Place Your Bets - Monday, May 11

The question of the day - at least in the popular financial press - appears to be, why are stocks rallying with the economy in free fall? Readers of my oftentimes meandering market missive likely already know the answer here. As we've discussed a time or twenty, the stock market is a discounting mechanism for future expectations. In other words, stocks look ahead, not back. And the bottom line is it looks like the market is currently looking ahead to better days.

Looking ahead to days when the economy is functioning again. To days when the majority of the unemployed are back to work. To days when there is a vaccine. To days when social distancing isn't necessary. And to days when the economy and life can return to "normal."

The key question in my mind is when will these days actually occur? And how long will it be before the economy returns to "normal?" Obviously, nobody knows the answers here.

In the meantime, the more pressing question is what does the "new normal" look like? You know, what does the rush to re-open hold for corporate America? Will the allowed 25% to 50% of capacity cut it? Or will businesses think fast and figure out ways to make up the shortfall?

Analyzing The Way Forward

While the questions are many and varied, one thing is for sure. Stocks are following any/all developments on the path forward very closely.

For example, the market appears to be betting that a vaccine will be developed in record time. We got good news on this front last week as we learned that Moderna's (MRNA) vaccine for coronavirus was approved for Phase 2 trials and that Phase 3 trials could begin as early this summer. And if things go well, this means a medical solution could be available as soon as 2021. This is indeed good news and allows stocks to look ahead.

Given that 2021 is less than 8 months away, this fits into the time frame the stock market typically "discounts" for. Therefore, further gains in the stock market are possible if traders continue to "look ahead" to normalization. And importantly, to the idea that we've seen the worst of the economic damage.

Given the immense importance of producing a medical solution to the virus problem (and of course, the potential profitability of such a solution), I have little doubt that a vaccine and a drug therapy will happen - and fast by historical standards.

But the next question is when should we expect the world's 7.5 billion inhabitants to be vaccinated?

While I am very excited about the progress that the folks at Oxford, Pfizer, Moderna, Gilead, etc. are making toward the development of a vaccine, I'm also a little concerned about the time frame involved to get everybody vaccinated. Because THIS is when things can go back to normal.

Then from the market's perspective, will this happen within the appropriate discounting window?

Yes, the market looks ahead. But can we really "pull forward" the expectations for better days by a year or more? Color me skeptical.

What Will You Bet On?

So from my seat, it's time to place your bets. If you believe that science will "get 'er done" before the end of the year, you should be buying here and on every dip.

But, if you believe that a solution will take longer, then caution is your watchword. And you will likely be looking to lighten up/take profits after the market's record-breaking joyride to the upside.

Expect Some Bumps Along The Way

Regardless of your near-term outlook/bet, it is probably a good idea to expect the longer-term road to normalization to be bumpy. There are any number of potholes such as another wave of the virus (especially now that the country is rushing to re-open), delays in the development of a vaccine, the contagion caused by oil's crash, a new phase of the trade war with China, etc.

Any of the above could easily cause investors who are currently looking past the economic nadir and across to the other side to recalculate their market math. In other words, any potholes that develop could cause the market's ride to experience a flat tire - I.E. a correction.

The Near-Term Narrative

But it is clear that stocks aren't worried about the long-term, complete virus fix here. No, traders appear to be focusing on what's going to happen within the next six months, when most states will be re-opened for business and the impact of the historic stimulus is being felt.

JPMorgan strategist Marko Kolanovic summed the situation up nicely. "While the collapse in economic activity is historic, so too is the global policy response to cushion the impact and support a recovery," Kolanovic wrote.

"We estimate the impact of Fed easing in both rates and credit [will] more than compensate for the temporary hit to corporate earnings when valuing the US market via discounted earnings," Kolanovic added.

Speaking of the Fed, traders appear to remain heartened about the outlook for Jay Powell & Company to stay "friendly" for a long - no, make that a very long time. For example, this week we learned that the Fed has pledged to keep rates at historic lows until the economy recovers. And the bottom line here is traders know that low rates are stimulative. Oh, and then there's the "Don't fight the Fed" rule. I'm pretty sure every investor on the planet knows that one by now.

