Potash: Nice Dividend, Big Upside

Potash (POT) cut its dividend twice this year, and it is underperforming the S&P 500 by more than 13%. As contrarian investors, we believe it’s now an attractive stock, with a nice dividend (2.5%), and big long-term price appreciation potential. Potash is particularly attractive because of it low cost mines, continuing long-term growth in global demand, and the current low point in the fertilizer business cycle.

Overview and Business Environment

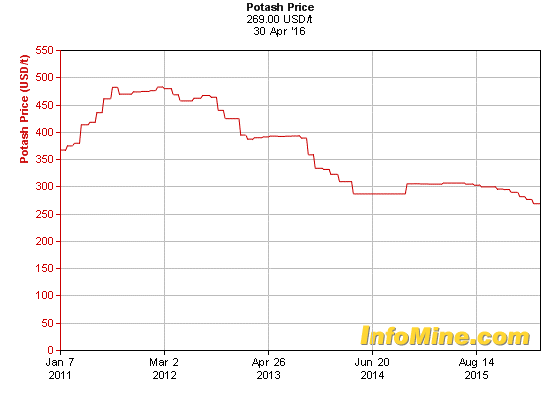

Potash produces crop fertilizers including potash, nitrogen and phosphate. Weaker prices across all three of these fertilizers have been a big driver of the company’s recent stock price declines (Potash’s stock price is down 41.1% over the last year). For example, the following chart shows the historical declines in potash prices since 2011.

And worth noting, the above chart only goes through April of this year, but Potash reported during its recent second quarter earnings announcement that their average realized price for potash had fallen further to $154 per tonne.

The other big driver of the company’s recent stock price declines has been lower sales volumes. Specifically, “Sales volumes for both the quarter (2.1 million tonnes) and first half (3.9 million tonnes) were lower than those in 2015, down 16 percent and 20 percent, respectively.”

The story has been largely the same for nitrogen and phosphate. Specifically, weaker prices and lower sales volumes have taken their toll on the company. The following chart provides additional color on how current market conditions have impacted Potash.

And in light of market challenges, Potash has worked to protect its balance sheet by lowering its quarterly dividend for the second time this year. The dividend went from $0.38 per share, to $0.25 per share, and most recently to $0.10 per share (this amounts to approximately at 2.5% annual dividend yield).

Business Should Improve for Potash

We believe business should improve for Potash in both the near- and long-term. For example, in the near-term Potash believes their market has bottomed, and their business should improve because of increased market certainty and due to lower inventories across the supply chain. Potash’s second quarter earnings release provides more detail:

“Following a prolonged period of market uncertainty and weakening fundamentals, we believe potash markets have reached their low point. Recently settled contracts in China and India and a reduction in inventory throughout the supply chain over the last six months are expected to support a more constructive environment. Much like recoveries seen after previous periods of delayed contracts, we anticipate stronger buyer engagement to support demand through the second half of 2016.”

And in the long-term, we expect Potash’s business to improve for two reasons. First, fertilizer demand should increase as the World population grows. Particularly, there are opportunities in emerging markets such as China and India for farmers to increase their crop yields via fertilizers. For example, the following chart shows global fertilizer consumption has historically increase consistent with population growth.

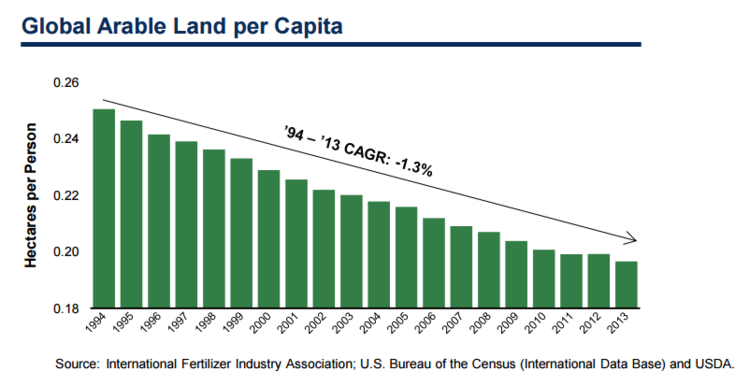

And as the population continues to grow, fertilizers become increasingly important for food production because global arable land per capital is decreasing steadily as shown in the following chart.

Secondly (and importantly), not only is Potash the largest potash producer in the world, but they are also NOT a marginal producer. This means when conditions get challenging, other producers (NOT Potash) will stop producing because they cannot be profitable. There are only a few economically viable potash deposits around the world (mainly in Canada and Russia), and Potash’s mines have a useful life that extends for around 70+ years. Therefore, Potash can remain profitable while many of the less cost-efficient marginal producers can be forced to shutter their businesses in challenging price environments.

