Pinterest Stock Offers Attractive Upside Potential

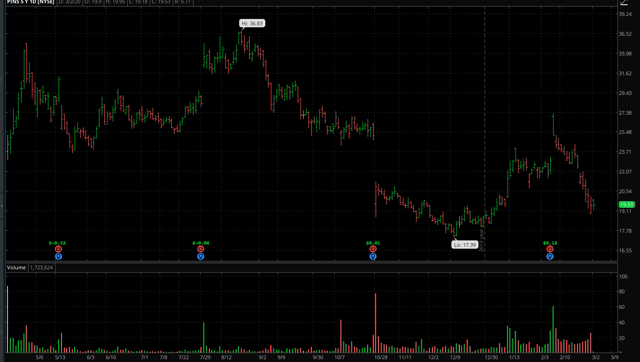

Shares of Pinterest (PINS) are down by more than 45% from their highs of the year. The company is growing at a strong rate, but a competitive new service from Facebook (FB) and general market weakness in the context of the COVID-19 panic are putting downside pressure on the stock price.

(Click on image to enlarge)

Source: TOS

Being a relatively small player in a dynamic industry, Pinterest is exposed to substantial risk and volatility in the near term. However, the stock offers attractive upside potential from current prices, and the potential gains could more than compensate for the risks.

The Big Picture

Pinterest has an interesting business model that can be beneficial to both users and advertisers. When users find ideas or inspirational images, they can pin those images to specific boards. Pinterest's algorithm then suggests more new pins based on the user's interest and previous activities, and some of those suggestions can be advertising.

When ads are relevant and useful, it's a win-win for both users and advertisers. The company reported a 3x increase in the percentage of people saving their ads this season, this shows that Pinterest is doing a sound job at optimizing its machine learning algorithms to deliver the right recommendations to the right users.

In times when social media platforms are heavily criticized for being home to toxic and aggressive content, Pinterest is focused on inspiring content and ideas. The company commissioned a survey of 2,000 users from Talk Shoppe on attitudes toward Pinterest. Among the findings: 91% of respondents find Pinterest to be a positive place and 90% say Pinterest inspires them.

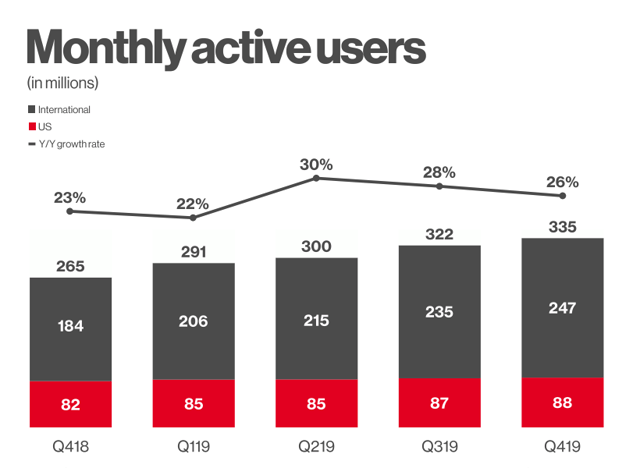

Pinterest ended the fourth quarter of 2019 with 335 million monthly active users, a healthy increase of 26% versus the same quarter in the prior year.

(Click on image to enlarge)

Source: Pinterest

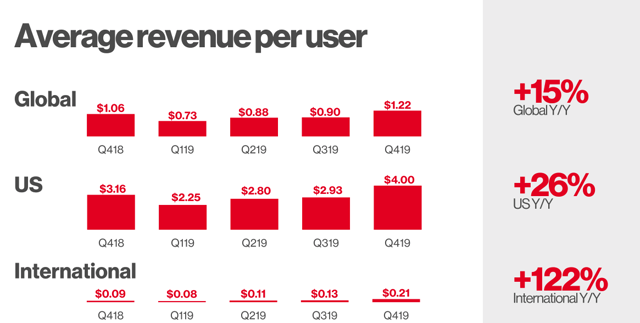

The business model is highly monetizable, but Pinterest is taking it slow. The average revenue per user is $1.22 on a global scale. By comparison, Facebook makes a much larger $8.52 per user.

Interestingly, Pinterest is making $4 per user in the US while still making only $0.21 in international markets. The company has plenty of room to continue increasing monetization in both the U.S. and international markets over the years ahead.

(Click on image to enlarge)

Source: Pinterest

Last year Pinterest expanded its offering to small advertisers by building a suite of mobile tools, basic analytics, and reporting. Now the company is working on improving the experience for midsized international advertisers by building more robust desktop self-service tools, creative capabilities, and scalable measurement applications.

Management is actively working on making the platform more shoppable. Pinterest is making it easier to discover shoppable products so that users can move seamlessly from inspiring images to shopping services where they can buy what inspires them. The company is also launching its verified merchant program, so users can know that they're buying from merchants that meet Pinterest's quality guidelines.

