Put This Stock Paying 7.5% And Increasing Dividends Into Your Christmas Stocking This Year

Happy Christmas! The boss said we would publish The Market Cap on Christmas Day, so I have been racking my mind for an appropriate topic. My work thoughts are already well into 2020 and my goals for the New Year. Today I want to share some lessons from 2019 and make one prediction to help you make money in 2020.

First and foremost, I want to thank the subscribers to my Dividend Hunter income stock service. Their loyalty and feedback provides great motivation.

The biggest lesson for me has been the importance of having a portfolio management strategy. I have found in the high yield stock universe that is the working space for The Dividend Hunter, investors focus first on the highest yields. That tactic does not always lead to the desired outcome. These are also the highest risk income stocks.

It became my mission in 2019 to provide my subscribers with portfolio management strategies and tactics specifically for the income stock focused investor. In the New Year, I will continue to teach subscribers how to manage their portfolios for stability and income.

Income Investors Focus on Dividend Growth

One more concept that I share with subscribers is that if you are investing in income stocks, your focus should be on how much income you earn and how to grow that income. Stock share prices go up and down, and the changes in direction are hard to predict.

While no one can predict any particular stock’s price with 100% certainty, I can accurately predict how much income a dividend stock portfolio will produce next quarter, and the following quarter, and the same quarter next year. It is easier to plan a financial future if you know how much cash your portfolio will generate. The income stream you build is cash to fund a retirement or reinvest to keep growing the income earned.

I said I would keep this short, and I know you want an investment idea. For income stock investors, one goal is to own shares of companies that will increase the dividend rates over time. A growing income stream is great on its own, but often dividend growth leads to share price appreciation.

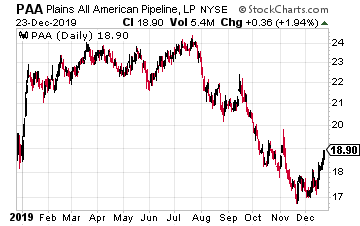

Plains All American Pipelines LP (PAA) is a master limited partnership (MLP) that owns the largest independent network of crude oil a natural gas liquids (NGLs) pipelines and storage facilities.

Plains hit a rough patch following the energy sector crash in 2015 and the company cut its dividend twice in 2016 and 2017, respectively.

The business has been stabilized and now distributable cash flow is almost double the distribution rate. At the beginning of 2019 Plains increased its dividend by 25%. I am looking for a 10% to 20% increase again in 2020.

Now trading around $20, this could easily be a $25 stock by the middle of next year.

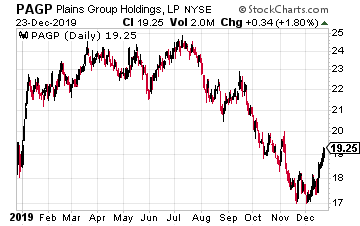

Plains GP Holdings (PAGP) shares are the IRS Form 1099 reporting equivalent of the PAA LP units. Pick either, depending on your tax situation.

Current yield is 7.5%.