Quality Dividend Stocks Showing Strength

Dividend stocks are having a great day with the iShares Select Dividend ETF (DVY) up over 4% as of this writing. That is the best day for dividend stocks since early November and is nearly 3 percentage points of outperformance relative to the S&P 500 (SPY).

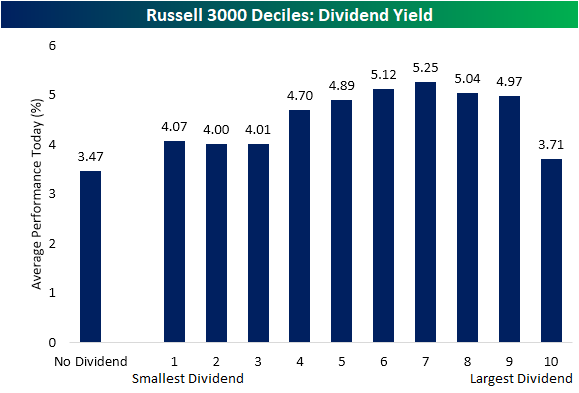

Looking at Russell 3000 stocks based on the constituents’ dividend yields, stocks that do not pay any dividends, of which there are over 1600, are up by an average of 3.47% today compared to an average gain of 4.58% for all stocks in the index that do pay a dividend. Breaking up those stocks that pay dividends into equal-sized deciles, generally, those stocks with higher yields are performing better. Granted, the 10th decile which is comprised of stocks with the highest yields have actually underperformed other dividend payers with an average gain of just 3.71%. That compares to deciles six through nine which have all risen around 5% on average. Although worse than other stocks that pay dividends, the performance of the 10th decile is still better than those stocks without a payout.

Taking a look at performance based on dividend growth over the past year, the stocks that have seen their payouts lowered from last year are actually up the most today. On the other hand, companies with higher dividends are underperforming with an average gain of just 4.36%. Again, while that is underperformance relative to other dividend payers, it still reflects stronger returns than those stocks with no payouts. Meanwhile, companies that have not changed their payout have seen more middling performance.

Investors also do not appear to be chasing just any yield. When a stock has a high payout ratio, it is typically viewed as being less likely to be able to maintain its dividend. Today, those stocks with the highest payout ratios have seen weaker gains. For example, the ninth decile actually is averaging weaker performance than non-dividend paying stocks. Comparatively, deciles three through six which are comprised of those with healthy payout ratios ranging between the low teens to low 40’s are all up over 5% on average. The bottom two deciles made up of the lowest payout ratios have seen slightly weaker returns, but those are also still stronger than those with the highest payout ratios.

Disclosure: Click here to view Bespoke’s premium membership options for our best analysis ...

more