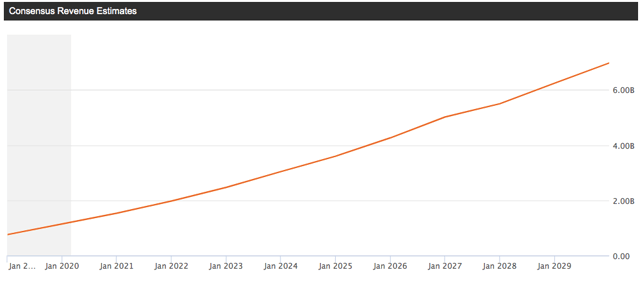

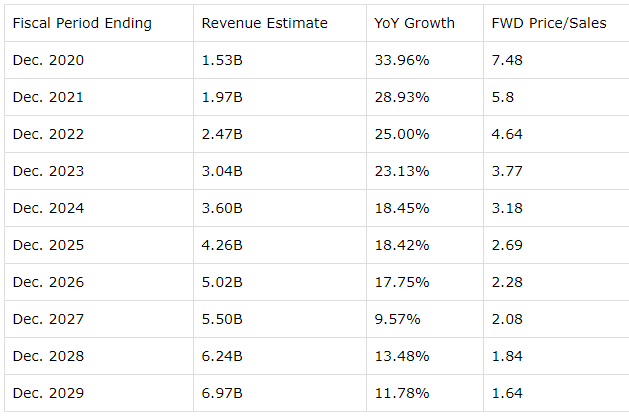

Pinterest reported $399.9 million in revenue last quarter, growing by 51% year over year. The number surpassed Wall Street expectations by 8.39%. Going forward, analysts are expecting revenue growth to be 34% in 2020 and to steadily slow down, albeit from high levels, in the years ahead.

(Click on image to enlarge)

Source: Seeking Alpha

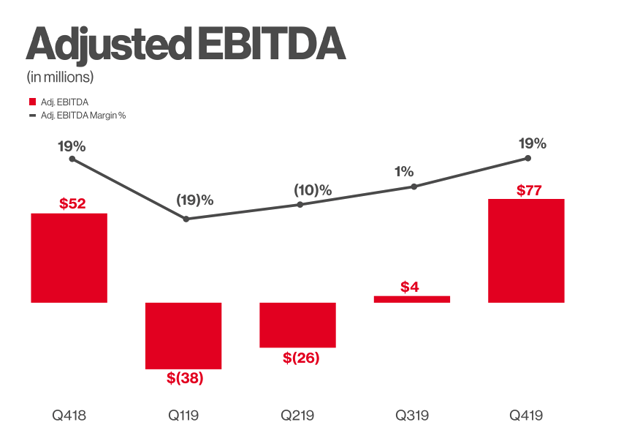

The company is still losing money on a GAAP basis, but Adjusted EBITDA is already positive and margins are moving in the right direction.

(Click on image to enlarge)

Source: Pinterest

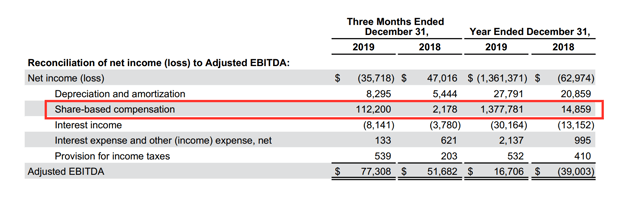

Stock-based compensation is taking a big toll on margins during 2019, and this is due in good part to the fact that Pinterest had its IPO in April of last year. The impact of stock-based compensation should be substantially reduced in the coming months, so profit margins will most probably expand in the middle term.

(Click on image to enlarge)

Source: SEC filings

Attractive Upside Potential

The table below shows revenue estimates for Pinterest over the years ahead, as well as the implied price to sales ratio. The stock is not too expensive at all based on these estimates, and revenue growth forecasts are quite moderate.

Pinterest still has plenty of room to continue delivering both sustained user growth and expanding revenue per user, so it is not unreasonable to say that Pinterest could exceed growth expectations if management executes well.

(Click on image to enlarge)

Source: Seeking Alpha

To put the company's size in perspective, the table below shows market capitalization and expected 2020 revenue for Pinterest versus Match (MTCH), Snap (SNAP), Twitter (TWTR), and Facebook.

Pinterest does not need to reach the gargantuan size of Facebook in order to deliver attractive returns for investors. Just closing the gap versus Match and Snap would mean a potential revalorization of 60% to 80% from current levels for Pinterest.

(Click on image to enlarge)

Data in $ Billions. Source: Seeking Alpha

On Risk And Opportunity

Global financial markets are under lots of stress due to the uncertainty caused by COVID-19 and its potential impact on the global economy over the coming months.

Pinterest as a business could actually benefit if people are staying more at home and spending a larger share of their time online, but the stock market still tends to run away from risky stocks in times of uncertainty.

Adding to the concerns, Facebook has recently rolled out Hobbi, a new platform for curating photos of interests and hobbies. Being such a massively big company with enormous financial and strategic resources, the competitive threat from Facebook is not a factor to disregard. However, only because Facebook has launched a similar product, that is no reason to sell Pinterest.

The stock market is generally too simplistic and short-sighted, especially in times of fear. When investors see increased competition from a bigger player, they tend to rapidly sell a company such as Pinterest, even if there is no evidence whatsoever to do so. Pure speculation and emotionally-driven decisions rarely lead to attractive returns in the long term.

The fact that Facebook is entering the space is not only a competitive threat but also a driver that could provide validation to Pinterest, while also attracting more attention from advertisers towards the platform. There is no reason to believe that the market is not enough for Pinterest to continue thriving in spite of growing competition from Facebook and others.

In any case, these two risk factors are already well known by the market and hence incorporated into the stock price, and this could be creating an opportunity for investors in the company.

One of the most important factors to consider is that the future performance of a stock does not depend on the fundamentals alone, but rather on the fundamentals in comparison to expectations. Generalized concerns can provide attractive opportunities for Pinterest to actually perform better than expected, delivering attractive returns for investors in such a scenario.

It is often said that bull markets climb a wall of worry, and there are plenty of worries currently affecting the Pinterest stock. However, the company is well-positioned to continue delivering attractive growth rates and expanding profit margins in the years ahead.

Investors considering a position in Pinterest in the current context need to be willing to accept considerably risk and volatility, but the upside potential may be well worth it.

Disclosure: I am/we are long FB. I may initiate a long position in Pinterest in the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am ...

more