Recognize Most Job Losses Aren't Permanent

While the press loves to promote the economic "death and destruction" happening out there, just reading the headlines can be misleading.

For example, a fact that didn't make the headlines is that 78% of the folks who "lost their job in April" said they were furloughed, meaning their unemployment is intended to be temporary. Additionally, CNBC reported the number of workers who described themselves as on temporary layoff (meaning they expect to be called back to work within six months) jumped from under two million to over 18 million last month.

The point is that temporary job losses due to a self-inflicted shutdown to keep folks safe and healthy is not the same as the traditional take on the term "unemployment". And yes, stocks may be discounting this as well as the fact that this is likely as bad as the "unemployment" situation will get.

The key going forward is to watch for the number of job losses that wind up being permanent. In short, the market will be monitoring where the jobs market will be in two to three months' time. Understand that data supporting the idea that most of the "unemployment" will be temporary is mission-critical to the bulls.

The Bottom Line

From my perch, the bottom line here is it's time for investors of all sizes and shapes to take a stand. Again, if you believe a medical solution will become a reality in the next six months, "Buy 'em!" But, if you see the future as uncertain or that it may take longer to get back to normal, some caution might be appropriate here. And with the roulette wheel now spinning, it is time to place your bets.

Weekly Market Model Review

Each week we do a disciplined, deep dive into our key market indicators and models. The overall goal of this exercise is to (a) remove emotion from the investment process, (b) stay "in tune" with the primary market cycles, and (c) remain cognizant of the risk/reward environment.

The Major Market Models

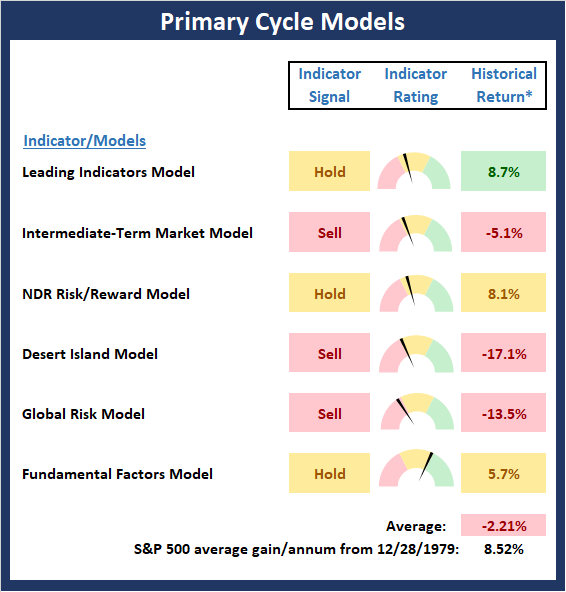

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

There are two changes to report on the Primary Cycle board this week. However, I think it is worth keeping in mind that while the stock market rally continues unabated, my favorite big-picture market model board remains fairly weak. This week, NDR's Risk/Reward Model flipped from negative to neutral while the Global Risk model went the other direction. The end result is a historical average return that remains negative. So, while traders may continue to look ahead to better days, unless this board can perk up in a meaningful way, I'm going to keep my enthusiasm curbed.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

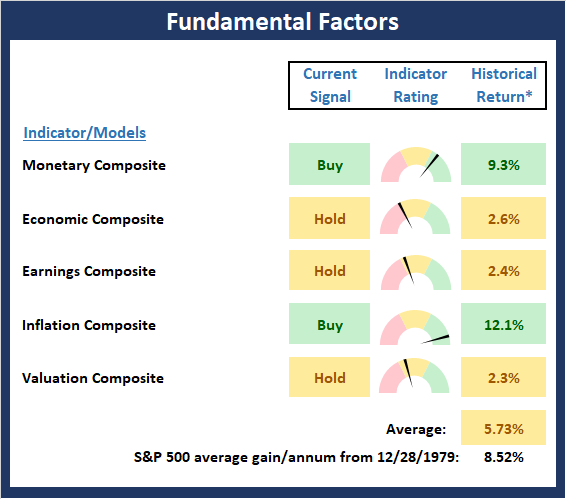

The State of the Fundamental Backdrop

Next, we review the market's fundamental factors in the areas of interest rates, the economy, inflation, and valuations.

