Pinterest And Snap Show V-Shaped Recovery; Cloudflare Guns For Zero-Trust

2020 earnings from ad-tech stocks have shown us that digital advertising has rebounded sharply from the pandemic recession lows. Pinterest’s (PINS) growth rate dropped to 4% YoY in Q2 but has since rebounded to +77% in Q4. SNAP’s growth rate bottomed at 17% in Q2 and has recovered to +62% in Q4.

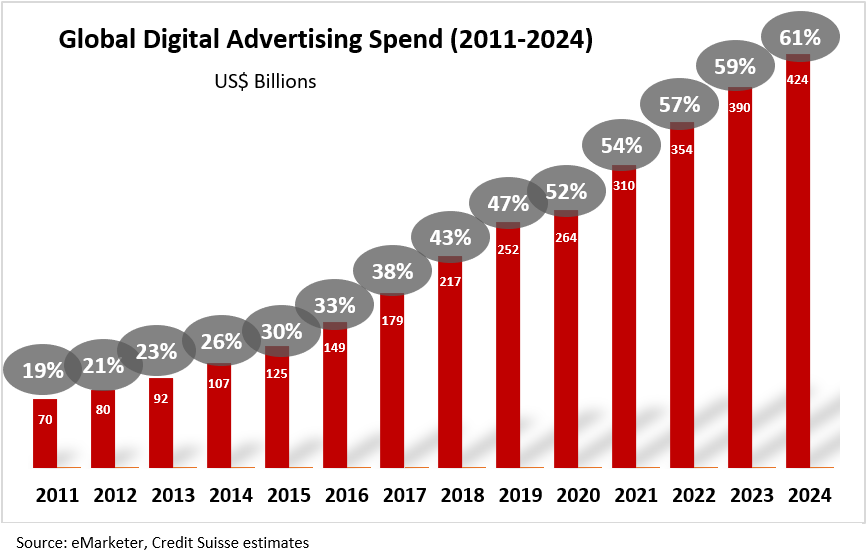

In total, global digital advertising spend grew less than 5% in 2020 but is expected to accelerate with 17% YoY growth in 2021 as we head into a higher GDP environment.

Global digital ad spend now makes up 52% of all ad spend, the first year it has eclipsed over 50% share. Over the next 4 years, global digital ad spend is expected to grow 61% from its current total and will exceed 60% of all advertising dollars. The industry growth we are expecting to see will provide a powerful tailwind for digital ad stocks. Pinterest and Snap have proven to be two of the industry’s leaders, with both companies announcing record results in Q4.

Pinterest reported Q4 results on February 5th, beating estimates on both the top and bottom lines. Revenue of $706M (+77% YoY) came in 9% above the consensus projection of $647M. Adjusted EPS of $0.43 exceeded the street estimate of $0.33 while adjusted EBITDA of $299M far outpaced estimates calling for $226M.

The company announced that Global Monthly Active Users (MAUs) grew 37% YoY to 459M vs. 450M consensus, US MAUs were 98mm vs. 97M consensus, and International MAUs were 361M vs 360M consensus.

Management also indicated that it is expecting revenue to grow in the low 70% range YoY for the March quarter.

In its Q4 earnings call, Pinterest CFO, Todd Morgenfeld, attributed the strong Q4 to the investments the company has made in technology and the expansion of their sales coverage:

“Over the last year, we’ve invested in our ability to better deliver returns [through] accountable performance advertising, including scaling, conversion optimization, ads, shopping, ads, and building improved automation to help advertisers of all sizes more easily onboard and realize the value of being on Pinterest…We also expanded our sales team in Western Europe to monetize our engagement there.”

One of the standouts from the company’s Q4 results is the international growth they saw. Pinterest grew international revenue 146% YoY, international MAUs 79% YoY, and international ARPU 67% YoY. All three metrics represent record results for Pinterest.

On the technology front, Pinterest has created value for advertisers through the onboarding of catalogs and automation tools to make spending on the platform easier. The investments Pinterest has made in improving their technology to deliver more value to advertisers paid off with record numbers in Q4.

Management’s commentary and guidance indicate that they expect this momentum to continue in Q1: “we expect positive trends from our investments in ad tools like shopping and automation, and sales coverage expansion to continue. We plan to expand our international coverage further in existing geographies, and also expand monetization into Latin America in the first half of the year.”

Recently, Microsoft attempted to buy Pinterest according to news sources. At $51 billion, Pinterest is twice the valuation of LinkedIn at the time of acquisition. Last year, Microsoft put in a bid for Tiktok.

Snap

Snap announced Q4 results on February 5th, topping consensus estimates on both the top and bottom lines although guidance for next quarter came in under expectations on adjusted EBITDA.

In Q4, revenue grew 62% YoY to $911M, topping Wall Street’s estimate of $855M by 7%.

Adjusted EPS of $0.09 beat by $0.02 while adjusted EBITDA of $166M comfortably exceeded expectations calling for $142M.

Global daily active users (DAUs) rose 22% YoY to 265M, surpassing expectations for 258M. Daily active users exceeded expectations across all geographies, including North America, Europe and ROWS.

