Pre-IPO Coverage: Levi Strauss & Co (LEVI)

Blue jeans maker Levi Strauss & Co. (LEVI) is expected to IPO on Thursday, March 21. At a price range of $14-$16 per share, the company plans to sell up to $150 million of shares with an expected market cap of ~$5.8 billion. Current shareholders will also sell up to $435 million of shares in the IPO. At the midpoint of the IPO price range, LEVI currently earns our Very Attractive rating.

Unlike the vast majority of recent IPO’s, LEVI is highly profitable and relatively cheap. However, the high number of insiders selling shares in the IPO should give investors pause. In addition, the company’s dual-class share structure gives the Haas family – descendants of founder Levi Strauss – total control while preventing public shareholders from having a say on corporate governance.

This report aims to help investors sort through Levi Strauss’ financial filings to understand the fundamentals and valuation of this IPO.

Economic Earnings Rebound in 2018

Even though LEVI has been a private company since 1985, the company has public debt, so it files regular 10-Ks. These filings give us more history to analyze than the minimum two years that most IPO companies provide.

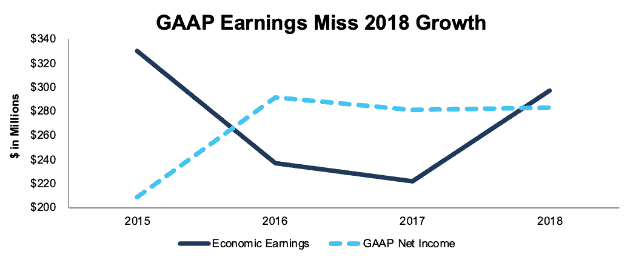

Figure 1 shows that investors who rely on GAAP net income get the wrong impression about the recent trend in LEVI’s profitability. LEVI’s GAAP net income increased significantly in 2016 and has stagnated the past two years. Meanwhile economic earnings – the true cash flows of the business – declined in 2016 and 2017 before rising 34% in 2018.

Figure 1: LEVI GAAP Net Income and Economic Earnings Since 2015

Sources: New Constructs, LLC and company filings

Two adjustments explain most of the discrepancy between GAAP and economic earnings in 2018:

- LEVI reported a $143 million (3% of revenue) one-time tax expense in 2018 due to the Tax Cuts and Jobs Act.

- LEVI also reported $44 million (1% of revenue) in non-recurring expense due to changes in the fair value of its stock-based compensation. This charge relates to cash-settled awards that were made in the past but increased in value in 2018 as the value of the company increased.

Investors that just look at GAAP net income will miss the significant growth in LEVI’s business in 2018.

Diversifying Away from Blue Jeans

LEVI has become synonymous with blue jeans throughout its 165-year history. In fact, it was the first company formed to manufacture blue jeans.

Reliance on a single line of products carries risk for any company, especially one in a fad-driven industry like clothing. The rise of athleisure – and companies like Lululemon (LULU) – put significant pressure on LEVI, as evidenced by the company’s declining economic earnings in 2016-2017.

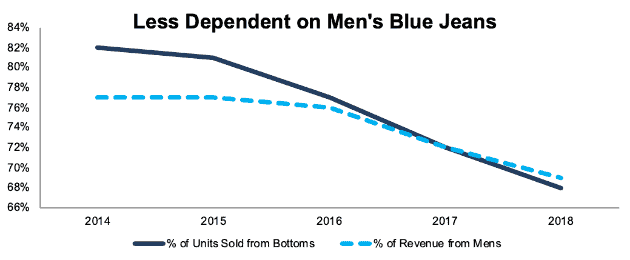

In response to this shift in consumer demand, CEO Chip Bergh, who took over in 2011, has worked hard to diversify LEVI’s revenue streams away from its core business of men’s blue jeans. The company now has rapidly growing product lines in t-shirts, fleeces, and a variety of women’s apparel. Figure 2 shows that the percentage of LEVI’s units sold coming from bottoms has dropped from 82% in 2014 to 68% in 2018, while its share of revenue from men’s products is down from 77% in 2014 to 69% in 2018.

Figure 2: LEVI % of Units from Bottoms and % of Revenue from Men’s: 2014-2018

Sources: New Constructs, LLC and company filings

LEVI’s core men’s pants business grew revenues by just 3% year-over-year in 2018, but the company as a whole grew revenue by 14%. The main drivers of revenue growth last year were tops – which grew by 38% – and women’s bottoms – up 16%.