There are no changes to the Fundamental Factors board again this week. However, as I've been saying, both the earnings and economic pictures are likely worse than the model readings. For example, most analysts would likely concur that the economy is in a recession as it appears there is almost no possibility of avoiding two consecutive quarters of negative GDP readings. In addition, since earnings are projected to drop 20-25% for CY2020, my guess is the model will pick this up eventually. So, from my seat, I think you have to take these model readings with a grain of salt.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

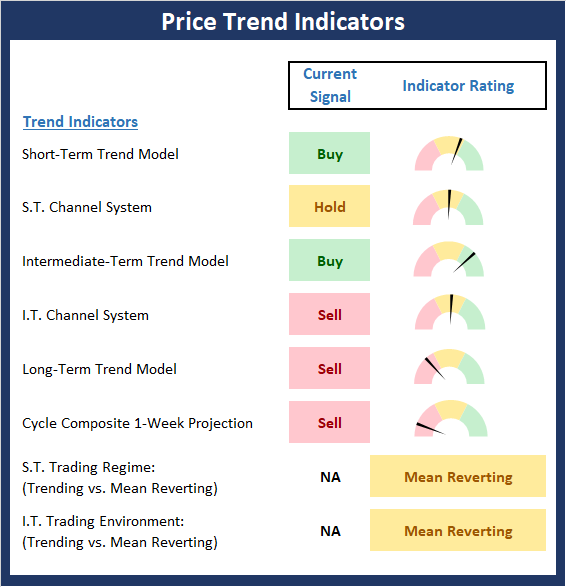

The State of the Trend

After looking at the big-picture models and the fundamental backdrop, I like to look at the state of the trend. This board of indicators is designed to tell us about the overall technical health of the current trend.

There was some improvement on the Trend board this week as our ST Channel System upticked from negative to neutral. However, despite the fact that stocks have bounced hard over the past few weeks, there is still a fair amount of damage when looking at things from the intermediate- and longer-term trend perspectives. And with stocks currently moving largely sideways, I'll rate the current "state" of the overall trend as neutral.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The State of Internal Momentum

Next, we analyze the "oomph" behind the current trend via our group of market momentum indicators/models.

Despite the sideways action in the major indices, the Momentum Board improved a bit as both the Volume and Breadth Thrust indicators upticked to positive from neutral. So, for now, the bulls appear to have some momentum on their side.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

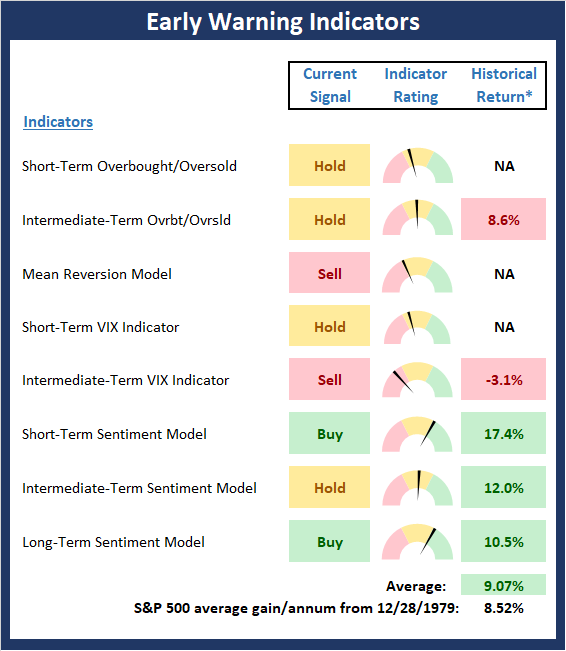

Early Warning Signals

Once we have identified the current environment, the state of the trend, and the degree of momentum behind the move, we then review the potential for a counter-trend move to begin. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

Last week, we noted that the Early Warning board was suggesting that the table was now set for a counter-trend move, which in this case, would be down. But while the bears may still hold the edge here from an overbought/sold and sentiment perspective, the case is not as strong this week.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more

Caution is most definitely my watchword at the moment. Still too much uncertainty out there. And I think the US COVID-19 response has been a mess. I think it's quite possible things will get far worse if the country starts opening up too quickly.