Price's Law And The Pareto Principle: Why Retail Investors Should Limit Their Day Trading

Retail investors who wish to accumulate wealth should limit their day-trading activities.

The more frequent the trading (like day trading), the higher the chances of loss overall. This is something I learned both from experience and from observation; wealth is accumulated by identifying the primary trend and staying with it, not by high-frequency trading.

There is a fundamental principle at work which results in a concentration of success in a minority number of players. Two models describe this tendency: Price's Law, and Pareto's Principle.

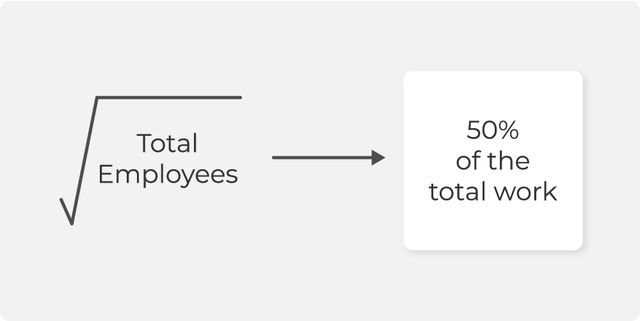

Price's Law says that 50% of the work is accomplished by the square root of the total number of employees.

This applies to every round of stock trading, and leads to a smaller number of traders getting the majority of the money after each iteration.

Imagine starting with 100 traders. Ten of them (the square root) will receive 50% of the profits, while ninety of the traders end up sharing the other 50% (with some of them losing everything and having to leave the game). The concentration of wealth will continue with each successive iteration until, theoretically, all the money will go to just one individual player as the rest go to zero. This is what happens when you play the game of Monopoly to its conclusion.

In day trading, it is not so simple because there are always new players coming into the game, but the tendency to concentrate wealth is the same. In a casino, the dealers and the house never lose. In day trading, the market-makers, high-frequency algorithms, and the trading platform always win.

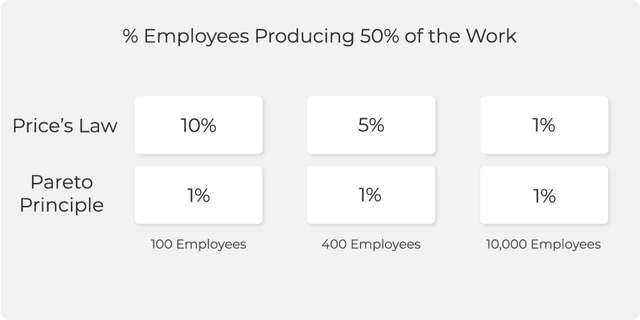

The Pareto Principle says that 80% of the work is done by 20% of the total number of people doing the work. At first glance, this seems different than Price's Law, but that is only because Price's Law is scale dependent; as the number of players increases, the difference disappears and the two principles converge. In a game with a very large number of players, both principles predict the same thing...1% of the traders will take 50% of the money (table below).

Here is a 13-minute lecture by Jordan Peterson that summarizes this nicely

This is why, despite having an advantage over many other investors (because of our better understanding of the drivers of markets), we only allocate a small amount of our funds to "trading". Most of our positions stay lined up with what we have determined to be the primary trend in the market. The trick is knowing enough to determine the primary trend above all the daily noise and MSM fear-mongering.

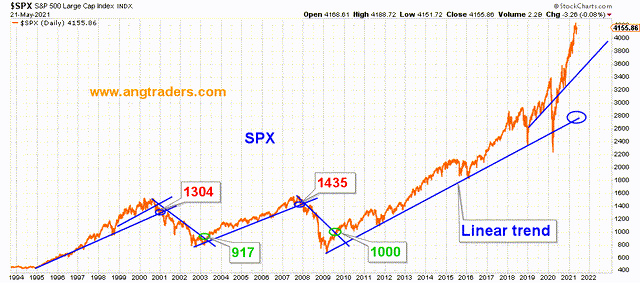

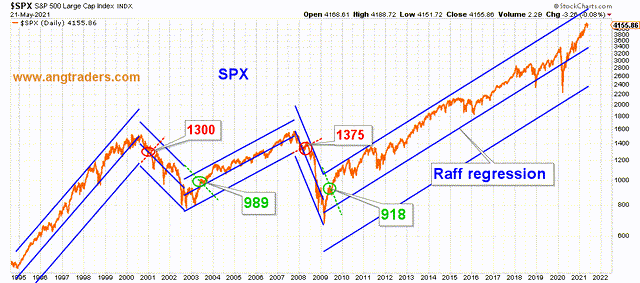

The charts below show that the primary trend is still technically bullish--both linear and logarithmic.

And our fund flow analysis shows that the bull trend is likely to strengthen over the next several years!

Note: We will continue to "trade" small amounts in order to satisfy our thrill-seeking neurosis.