Pinterest Down After Earnings: Buying Opportunity

Pinterest (PINS) stock was crashing by nearly 11% on Tuesday - March 27 - after the company released its earnings report for the first quarter of 2021. The financial numbers were actually very strong, but management provided fairly low - perhaps too conservative - guidance numbers for user growth.

The simplistic narrative would be that the numbers were great but growth is slowing down, so the stock deserves a lower valuation. That would make sense in theory, but I don't think it accurately describes the future.

Pinterest looks well-positioned to delivering vigorous revenue growth and expanding margins in the years ahead. If the business does well, the stock price should follow.

The Reason For The Decline

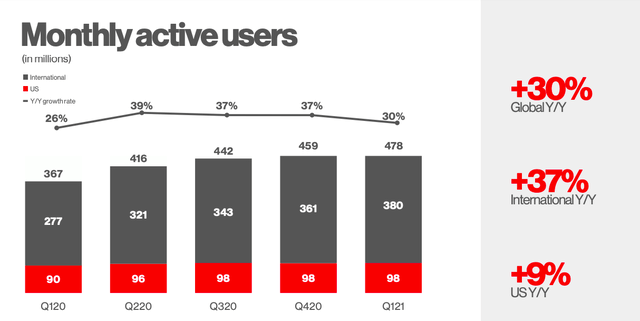

If you want to know the reason why Pinterest is down so much after the report, then you should look no further than the user growth numbers. The company ended the quarter with 478 million users, a year-over-year increase of 30%. The number was slightly below market expectations, but nothing to be too concerned about. International markets are clearly the main growth engine for the company in terms of users nowadays.

Source: Pinterest

However, user growth guidance was a big disappointment in the report. Management is expecting monthly active users to grow in the mid-teens next quarter, and user growth in the US is expected to be around flat on a year-to-year basis.

The main driver behind this modest user growth guidance is that management considers that the pandemic has pulled forward some of the longer-term user growth in recent months. After the reopening gained steam in the second half of March, management observed deceleration in user growth, especially in the US, where the company has a larger user base and the low hanging fruit has already been captured.

Management said that engagement levels from users gained in 2020 remained strong in the first quarter of 2021, but it also clarified that it has a limited understanding of how engagement levels will evolve in the future.

There was an interesting positive in the numbers, though, since the company observed "particular strength coming from users under the age of 25, a persistent trend that we’ve seen for many quarters. Gen Z Pinners tend to also be more engaged than older users." From a demographic perspective, it is clearly exciting to see Pinterest gaining strength among younger generations.

Growth was already decelerating in the company's biggest markets due to the natural maturation of the business, the pandemic pulled forward some of that user growth, and now there will be a deceleration after the reopening. Both the pandemic-related acceleration and the subsequent deceleration after the reopening are transitory by nature, though.

The main thing to consider is that Pinterest has already reached a massive scale, which is crucial in order to capitalize on the network effect and also to attract enough advertisers to the platform. That battle has already been won, and Pinterest has lots of levers to pull in order to drive strong revenue growth from such a user base.

Pinterest Is Just Getting Started

User growth is slowing down, even if some of that slowdown is temporary because of the unwinding of the pull-forward created by the pandemic, the slowdown in user growth is for real. It is also widely anticipated by the market, though, especially after the most recent earnings report.

On the other hand, the best days are still ahead of Pinterest when looking at the value of the platform and the potential of the business.

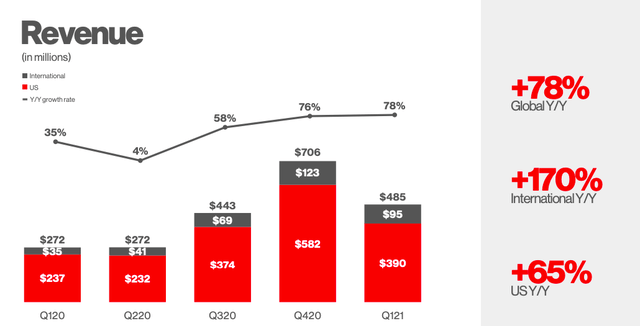

Revenue reached $485 million last quarter, growing by 78% year over year and representing an acceleration versus prior quarters.

Source: Pinterest

Even more impressive, management is expecting revenue growth to be 105% in the second quarter of 2021. Yes, you read that right, the company is expecting user growth to be in the mid-teens with revenue growth of 105%, which obviously implies a massive acceleration in monetization.

