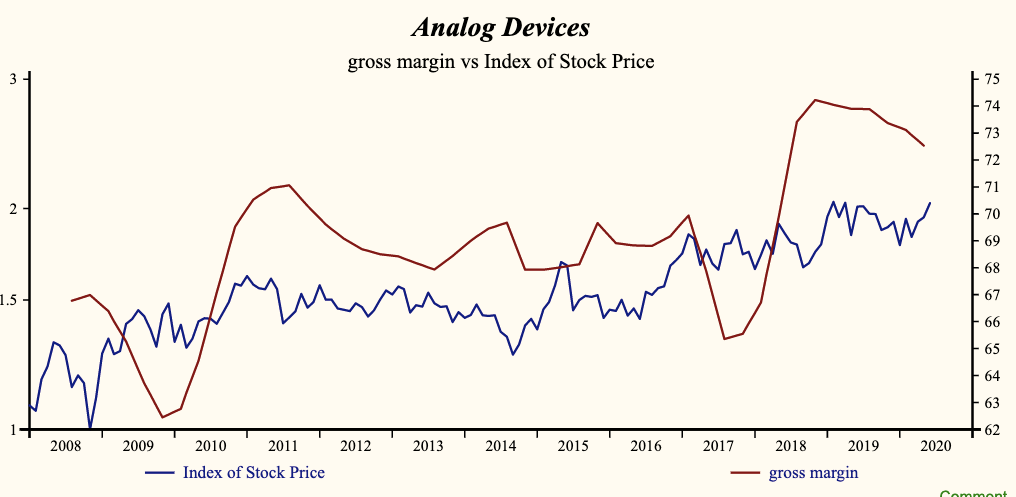

The company is recording a high and falling gross profit margin which has been 64% correlated with the direction of the share price. SG&A expenses are low in the record of the company and rising. That implies that the company has limited scope for further cost containment and rising costs are slowing the EBITDA growth rate relative to sales. Lower gross margins and higher SG&A expenses are producing a deceleration in EBITDA relative to sales which has been 85% correlated with the direction of the share price.

More recently, the shares of Analog Devices have remained relatively flat to the February, 2019 high. The current indicated annual dividend produces a yield of 2.2%. Five-year average dividend growth is 6.0%. Current trailing operating cash-flow coverage of the dividend is 2.4 times.

The shares are trading at upper-end of the volatility range in a 16-month falling relative share price trend. The current extended share price provides a good opportunity to sell the shares of this evidently decelerating company.

Make the shift to Active Management now!

Empower yourself with data and analytics that has identified every market peak and trough in the past 50 years. Please remember Otos in your money and investment conversations.

Reminder, Otos is hosting a conference call this Wednesday, June 24, to mark the end of the quarter. The call will be under the auspices of the Financial Executives Networking Group.

Disclaimer: This article is not an investment recommendation, Please see our disclaimer - Get our 10 ...

more