Q3 Earnings Season Is Underway

Earnings Season Is Here

Earnings season has started, and we're looking for large beats and an increase in firms giving 2021 guidance. As of Q2 last year, there were 147 firms giving next year guidance. Obviously, that guidance was hogwash because an unexpected pandemic occurred. As of Q2 this year, 138 firms gave 2021 guidance.

More firms should have the confidence to give next year guidance in Q3. The best solution might be to give guidance with 2 scenarios. The first being with COVID-19 under control and the second being if COVID-19 gets worse (but better than this spring).

In Q2 earnings season, consumer discretionary had only 4 firms provide guidance and 33 didn’t provide it. Utilities were the opposite with 9 not providing it and 26 providing it. The trend is our friend as 37 firms provided guidance in Q2 after withdrawing it and just 3 withdrew it after giving it.

Most don’t see why any firm would withdraw guidance after this past quarter where the economy improved. There is uncertainty about COVID-19, but I don’t think it has increased compared to 3 months ago.

Earnings Will Fall Again

Earnings season will be weak again on a year over year basis. Growth is going to be much better than last quarter though. The chart below shows the major difference between stocks and earnings. However, keep in mind the companies hurt the most are underperforming the market. It’s not as if earnings don’t impact stocks.

Only areas where earnings are ignored are software, SPACs, and electric vehicles; these stocks are being priced off revenue growth. That’s not going to last and neither is the sales growth. Competition is heating up, COVID-19 going away will lessen demand, and comps are about to be impossibly tough.

(Click on image to enlarge)

According to FactSet, S&P 500 EPS growth will be -20.5%. That’s up from -21% as of the end of September. EPS growth is going to easily exceed -20%. It will probably be between -15% and -17.5%. Obviously, that’s still bad. It’s surprising estimates are so easy to beat with the stock market doing so well.

Stock traders have jumped the gun before analysts. That’s because firms have given out cautious guidance. Some stocks might not even rally when they beat estimates because a lot of optimism is already priced in.

It’s About To Be A Good Earnings Season

The best sector is healthcare which is expected to see a 40 basis point decline in EPS. The worst sector is of course energy which is expected to have a 118.4% decline in EPS. That’s because the sector is expected to lose money. This is amazing because it’s not as if energy was doing well in Q3 last year.

It went from doing poorly, but manageable to the worst period in history. S&P 500 sales are only expected to fall 3.5% which tells us firms are losing operating leverage.

(Click on image to enlarge)

As you can see from the chart above, the 1-month guidance ratio has fallen but is still strong. And the 3-month guidance ratio is the strongest ever. However, even with high improvement, firms were still cautious. That’s why we will see strong beats this quarter. Analysts make estimates based on guidance/management sentiment.

We’ve seen many firms say they are baking in a double-digit unemployment rate. Obviously, the labor participation rate is still low, but the labor market improvement in the past 3 months has outperformed the gloomy outlooks. Firms need to become more optimistic. Their results will reflect the economic improvement.

On the negative side, with COVID-19 cases increasing, we may hear some pessimism on earnings calls especially from firms that do a lot of business in the Midwest.

COVID-19 Worries Increase

Regulations obviously play a big role in reopening the economy because if a law is in place, it can eliminate all activity in that area. However, as many have said, COVID-19 is the problem, not just regulations. If there never were any lockdowns, activity still would have been weak. There has recently been a spike in people concerned.

As you can see from the chart below, when COVID-19 was the worst in April 46% of people were very concerned and 41% were somewhat concerned. Then when we had a second wave, which didn’t cause as many deaths, 50% of people were very concerned. 25% were somewhat concerned.

It’s definitely fair to be concerned, but it's unclear why someone would be more concerned in July than in April since the virus killed fewer people in the summer than the spring. Hospitalizations were lower if you adjust for the fact that some states didn’t report their numbers in the spring.

(Click on image to enlarge)

Finally, in early October 45% of people were very concerned. On the other hand, just 31% were somewhat concerned. The trend is bad. It’s following hospitalizations and cases. A troubling issue is it seems like each subsequent wave causes more concern despite the decline in deaths. You can spin this as a positive since the more people worried, the more precaution will be taken. However, there will still be a decline in activity in the meantime.

Midwest Struggles With COVID-19

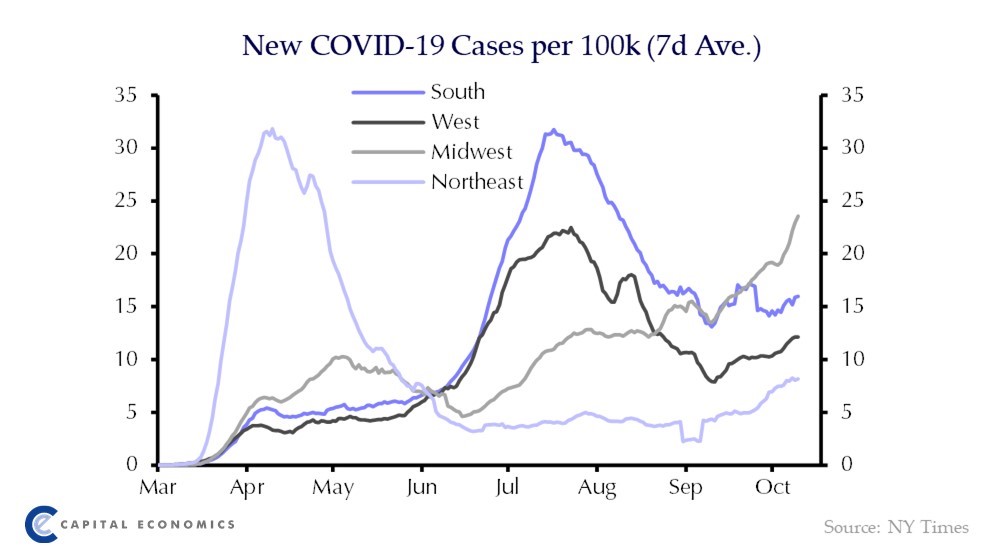

It appears that the Midwest is now the hotspot for this wave of cases. As you can see from the chart below, the Midwest is seeing a new high in new cases. Other regions have seen a modest increase in new cases, but that’s a result of more testing. If you take the Midwest out, there hasn’t been a spike in COVID-19 since there are now over 1 million tests per day.

(Click on image to enlarge)

Of course, we can’t take the Midwest out. It was the one region that hadn’t had a true spike. We are all wondering if after it’s over if this ends up being the last wave. New York has seen a very modest increase in cases because of testing. If it has another outbreak, it would be a very bad sign. It’s possible to get the virus again, but we don’t know how popular re-infection will be.

On Wednesday hospitalizations increased to 37,046 which is bad news. 7 day average of new tests increased to 1.02 million which is a new record high. And the 7 day average of deaths fell by 12 to 685. So far, this has been an outbreak without a spike in deaths. But we need to wait 2 weeks to confirm that since hospitalizations are up.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more