Rise of Direct-to-Consumer (DTC)

In addition to diversifying its product line, LEVI has expanded its direct-to-consumer (DTC) business from 29% of revenue in 2015 to 35% of revenue in 2018. DTC sales earn higher margins by eliminating the cut taken by the third-party retailer. From 2015 to 2018, LEVI’s gross margins improved from 51% to 54%.

With DTC driving higher margins and new product lines driving revenue growth, LEVI looks to be in the early stages of a significant turnaround. If the company can continue to execute on these strategies, it should be able to continue growing economic earnings as it did in 2018.

Public Shareholders Have No Rights

While LEVI’s business appears to be headed in a positive direction, the corporate governance leaves much to be desired. The company will offer Class A shares – which have one vote – in the IPO, while insiders will retain Class B shares – which have 10 votes. The Haas family hold the majority of Class B shares, and they are also selling the majority of the shares that will be available in the IPO.

In effect, this means LEVI, while technically a public company, will still be run as a family business. What’s more, the family that controls the business is about to sell off hundreds of millions worth of stock.

This dual-class share structure has become the norm in recent IPO’s, but those have mostly been tech companies led by “visionary” founders. Non-tech businesses haven’t been able to get away with this sort of poor governance in the past, and it seems that investors may be punishing LEVI for it based on its cheap valuation.

LEVI Is Undervalued Compared to Peers

Numerous case studies show that getting return on invested capital (ROIC) right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC. Harvard Business School features the technology that empowers this research.

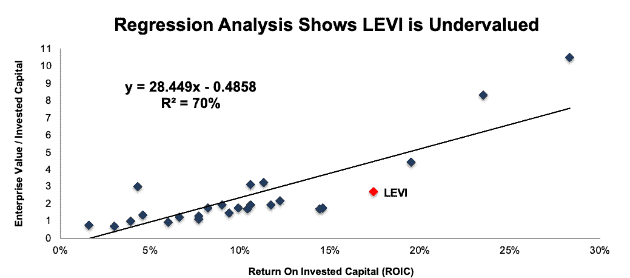

Per Figure 3, ROIC explains 70% of the difference in valuation for the 26 companies in LEVI’s competitive peer group from its S-1. LEVI is valued at a significant discount to its peers based on its position below the trendline.

Figure 3: ROIC Explains 70% of Valuation for LEVI’s Peers

Sources: New Constructs, LLC and company filings

Based on its enterprise value to invested capital (a cleaner version of price to book) of 2.7, the market expects LEVI’s ROIC to decrease from 17% to 11%. Notably, LEVI’s worst ROIC in the past five years was 14% in 2017.

If LEVI were to trade at parity with its peers, the stock would be worth $28/share, an 89% upside from the midpoint of the proposed IPO range.

Our Discounted Cash Flow Model Reveals LEVI Has Upside

At the midpoint of LEVI’s IPO range – $15/share – the stock has a price to economic book value of 1.1. This ratio means the market expects LEVI to grow after-tax operating profit (NOPAT) by no more than 10% over the remainder of its corporate life. This expectation seems pessimistic for a company that grew NOPAT by 28% last year alone.

If LEVI can maintain 2018 NOPAT margins of 9% and grow NOPAT by 4% compounded annually (McKinsey’s projection for the growth rate of the fashion industry) for the next 10 years, the stock is worth $19/share today, a 29% upside from the current stock price. See the math behind this dynamic DCF scenario.

Do LEVI’s poor governance practices warrant a 29% discount to fair value? That’s a question investors will have to answer themselves.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments[1] we make based on Robo-Analyst[2] findings in Levi Strauss & Co’s S-1:

Income Statement: we made $413 million of adjustments, with a net effect of removing $199 million in non-operating expense (4% of revenue). You can see all the adjustments made to LEVI’s income statement here.

Balance Sheet: we made $2.3 billion of adjustments to calculate invested capital with a net increase of $395 million. You can see all the adjustments made to LEVI’s balance sheet here.

Valuation: we made $2.8 billion of adjustments with a net effect of decreasing shareholder value by $1.9 billion. Despite this decrease in valuation, LEVI remains undervalued. You can see all the adjustments made to LEVI’s valuation here.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the link between an accurate calculation of ROIC and shareholder value.

[2] Harvard Business School Features the powerful impact of research automation in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.