PepsiCo: Rare Opportunity To Buy At A Better Valuation: Part 6

<< Read: It Is No Longer A Gamble Investing In Procter & Gamble , Part 5

<< Read: Campbell Soup Company: High-Yield And Speculative Capital Gain Potential, Part 4

<< Read: 3M Company: It Didn’t Take a Crystal Ball to See That It Was Overvalued, Part 3

<< Read: Dividend Growth Stocks in a Stealth Bear Market - Kimberly-Clark Corporation, Part 2

<< Read: Have You Noticed That Many Dividend Stocks are Finally in a Bear Market? General Mills Inc., Part 1

PepsiCo (PEP) is a Dividend Aristocrat, Champion and blue-chip stalwart that has increased its dividend for 46 consecutive years. Therefore, it should be no surprise that just as we saw with Procter & Gamble in part 5, this blue-chip stalwart has traditionally commanded a higher valuation (earnings multiple) than the average stock. Over the past couple of decades at least, it has been a very rare occurrence to be able to invest in this company at a valuation that would be considered reasonable or attractive.In fact, prior to current time, it took the Great Recession of 2008 and 2009 to bring PepsiCo down to reasonable valuation levels as measured by P/E ratios.

Although PepsiCo is not back to those recessionary levels, its current low blended P/E ratio of 19.8 has not been available since 2013. Consequently, although I do not consider it a screaming bargain, I do consider it attractive relative to historical norms. To put PepsiCo’s current valuation into perspective, this blue-chip can be purchased today with a 3.4% current dividend yield which is hovering around the highest it has been over the past two decades. Moreover, PepsiCo does provide the prudent investor with the opportunity for above-average capital appreciation going forward in addition to its high current and growing dividend yield.

Furthermore, PepsiCo appears attractively valued over virtually every rational valuation metric that prudent value investors might consider.Later in the FAST Graphs analyze out loud video I will value PepsiCo utilizing several different metrics.

PepsiCo at a Glance

Although PepsiCo is best recognized for their soft drink business, they are more diversified than most of their competitors.As taken from their website below, the company has 22 iconic billion-dollar brands.And, the company is working hard to produce and market healthier options which are in vogue in certain circles.On the other hand, the company is not abandoning their traditional and some would say better tasting salty snacks and sugary beverages.

Also, PepsiCo is working hard to transform their portfolio and market their products effectively.This is easily seen by evaluating the company’s priorities that they have recently presented at analyst meetings.This includes creating new products, a commitment to more focused marketing and a solid merchandising strategy.

In the same vein, PepsiCo is focused on serving their customers and giving them what they want and/or prefer. This also opens additional marketing opportunities for the company.

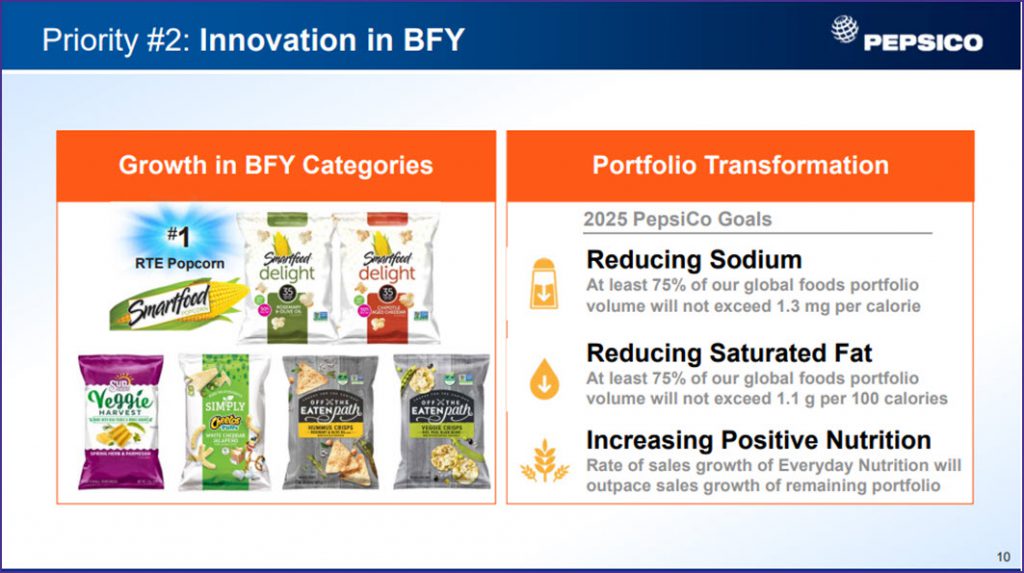

Part of PepsiCo’s initiative in this area is innovation in better for you (BFY) product offerings. This includes reducing sodium content and saturated fats.PepsiCo believes these products will be big sellers, but I believe the jury is still out.