Valuation

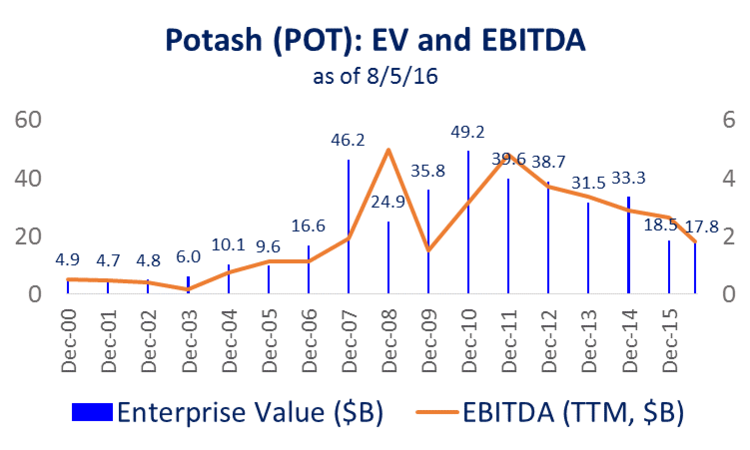

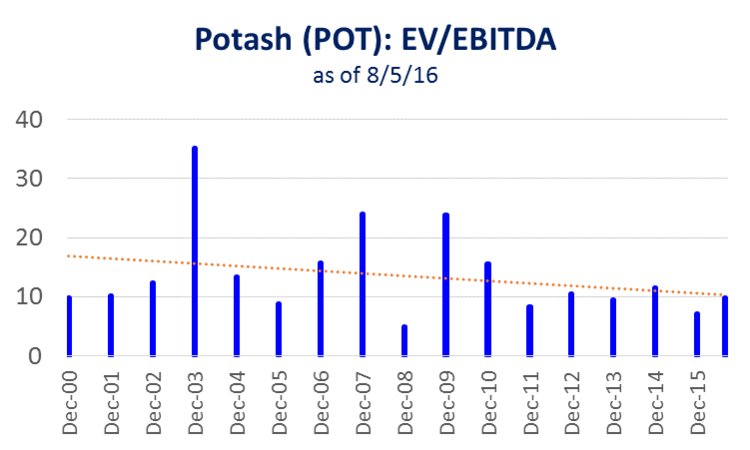

Investors should be careful not to let backward looking valuation metrics prevent them from recognizing Potash’s future price appreciation potential. For example, from an enterprise value to current EBITDA standpoint, Potash appears fairly priced. As the following chart shows, Potash’s enterprise value (basically debt plus equity) historically hovers around 10 times its EBITDA.

This next chart shows Potash’s historical EV/EBITDA ratio, and it’s not currently particularly over- or under-valued on this metric.

However, we believe this EV/EBITDA ratio is an example of a backward looking ratio, and in this case it is likely misleading. For example, according to Potash 2Q earnings release, “we believe the uncertainty that weighed on potash market sentiment is now lifting and a recovery is beginning.” Additionally, backward looking valuation metrics don’t necessarily take into consideration the long-term growth in fertilizer needs combined with Potash’s competitive advantage from its low-cost mines.

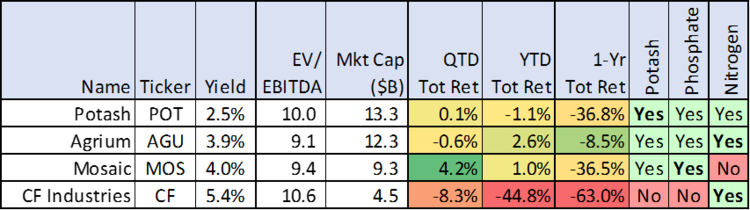

The following table shows Potash versus several peer with regards to yield, valuation, performance and types of fertilizers.

Relative to peers, Potash tends to be somewhat middle of the road with regards to recent price performance and valuation (EV/EBITDA). However, its dividend yield is lower following this year’s two dividend cuts. We believe Potash has gotten much of the pain out of the way, and is now positioning for what they believe to be a “low point” in the potash market. Additionally, we believe Potash has somewhat of a stronger competitive advantage with its low cost potash operations in Saskatchewan (5) and New Brunswick (1). On the other hand, we believe CF Industries dividend is high, especially considering the company has entered cash conservation mode as they’ve suspended share buybacks. Additionally, Mosaic faces unique risks of its own with Florida flooding risks, and more costly potash production. And Agrium isn’t unattractive, but its Nitrogen focus seems to face a trickier domestic and international competitive environment.

Risks

Potash faces a variety of risks. For starters, Potash prices and demand could remain lower for longer than anticipated, and the company’s belief that the market is at a low point could be simply incorrect. And generally speaking, the price of potash can be volatile depending on weather conditions. Potash also faces legal and environmental risks. Operating underground mines raises issues with regulators that can be costly. Currency exchange rates are another risk. For example, the Russian ruble has weakened significantly making Potash product relatively more expensive compared to potash produced there. These currency affects can have a significant impact on sales and profitability.

Conclusion

Potash is an attractive contrarian investment. Its price and dividend payments have both declined sharply, and fertilizers markets remains challenged. However, the dividend yield (2.5%) is still attractive and the stock has very significant long-term upside potential. We have ranked Potash #3 on our list of Top 6 Big Yield Fertilizers Worth Considering because of its low cost mines and because of the steady, growing, long-term, global industry demand. In our view, the continued challenges in the fertilizer industry make for an attractive entry point for diversified, long-term, income-focused, contrarian investors.

Disclosure: None.