Q2 2016 Saw The Greatest Corporate Earnings Gains Of All Time

Our markets moved ahead in Q2 with the usual reason being given: more companies than not "beat the estimates" of Wall Street analysts. However -- it has now been 18 months since more companies reported higher earnings than the quarter before. That news was lost in the noise from Wall Street and its cheerleaders who whispered among themselves, " Yes, their earnings declined," but then shouted,"However, they beat our[recently lowered yet again]"estimates" of what their earnings might be!"

My concern is that such folderol sooner or later comes home to roost. That's why we mix income and capital gains with protective positions. I don't know when the next decline will begin. I'd be delighted if it didn't happen at all -- but I've been around this tree often enough to know that only happens in traders' dreams.

Steady as she goes is our mantra, and long-term is where we expect to take our profits. As a result, we use diversification, trailing stops, cash if appropriate and just a soupcon of common sense and adherence to the Walter Gretzky principle.

How Do We Sidestep Catastrophe?

Diversification is one key, of course. But I don't personally subscribe to the crux of Modern Portfolio Theory (MPT) that says we need to diversify x% into 10 or 12 categories, all of which are always-long positions among various types of equity and fixed income.

Staying fully invested (but "diversified"!) during down markets since (the mantra goes) "No one can know when the market will decline" just sets one up for a rollercoaster ride; when the markets are up, you are up and when they are down you are down. It is little solace that you are well-diversified if all 6, 10, 12 or however many categories you have your investments spread among are all down, albeit to varying degrees.

Instead, for ourselves and our clients we use the core MPT theory during recoveries and during clearly-defined up-markets but not in mature bulls and established declines. Then -- now -- we are willing to use the smartest long/short and liquid alternative funds.

We also use trailing stops so as to remove some of the emotion involved in investing. As a professional investor, even I am subject to emotion. I spend a great deal of time researching mutual funds, closed-end funds, stocks, bonds, option strategies and so on. Having invested that time and selected what I believe are the best choices, without the discipline of trailing stops I might make excuses for the companies whose stock I worked so hard to select.

Next, we are not abashed about having a cash cushion when common sense and the markets themselves dictate the wisdom of doing so. As our trailing stops execute, we stop and ask, "Is this just a sector rotation and, if so, where should we place the funds freed up by these sales?" or "Is everything else looking weak as well, in which case we are happy to avoid losing money in cash equivalents.

Rather than create a passive portfolio of funds or ETFs that goes with the flow of the markets we try to follow the wisdom of hockey great Wayne Gretzky: " A good hockey player plays where the puck is. A great hockey player plays where the puck is going to be."

One example of this approach right now, for us, are the REITs and closed-end muni bond funds we have moved to in 2016. Come September 19, for the first time since 1999, the S&P will add a new sector to its benchmark S&P 500. Real estate companies will be split off from the Financial Sector, leaving mostly banks and insurance companies in that part of the benchmark (although mortgage REITs will remain with the Financials.)

When all those me-too passive mutual funds and ETFs take a fresh look at their holdings on September 20, they will need to ensure they have the proper percentages in the erstwhile Financials as well as in the new Real Estate sector. As the boss of Vanguard's ETF division. Rich Powers, recently said, "We're going to follow the changes in the benchmark.Latitude to depart very materially from that is limited." [Emphasis mine.]

My analysis leads me to conclude that all those expecting a big jump in interest rates that will add to banker's profitability are about a year too early. I see banks and even most insurers, normally one of my favorite industries, struggling. But real estate tends to march to a different drummer than the rest of the financials. Lots of gurus disagree with me -- that's what makes ball games and stock markets so interesting:

Peter Stournaras, the portfolio manager of the BlackRock Large Cap Series Funds recently said, "I think financials [that is, the banks and insurers] are the most attractive part of the market." He is staying away from REITs.