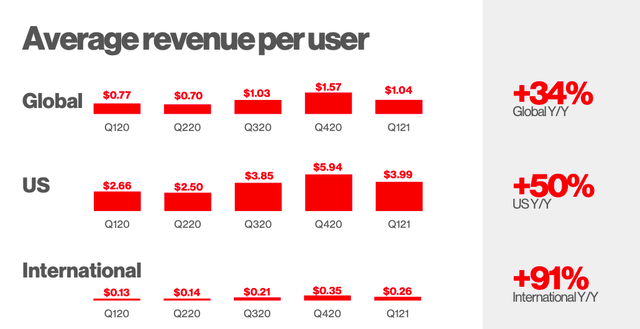

The average revenue per user increased 50% in the US and 91% in international markets last quarter. International revenue per user is still minuscule in comparison to the US - $0.26 versus $3.99 - and Pinterest is just giving its first steps regarding international monetization.

Source: Pinterest

Management explicitly said in the conference call that ad impressions were slightly down year over year, both in the US and internationally, last quarter. The increase in monetization is being driven by more engagement and better performance as opposed to showing more ads. In other words, Pinterest is increasing monetization without hurting the user experience at all.

Shopping could be a powerful driver for such a visual platform like Pinterest, and the comments from management are quite encouraging. The number of users engaging with shopping surfaces on Pinterest grew over 200% in the 12 months ending March 31, 2021. Initial data is indicating that post-COVID shopping engagement could be more resilient than overall engagement.

On April 21, Pinterest announced an expansion of its alliance with Shopify (SHOP) to bring social commerce to 27 new countries. The Shopify Pinterest channel is now live in Australia, Austria, Brazil, France, Germany, Italy, Spain, Switzerland, and the UK. More than 1.7 million Shopify merchants around the world can bring their products to Pinterest and turn them into shoppable Product Pins that are discoverable across the Pinterest platform.

Advertising in international markets is also growing very strongly, and it reached 20% of total revenue for the first time ever last quarter. Pinterest has recently launched advertising in its first Latin American country, Brazil, and it has plans to launch ads in Mexico in May. These particular data points show how much room Pinterest still has in order to continue expanding monetization and revenue growth over the years ahead.

Show Me The Money!

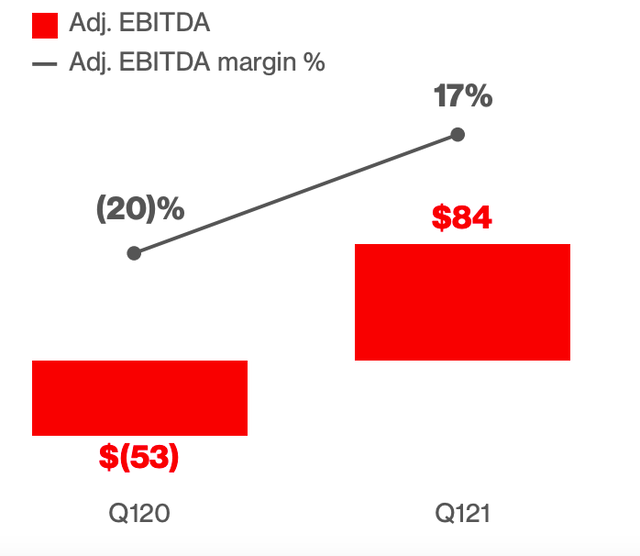

Another key area where Pinterest is performing very well is profitability. The company still has a long way to go before reaching its full profitability potential, but expenses are growing at a slower rate than revenue, so profit margins are expanding at a strong rate.

To highlight some key data points, the adjusted cost of revenue was 27% of revenue last quarter, down from 36% of revenue in the year-ago quarter. While revenue grew 78% year over year, R&D expenses increased 18%, sales and marketing grew 11%, and G&A expenses increased 30%.

The business model allows for abundant profitability once reinvestments start to slow down in comparison to revenue growth. Pinterest is barely scratching the tip of the iceberg regarding profit potential, but the business is clearly moving in the right direction.

Source: Pinterest

Some of the deceleration in user growth will be temporary due to the impact of the pandemic, although it obviously makes sense to expect user growth to slow down as the platform gains size over time. Nevertheless, Pinterest is still producing outstanding revenue growth, and the opportunities for sustained improvements in engagement and monetization are very exciting, both in advertising and in e-commerce.

A growing top line, combined with an expansion in profit margins could be a powerful upside fuel for Pinterest stock going forward. Any weakness in the stock price could create a buying opportunity for long-term investors with an opportunistic approach and enough tolerance to volatility.

Disclosure: I am/we are long PINS, SHOP.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more