Qualcomm: 4.3% Dividend Yield, With NXP Acquisition A Major Growth Catalyst

A 4%+ dividend yield is hard to find in the technology sector, which makes Qualcomm (QCOM) that much more appealing.

Qualcomm stock possesses the rare combination of a high dividend yield, along with high dividend growth as well.

It recently raised its dividend by 7.5%, which pushed its dividend yield up to 4.3%.

Qualcomm is a Dividend Achiever, a group of 265 stocks with 10+ years of consecutive dividend increases.

The stock has been dragged down by a negative news flow. It has lost nearly 20% of its value year-to-date.

But long-term investors should not be swayed.

Qualcomm remains a high-quality company, with a strong industry position, high free cash flow, and an excellent balance sheet.

Its sagging share price—which has pushed its dividend yield to 4.3%–could be a great buying opportunity for long-term dividend growth investors.

Business Overview

Qualcomm’s troubles stem from a Federal Trade Commission investigation, first announced in 2014. The FTC is investigating Qualcomm’s business practices, primarily involving its patent licensing.

In January 2017, the FTC charged Qualcomm with using anti-competitive tactics to build a monopoly in baseband processors, which the company then leveraged to impose exorbitant licensing terms.

This came one month after the news that South Korea fined Qualcomm roughly $890 million, on similar anti-trust grounds. Qualcomm is also being investigated by regulatory authorities in the European Union and Taiwan.

To make matters worse, Qualcomm is being sued by one of its major device customers—Apple, Inc. (AAPL)—for $1 billion in damages.

For a more in-depth discussion of the Apple vs. Qualcomm legal battle, click here.

If that weren’t bad enough, an arbitration panel recently awarded BlackBerry (BBRY) $850 million in royalty refunds that were previously paid to Qualcomm.

The seemingly non-stop cascade of regulatory investigations and lawsuits has weighed on Qualcomm stock for over a year.

However, the fundamentals of the company have largely remained intact.

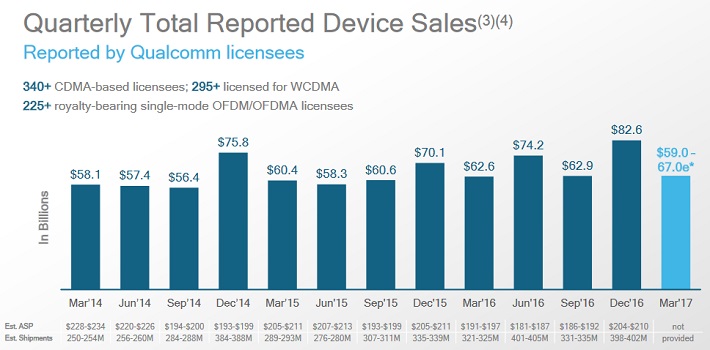

Source: FY17 Second Quarter Presentation, page 8

The smartphone industry is still healthy, which has kept Qualcomm’s licensing business in good condition.

Qualcomm is in a turnaround period, but the company took a step forward in fiscal 2016. Earnings-per-share increased 18% from the previous year, to $3.81.

While Qualcomm’s earnings-per-share have still not recovered to their 2014 level of $4.65, global smartphone shipments continues to grow.

Source: FY17 Second Quarter Presentation, page 9

Global 3G and 4G device shipments increased 10% in 2016, and are projected to grow by another 3%-9% in 2017.

Qualcomm dominates the smartphone industry, and rollout of 5G gives its turnaround a good chance of succeeding. In addition, the company has a number of other growth catalysts in its future outlook.

Growth Prospects

Qualcomm could continue to see pressure on revenue this year, particularly if its licensing royalties decline. The company expects fiscal third-quarter revenue in a range of down 12%, to up 1%.

Fortunately, Qualcomm should benefit from several long-term growth catalysts. These include new technologies, such as 5G rollout, the Internet of Things, and autonomous vehicles.

Qualcomm has invested internally in these areas, and took a huge step forward with its $47 billion acquisition of NXP Semiconductor (NXPI).