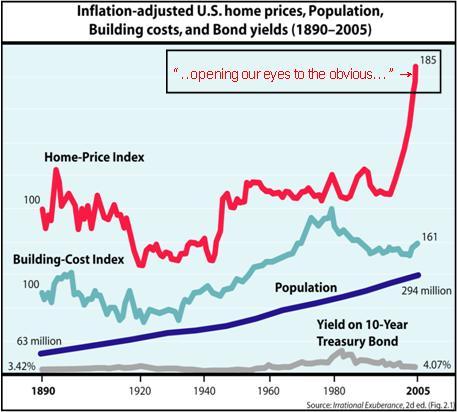

There are reasons for investor unease about real estate in general. One, of course, is the devastation wrought by the housing bubble created in 2006-2007 as a result of the abolition of redlining (a good thing) and the concurrent offering of mortgages to individuals with no ability to repay those loans (not so good) followed by the subsequent bundling or the least-creditworthy mortgages sold as AAA paper.

That one is history -- painful history but history nonetheless. After every real estate bust, the memory keeps most investors from taking advantage of excellent entry points. We warned our subscribers in the January 2006 issue of Investor's Edge (available upon request) based upon nothing but common sense and opening our eyes to the obvious. We sidestepped most of the subsequent real estate-related bust and perhaps, therefore, don't have the same adverse reaction today. (See chart below.)

A second cause for hand-wringing by some is the belief that Millennials don't ever want to own their own home (or car, for that matter; it's the sharing economy, dude.) After all, one in three are quite happy living with mom and dad. Others don't mind sharing a place in town with roommates so they can take public transportation everywhere and be close to the good bars and restaurants. I disagree with this opinion, taken as gospel by most analysts.

I don't think Millennials are any different than those of us who came before. They're just doing everything every generation has done, but later. I left home at 17 to work my way through college. That was then. Today that survival pressure isn't as manifest. In many cases, mom and dad actually want you to stay home longer; after all, they're your best friends, not just your parents.

And going to college can be either a time to expand your horizons; even with work crushing my time in school, this was a magnificent and fondly-remembered time of my life. But for some, I imagine it effectively prolongs for four years their extended childhood. So they want to party and be social after even after school is finis. Who wouldn't?

But when they find true love, marry and start a family? With kids they themselves can now dote on? Is it still so cool to be able to bike to work if the nursery or day care is 5 miles away and you have to get the kids there in the rain? Can Uber or Lyft retain their luster when you are a soccer mom or daddy with your own full-time career and a spouse who travels for their own job? I don't think so.

I believe instead that the real estate (and auto-buying) trough of today will just as likely become the bonanza of tomorrow….

How to Profit In an Over-Heated market?

In a market that has begun moving up from a decline all the way until that market reaches the point where, historically, it begins to tire (based upon length of time, an unusual event, black swan or valuation parameters like PE, PB and PS ratios) stocks and bonds of non-commodity producers make the most sense.

I remain 100% bullish on America long term. But there comes a time when secular bull markets pause for awhile or even lay down for a rest. I believe those advocating a fully-invested position 100% of the time might find themselves crushed when the old fella decides to get off his legs and roll over.

We have begun the process, in concert with the steps taken in the previous section, of also adding some hard assets now, in order to protect the wealth we've accumulated by owning stocks that rise with the market. When most people consider investing in hard assets, they typically think about silver or gold coins or bullion, physical real estate or mattresses with secret security pockets in them.

That's unnecessary. Today we have securitized hard assets so we can own tangibles like silver or land via common stocks, mutual funds, ETFs and REITs. (There will always be those who believe the government will confiscate everything not held in their own personal home, vault or apocalypse shelter. I won't try to disagree; we all have our tinfoil hat moments and they may be proven right. But if they are we have problems far more immense than owning a gold bar or two will solve!)

When I determine hard assets are appropriate, I look to buy stocks of or funds (open-, closed- and exchange-traded) comprised of companies in the agricultural, energy, basic materials, chemicals, metals and precious metals, and real estate sectors.

I apply the same rigorous standards to each of these that we would to buying any stock in any sector or industry. If they are too expensive we stay in cash. But I don't think they are too expensive right now. Even gold and silver, which have had quite a run, may have some companies that are cheap if history is our guide. For instance, Goldcorp (GG) is up only about a third as much as many of its peers. So what's the problem here?

