President Trump Signs The Stimulus. Will There Be More?

Traveling Growth Increased

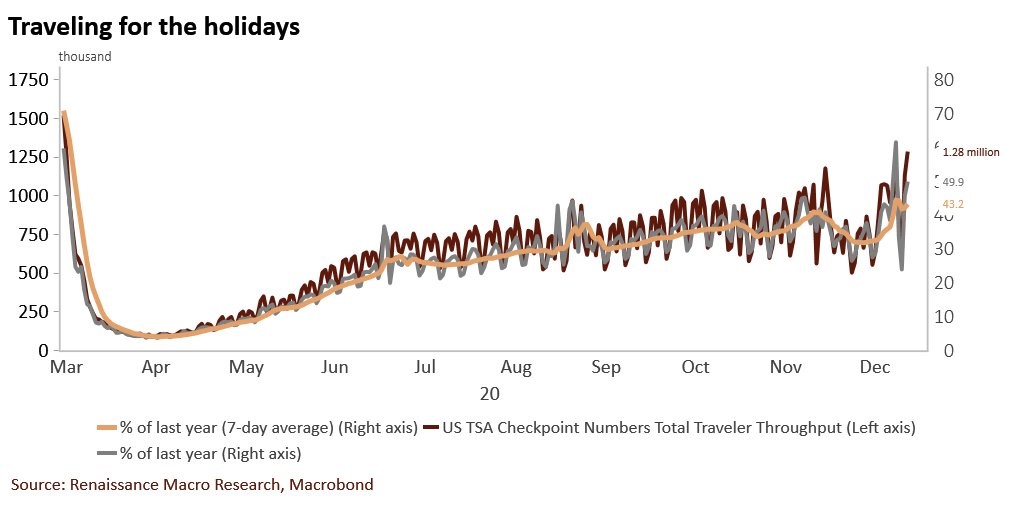

We have two trends starting. They are the vaccine going out to more people and an increase in mobility. The increase in mobility will definitely feed off the increase in vaccine distribution because people will feel safer. It’s a good sign people are willing to go back to normal, but it could lead to an increase in cases in the short term.

Some are estimating cases will increase until March. The spread may get worse as people travel more. On the bright side, if the most vulnerable get the vaccine first, which they are, we could be looking at a peak in deaths before the end of January.

Specifically, the chart above shows TSA traveler throughput was 1.28 million on December 27th which is the highest since the pandemic started. The 7-day average is 43.2% of last year’s levels. Its recent peak is the highest since the pandemic started. It’s possible that's wrong about the increase in traveling being because people feel safer due to the vaccines. It could be that people really wanted to see their families over the holiday, so they didn’t care about the virus.

As of December 28th, more than 2.1 million people in America got a COVID-19 vaccine. There are 3 factors to consider. They are when the vaccines cause a peak in cases, when they cause a peak in deaths, and when most people feel safe. The latest COVID-19 data isn’t useful because many states didn’t publish information during the holidays. The only thing we know for sure is hospitalizations are increasing at a slower rate than a few weeks ago, but the 7-day average is still at a record high.

Stimulus Passes

President Trump initially spoke negatively about the stimulus, but then he signed it on Sunday night. There wasn’t a good reason to hold it up because 14 million people were about to lose their unemployment benefits. It’s notable that Rhode Island and New Jersey won’t have a gap in benefits and Michigan said there will be a temporary lapse ($300 boost will go out next week in Rhode Island). Before looking at the impact of the stimulus, let’s discuss the $2,000 stimulus.

Initially, President Trump wanted the stimulus to be raised to $2,000. Instead of torpedoing the entire vote, the stimulus passed as is and there will be a separate vote on raising the checks to $2,000. This isn’t an additional $2,000. It’s an additional $1,400 to be clear.

The House passed this additional stimulus in a fast track procedure as the vote was 275 to 134 which means more than 2/3rds supported it. The President and the Dems agree. They both want a bigger stimulus. The Dems backed this 231 to 2.

The GOP opposed it as 42 voted yes and 130 voted no. If President Trump didn’t support this, even fewer Republicans would have supported it. It’s not fiscally conservative. It seems like a battle between Trump and McConnell. Marco Rubio supports this stimulus which means the vote would be close if McConnel allows it to happen.

If it passes, it would spark another major rally in cyclical stocks (small-cap value). To make matters even more confusing and interesting, the Georgia Senate election is next week. If the Dems win and this latest stimulus doesn’t pass, another one is coming.

Let’s look at the $900 billion stimulus that became law. This we know will impact the economy in January. There won’t be any impact on retail sales this month because the few days it was delayed. As you can see from the graphic above, with the $600 per person checks Goldman estimates Q12021 GDP growth will be 5% instead of 3%.

Q1’s growth largely depends on the quickness of the vaccine rollout. However, there is no mistaking the stimulus’ impact on growth. The 2021 annual growth estimate was revised up a half a point to 5.8%.

ISM Composite Vs. Leading Commodities

The chart below shows the correlation between the rate of change of the ISM composite PMI and 3 leading commodities which are lumber, copper, and gold. Some investors don't like using gold as a correlation because it isn’t an industrial metal.

Also, lumber had a massive spike, then sharp pullback, then another spike. This is because of the hot housing market which should cool off a bit. It's doubtful that lumber will stay this high since commodity supply always increases after the price spikes. Some are bullish on the economy next year, but those 2 commodities might not rise.

Manufacturing was strong this fall as it is the most resilient part of the economy. It is deemed essential and goods demand has spiked this year. The December Dallas Fed manufacturing index fell from 12 to 9.7 which isn’t that bad. It beat estimates for 5. The consumer seems to have been the biggest loser in December.

Earnings Revisions Up Hugely

Analysts have raised 2021 EPS estimates 10 straight weeks. As you can see from the chart below, of the S&P 500 firms issuing Q4 profit guidance, more than half have increased it which is the most in at least a decade. S&P 500 EPS is expected to be $167 in 2021 which is up from $159 in July.

Usually, estimates for the next year fall during this period. However, that doesn’t make up for the fact that the S&P 500 trades at 22 times earnings. Tesla’s entry into the index certainly doesn’t make it cheaper.

Conclusion

Traveling is likely going to increase in the next few weeks as people gain confidence in the vaccines. That could lead to a temporary increase in COVID-19 once we start getting better data in January. The stimulus passed and another one is being voted on.

It would be hugely bullish for small cap value stocks if it passes. It would also be bullish for the stocks popular with retail traders because many will put their money directly into the market. EPS revisions have been great, but the market is still expensive.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more