For Q1, Snap sees revenue of $730M at the midpoint and adjusted EBITDA of -$60M. The adjusted EBITDA guidance came as a surprise as analysts were expecting positive EBITDA for Q1.Still, -$60M would be an improvement over -$81M in Q1 2020.

In its Q4 earnings call, Snap CFO Jeremi Gorman discussed the rebound the company observed after Q2: “in Q3 and Q4, we saw many existing advertisers return to Snap and so many new ones leverage our innovative ad formats and bidding capabilities to drive real business value on our platform. This drove active advertisers to an all-time high.”

Snap currently has an average of 200 million people engaging with AR on Snapchat every day. The company noted that they will continue to invest heavily in AR to create new cutting-edge tools and capabilities that allow advertisers to reach their audience in new ways.

Snap believes there is tremendous value in giving advertisers the ability to engage with their audience directly via the camera.Management disclosed that businesses leveraging AR as one component of a larger multi-product campaign on Snapchat tend to achieve stronger results.

Another key area for investment moving forward for Snap is video advertising and the growth of Spotlight: “We see more opportunity over time to grow video inventory particularly via the growth in viewership of Spotlight and Stories.” This is the primary way Snap monetizes its users, but the company believes there will be even more opportunity here in the future.

Snap has invested in content to support the launch of spotlight and plans to continue to make this a focus area moving forward.These investment areas are the main reason for Snap’s adjusted EBITDA target coming in below consensus.

Snap management tempered expectations for 2021 when discussing how the iOS platform policy changes could affect their business: “We anticipate that the iOS platform policy changes to be implemented later this quarter will present another risk of interruption to demand in the period immediately after they are implemented. It is not clear yet what the longer-term impact of those changes may be for the top-line momentum of our business, and this may not be clear until several months or more after the changes are implemented.”

Snap showed tremendous growth in Q4 and continues to be a key tool for advertisers that are trying to reach a younger audience. On average, DAUs opened the app 30 times a day in the fourth quarter with an average of over 5 billion snaps created each day.CEO Evan Spiegel indicated that he expects Snap to accelerate its full year growth rate in 2021 to above the 46% number the company recorded in 2020.

Cloudflare

Cloudflare (NET) announced Q4 earnings results on February 11th.Adjusted EPS of ($0.02) beat consensus estimates by $0.02 while adjusted operating margin of (7.9%) improved 1.7% on a YoY basis.Revenue of $126M grew 50% YoY, topping consensus expectations by $7.6M.

Gross margin declined slightly on a YoY basis to 77.6% from 78.2% a year ago.Management attributed this decline to the fact that they did not raise prices because they did not want their customers to end up with a surprise bill during the pandemic.FCF was negative $23.5M, representing a FCF margin of (18.7%).

For Q1, Cloudflare sees $130.5M in revenue at the midpoint, coming in above the $126.2M consensus. Loss per share is expected between $0.02-0.03 vs. the $0.03 loss estimate. Full year 2021 guidance also topped analyst estimates with management expecting revenue of $591M versus a $561M consensus. On the bottom line, Cloudflare is expecting a loss per share of $0.08-0.09 for the FY21 versus the $0.09 loss estimate.

Q4 was a strong quarter for Cloudflare despite the initial 6% decline in the stock on Friday following the announcement of these results. NET shares were up 20% YTD coming into the earnings report, creating a potential profit-taking scenario following Q4 results.

CEO Matthew Prince highlighted the company’s growth in paying customers accounts and large customer accounts in Cloudflare’s Q4 earnings call: “Our paying customer accounts grew to over 111,000, up 10% quarter-over-quarter and our strongest quarterly growth in several years.

Large customers, those that spend over a hundred thousand dollars per year with us, continue to be our strongest growth area adding 92 new customers in Q4 and bringing our total large customer account to 828. Revenue from these large customers increased sequentially to 49%, up from 47% in Q3 as our sales team continues to close larger and larger enterprise accounts.”

Cloudflare announced that their Dollar-based net retention of 119% improved 3% sequentially, driven by continued strength from large enterprise customers. Management attributes the growth in large enterprise customers to the company’s expanded product portfolio.

The company has launched a number of products and features that are important to customers, including its zero-trust network security solution, Cloudflare 1, and Magic Transit. CEO Matthew Prince believes Cloudflare’s zero trust solution is the best in the industry, noting that Cloudflare “is the only company with a zero-trust solution that really understands and is built for the needs of developers”.Cloudflare’s mission is to provide value for developers in a way that other companies do not.

Cloudflare management highlighted a few significant customers wins in Q4.They attributed these customer wins to the platform’s ease of use, technical innovation, and the way multiple products fit together into a unified solution. CEO Matthew Prince believes his company is on the path to more significant customer wins in the future: “Developers are the future of IT and having won their trust we expect will help us win, retain and expand more and more customers over time.”

Looking ahead, Cloudflare management believes the strong business momentum they observed in Q4 will continue into Q1 and throughout 2021.The company raised its outlook on both these numbers.Management noted that in 2020 companies were simply trying to survive.

In 2021, management believes there will be a big shift from a traditional hardware-based security approach to a much more modern zero trust approach.The company is confident that Cloudflare will be one of the leaders in enabling companies to make that transition.

My premium subscribers received a 12-page report on Roku And TTD prior to earnings, Snap prior to earnings and tech trade war plays to hedge their portfolios.