The knock against Goldcorp is that they have grown by acquisition and, favoring North American reserves, they have often had to pay up to outbid other firms to add mines in what we consider relatively safe areas geopolitically. And because of planned-in-advance maintenance at one of their biggest properties, their 12-week earnings were lower than a year ago. Also, they cut their dividend at the beginning of the year.

I don't see any of these as deal-killers. Most gold miners don't pay any dividend so even the current paltry .05% yield is something. And I'd rather, personally, pay up for safety so Goldcorp's decision to avoid Ghana, Papua New Guinea, China, et al makes sense to me. Some 40% of GG's production comes from the US and Canada with another 30% from Mexico and only 30% from Argentina, Guatemala and the Dominican Republic.

The result is that Goldcorp has paid up for better quality, lower-operating-cost mines. Its all-in sustaining cost (AISC) to produce an ounce of gold is typically under $900, with the occasional outliers on either side. In the current environment, that translates to strong free cash flow. Since they also produce silver, zinc and lead as by-products of the gold-mining business, their actual cost is even lower.

Does gold lose its luster if interest rates rise and investors begin getting better interest payouts on bonds and such? Sort of… Precious metals are usually bought for three reasons: an inflation hedge, a panic hedge or a metal in demand for jewelry and hi-tech applications. There is a demographic trend that argues for increasing gold usage in jewelry and hi-tech. Additionally, both India and China, with 37% of the total world population between them, have a strong preference for gold jewelry. Barring war or pandemic, their population growth is unlikely to abate.

In short, I think most analysts have viewed Goldcorp's short-term issues as the beginning of some sort of negative trend. Scratching below the surface, I disagree. This is a senior producer with 3-4 million ounces of production (ex the by-products) and 41 million ounces of gold reserves, higher than most better-known names. We are buying shares as both a hedge and a potential gain.

A More Diversified Way to Buy PMs

If investing in what I consider a quality senior miner seems scary, you might want to take a look at the ASA Gold and Precious Metals closed-end fund (ASA) for greater diversification. We are buying it for more conservative clients. The fund's top 10 holdings are:

ASA pays a miniscule 0.25% dividend and trades at a 6% discount from NAV (up from a whopping 21% discount a few months ago when no one wanted to own gold!)

Finally, a Hold-Your-Nose Rank Speculation...

U.S. Global Investors (Class A - GROW) is an under-performing mutual fund family. It just added its first ETF in an attempt to capitalize on what have been the "high flying" airline stocks. Given the volatility of this industry, the fluctuating price of oil transformed into jet fuel, and the fickle nature of the traveling public, terrorism concerns, etc., I wish them well.

Their mutual funds have traditionally covered natural resources, precious metals and emerging markets, though a couple newer ones have broadened the base a little. They seldom outperform their peers in any of their categories.

Their market cap is double their enterprise value and, by most valuation measures I use, they are dreadful. Net margins come in at a -71%, the ROE is -20%, the ROA is -19%, and their 3-year revenue growth is -27%. "Other than that, how did you like the play, Mrs. Lincoln?"

So why would I consider owning it? Because not all investors are as sharp as our clients and subscribers - when some buyers want to get in on the boom in a particular sector they just pick a mutual fund with the most convincing advertising that has the words they are seeking in the name of the fund.

In this case, I think that may be that is likely to be "Precious Metals" in the coming months. Since that is where U.S. Global made its bones, I think it has an inside track to grab investor eyeballs. GROW sells for 2.06, about the only precious metals fund manager whose parent company shares are actually down over the past 52 weeks. However, the last time gold enjoyed popular sentiment, the stock rose to $10. Every dog shall have its day? At least the company has no debt and a good balance sheet. Who knows? If gold and silver run further, maybe GROW's income statement will look good, too. It's worth a small gamble for our Aggressive Portfolio.

Disclosure: I am/we are long GG, GROW.

more