Plant-Based Food Stocks Growing In Value Again But Still Down YTD

TM Editors' Note: This article discusses some penny stocks and such stocks are readily manipulated so do your own due diligence.

The Pure-Play Plant-Based Food Stocks Index* tracks the 11 stocks in the fledgling plant-based fake meat, dairy, eggs, and seafood sector and it is up almost 3% so far in April.

Photo by zenad nabil on Unsplash

Chris Thompson, President and Director of Equity Research at eResearch Corporation, the new parent company of munKNEE.com, reports that:

- about 9.7 million Americans now follow a plant-based diet up from just 290,000 in 2004,

- year-over-year sales are growing by 11.4% p.a.,

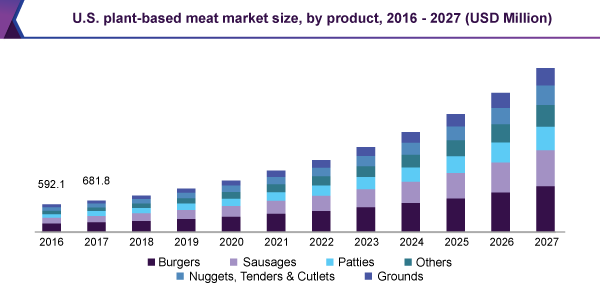

- the market sector should be worth $74.2 billion in the next seven years of which the plant-based meat market, specifically, will be worth $35.4 billion by 2027, and that

- online grocery sales of vegan products are growing 5x faster than other product categories, generating the highest growth in the consumer goods sector.

Million Insights presents the table below from its Plant-based Meat Market Analysis Report By Source, By Product, By Type, By End-user, By Storage, By Region And Segment Forecasts From 2020 To 2027:

Stock Performance Comparisons

The Pure-Play Plant-Based Food Stocks Index is divided into two groups – those seven (7) trading for less than US$10/share and those four (4) trading at much higher prices – to provide more meaningful comparisons and conclusions as to the performance of the sector.

Below are the constituent stock performances so far in April, in descending order, and YTD, in brackets, with the most recent news on every company.

- The Very Good Food Company (VRYYF): +7.6% (-15.4% YTD) to $4.13/share

- Reported its financial and operational results for its fiscal fourth quarter and 2020 year ended December 31, 2020, which showed:

- a 364% increase in revenue to $4.6M compared to the prior year,

- an increase in adjusted gross profit to 32% compared 16% in Fiscal 2019,

- an 825% increase in online orders from its eCommerce channel vs. FY2019 and

- an increase in retail distribution points in FY 2020 from 100 to 1,300,

- Partnered with Colorado-based brokerage, Green Spoon Sales, to accelerate its reach into grocery and retail outlets across the U.S.,

- Listed on the TSX Venture Exchange (TSXV) under the VERY stock ticker in addition to being listed on the Canadian Securities Exchange (CSE),

- Commissioned its first production line by butchering its very first bean at the newly renovated Rupert production facility located in Vancouver, British Columbia.

- Reported its financial and operational results for its fiscal fourth quarter and 2020 year ended December 31, 2020, which showed:

- Eat Beyond Global (EATBF): -4.0% (-22.9% YTD) to $1.45/share

- No noteworthy news to report

- Else Nutrition (BABYF): -5.8% (-27.8% YTD) to $2.28/share

- Reported that its online sales on elsenutrition.com and amazon.com are expected to double every 3-4 months and reported that it has added iHerb and Thrive Market, two of the leading online platforms for natural food products to its online sales network,

- Announced that it will expand distribution into 159 Natural Grocers by Vitamin Cottage stores across 20 states in May 2021 to compliment its listings with Sprouts Farmers Market (since mid-Feb. - 21) and in Big-Y (since April - 21) and will soon also be on the shelves of Raleys for a total of 750 retail grocery outlets,

- Reported that it is now shipping products to the two largest natural food distributors in North America (UNFI and KeHE Distributors) which, together, cover almost the entire retail market in the U.S. as well as Imperial, a local distributor in the North East,

- Tofutti Brands (TOFB): -12.7% (+50.3% YTD) to $2.75/share

- Issued its results for the fiscal year ended January 2, 2021 which showed a 5.2% increase in net income, a 5.3% increase in gross profit, and a gross profit percentage that remained steady at 31%,

- Modern Plant Based Foods (MDRNF): -20.6% (-48.1% YTD) to $1.66/share

- No noteworthy news to report.

- Sire Biosciences (BLLXF): -27.9% (+342.9%) to $0.31/share

- announced that it intends to change its name to "PlantFuel Life Inc." and its ticker symbol to "FUEL" and will provide details about when it will begin trading under the new name and ticker symbol as that information is available,

- Announced that its wholly-owned supplements subsidiary, Fusion Nutrition Inc., will be launching 3 new creatine products in the coming 12 weeks in addition to Purple K, Canada’s top-selling creatine pills.

- Plant & Co Brands (VGANF): -34.6% (-58.5% YTD) to $0.17/share

- announced that it is proceeding with a corporate reorganization of assets (subject to various approvals) by spinning out its technology business to unlock additional shareholder value sometime within Q2 of 2021,

- has applied to list 21,613,250 share purchase warrants of the Company for trading on the Canadian Securities Exchange under the symbol VEGN.WT which will entitle the holder to acquire one common share of the Company upon payment of the exercise price of C$0.25 prior to December 10, 2022.

Average Sub-Total Performance: -6.9% (-17.4% YTD)

- Laird Superfood (LSF): +9.7% (-22.3% YTD) to $32.61/share

- No news of note.

- Beyond Meat (BYND): +3.9% (-4.1% YTD) to $134.22/share

- announced that a new version (improved taste and nutrition) of its Beyond Burger will arrive in grocery stores nationwide beginning the week of May 3rd,

- Guru Organic Energy (CSE: GURU): -4.1% (-21.7% YTD) to C$15.83/share

- No news of note.

- Tattooed Chef (TTCF): -6.4% (-21.9% YTD) to $17.88/share

- On April 15, 2021, the CEO sold roughly 1.3 million of his +30 million shares and, on the same day, the CFO resigned from his position, effective immediately.

- Research shows that the recent weakness in its stock is the result of the overall movement away from SPAC stocks not in the demand for its products

Average Sub-Total Performance: +3.0% (-11.2% YTD)

The Pure-Play Plant-Based Food Stocks Index has gone down, in total, by -2.6% so far in April and is down -11.6% YTD.

*Please note: The 11 pure-play stocks in the munKNEE Pure-Play Plant-Based Food Stocks Index are just that, pure, and focused almost exclusively on the research, development, sales, distribution, and marketing of vegan food products and, as such, the Index reflects the true health of the plant-based food sector in the U.S. and Canada.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

An interesting schemeof listing both momentary changes and year-to-date changes, which creats interesting illusions sometimes.