Profiting From Biden’s Infrastructure Plan Using Simple Options

This past week’s big political and economic news came from a long-awaited bipartisan agreement on a physical infrastructure bill. There is still a long way to go before the bill can pass, but it does seem like the groundwork is there.

The most recent iteration of the agreement is only focused on physical infrastructure. The infrastructure plan with a broader scope (healthcare, education, etc.) will come separately and likely won’t receive bipartisan support.

White House on deep blue sky background

As it stands, the physical infrastructure bill is undoubtedly good news for a country dealing with crumbling roads, bridges, and railways, along with outdated water safety systems. The bill will also address issues such as improving broadband access and electric vehicle-related infrastructure.

Given the broad reach of just this bill, several industries stand to benefit from the estimated $1 trillion expected to be spent on its implementation. Given the ambitious amount of work expected to occur, construction and raw material companies certainly will be in good shape.

Given its dominance in the construction equipment space, is Caterpillar (CAT) is the first company that generally comes to mind when it comes to construction. The $117 billion company (by market cap) also generates about $43 billion in revenue per year. That number could see a considerable increase once this bill passes.

Instead of looking at a pure bullish options play on CAT (such as buying a call), at least one strategist is taking the approach that the stock isn’t likely to lose any ground over the next couple of weeks. The trader sold a 217.50-220 put spread that expires on July 9. That means the 220 puts were sold, and the 217.50 puts were purchased simultaneously. By purchasing the lower strike put, there is a limit on how much the trade can lose. Conversely, selling the higher strike put results in the premium being collected by the trader.

In this case, the put spread seller will keep 100% of the premium collected, as long as CAT doesn’t close below $220 at expiration on July 9. Specifically, the 220 puts were sold for $4.13, and the 217.50 puts were purchased for $3.06. That makes the credit (from the premium collected) $1.07. Given the premium collected, the breakeven point for this trade is $218.93.

The max loss on the trade is the difference between the strikes of the spread minus the premium collected. For this position, that amount is $1.43. Max loss occurs if CAT is below $217.50 on expiration. In terms of profits, if the stock closes above $220, the trader keeps the full credit. That equals a return on cash of 43%—not bad for what roughly amounts to a two-week trade.

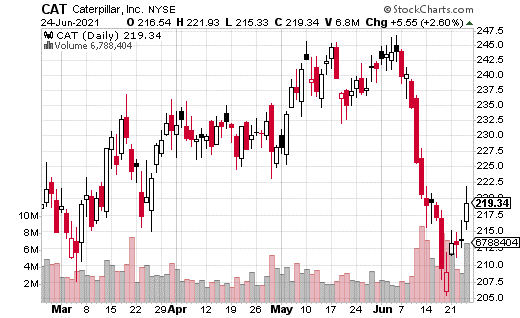

As seen in the above graph, CAT sold off sharply this month when raw material prices pulled back. However, it has since rebounded to some extent. The big up at the far right of the graph is when the infrastructure deal was announced. Selling the put spread right around the share price means the stock doesn’t have to climb all that much for the trade to reach max potential. Instead, the trader simply needs the stock price not to go back towards the recent lows.

Disclaimer: Information contained in this email and websites maintained by Investors Alley Corp. ("Investors Alley") are provided for educational purposes only and are neither an offer ...

more