PepsiCo third priority is also reevaluating and improving their direct store delivery (DSD) capabilities.This initiative helps them serve their retail customers better and solidifies their relationship with large retailers.

Morningstar Gives PepsiCo a Wide Economic Moat

The above described initiatives and priorities are consistent with Morningstar’s awarding PepsiCo a wide economic moat.The following excerpt by Sonia Vora summarizes Morningstar’s views:

“Economic Moat by Sonia Vora Updated May 08, 2018

We believe that PepsiCo enjoys a wide economic moat created by intangible assets and cost advantages related to the manufacturing and distribution of its products. Pepsi is a formidable player in the nonalcoholic beverage and snack categories, with the top seven brands in salty snacks and nearly a quarter of the share of the United States liquid refreshment beverage market, according to management. Its portfolio includes 22 brands that generate over $1 billion in revenue annually, leading to sticky relationships with distributors and retailers that depend on leading brands to generate store traffic, a dynamic we expect to continue given the resources that Pepsi has to reinvest in its brands. Pepsi has consistently been a price leader, relying on product innovation to drive net pricing increases (by our estimates, maintaining a five-year historical mean price 1.7% above inflation) rather than competing on the basis of volume alone, which we consider further evidence of its wide moat.”

Furthermore, Morningstar also believes that Pepsi’s commitment to “guilt free” products will be a contributor to continue growth as follows:

“We anticipate growth will be fueled by Pepsi’s noncarbonated beverage and snack businesses, which should enable it to offset the impact of secular declines in the consumption of carbonated soft drinks (which account for less than one quarter of overall sales) in developed markets. We appreciate the firm’s focus on “guilt-free” products (that contribute roughly half of sales), which align with consumer trends, and surmise sustained brand-related investments (with combined expenditures on advertising and research and development remaining above 7% of sales over our forecast) will allow it to develop and market innovative new products, further bolstering the intangible asset source of its wide moat. In addition, efforts to drive efficiency gains (targeting $1 billion in savings annually) stand to enhance its margins and free up funds to support its product set.”

FAST Graphs analyze out loud video: Valuing PepsiCo in Multiple Ways

There are numerous ways to examine and then ascertain the fair value of a business public or private.I am often asked what do I think is the best metric to use when trying to determine fair value?My answer to this question is simple and straightforward.I believe that investors should evaluate any stock they are examining over as many valuation metrics as they can.Therefore, my stock answer is to utilize all of the valuation resources at your disposal.

In addition to providing different perspectives on the relative valuation of a given stock, examining various metrics can also provide insights into the company’s operating strengths and/or challenges.Moreover, in addition to simply trying to ascertain valuation, I believe that examining various metrics also affords insights into important considerations such as dividend coverage.In other words, is the dividend safe and can it be expected to continue growing?Finally, examining numerous metrics provides a perspective on whether or not the company in question is worthy of a more comprehensive research effort or not.

Consequently, the following analyze out loud video will look at PepsiCo’s valuation and the safety of its dividend utilizing numerous metrics. These will include adjusted and GAAP earnings, operating and free cash flow as well as EBITDA. I will also look at important underlying financial numbers associated with the company’s financial statements.

Video length: 00:12:39

Summary and Conclusions

PepsiCo is a blue-chip Dividend Aristocrat that is currently available at sensible valuations. I believe its most salient features are a well-covered dividend and the opportunity for that dividend to continue to increase. Moreover, when purchased at sound valuation, investors can also expect attractive long-term capital appreciation in addition to its growing dividend income stream. Although PepsiCo has bounced approximately 7% off its low established at the end of May, I still consider it reasonably attractive given its quality and fundamental attributes.

With my next article in this series, I will be covering Coca-Cola (KO).

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more