NXP will be an immediate shot in the arm for Qualcomm. NXP’s revenue increased 56% in 2016, to $9.5 billion. And, it is likely Qualcomm will be able to generate significant cost synergies from the deal.

The pending merger received regulatory approval in the U.S. last quarter, and Qualcomm anticipates the deal closing by the end of 2017.

While fiscal 2017 could be another year of revenue decline, 2018 and beyond looks promising.

Until Qualcomm’s revenue returns to growth, the company is using cost cuts and share repurchases to generate earnings growth.

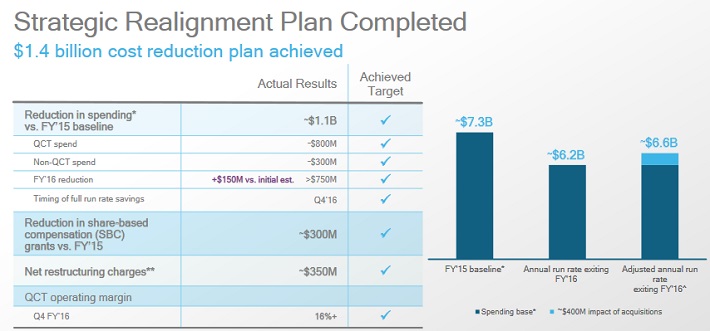

Last year, the company achieved a $1.4 billion cost reduction program.

Source: 4Q 2016 Presentation, page 5

Qualcomm cut capital expenditures by 46% in fiscal 2016. Capital expenditures are down 55% since 2014.

Its lean operating structure allows it to continue generating strong cash flow, which in turn gives the company the opportunity to reward shareholders with cash returns.

Qualcomm has returned more than $56 billion to shareholders, through share repurchases and dividends. It has reduced its diluted share count by 12.6% over the past two years.

The dip in Qualcomm’s share price over the past year, gives the company the opportunity to repurchase stock at attractive prices.

Source: FY17 Second Quarter Presentation, page 12

As of the end of last quarter, Qualcomm had an additional $2.3 billion left in its share repurchase authorization. This will help boost future earnings growth.

In addition, there is plenty of cash left over to pay dividends to shareholders.

Dividend Analysis

Qualcomm’s earnings-per-share are in decline, due to significant non-recurring charges, such as restructuring and acquisition expense.

However, the company continues to generate lots of cash flow, which helps secure its dividend.

In fiscal 2016, Qualcomm generated free cash flow of $6.86 billion. Its dividend required $2.99 billion for the year.

As a result, its dividend payout ratio from last year, as a percentage of free cash flow, was 43.5%.

Qualcomm has a very sustainable dividend, since it is distributing less than half of its annual free cash flow. This gives the company considerable cushion for its dividend.

Another margin of safety for the dividend is the company’s excellent balance sheet, which is loaded with cash.

Qualcomm ended last quarter with $9.98 billion in cash and short-term marketable securities, along with another $18.87 billion in long-term marketable securities. It has a total of $28.85 billion in cash and securities on its balance sheet, compared with just $9.94 billion of long-term debt.

Qualcomm’s long-term debt to equity ratio was a modest 31% at the end of last quarter.

Overall, the company is in very strong financial position. It has a very low level of debt, relative to the amount of cash it holds on the balance sheet. This gives more leeway for the company to raise its dividend each year, even though it is a period of slowing growth.

Final Thoughts

Qualcomm is an interesting stock for valuation and dividends. Based on 2016 adjusted earnings-per-share, shares trade for a price-to-earnings ratio of 11.9, which is less than half the average valuation of the S&P 500.

The stock may continue to struggle, with such a heightened level of headline risk as an overhang. But the various penalties and settlements against Qualcomm are non-recurring issues.

The long-term health of the global smartphone industry is strong. Qualcomm will be a leader in 5G, and will reap considerable growth thanks to its huge acquisition of NXP.

For income investors looking for a combination of high dividend yield and high dividend growth rates, Qualcomm is an attractive buying opportunity.

To see how Qualcomm stock compares with another widely-owned tech dividend stock—Intel (INTC)—click here.

more

Good analysis, has encouraged me in my investment qcom. Thank you