PayPal Stock Crashes: Buying Opportunity Or Time To Panic?

eBay (EBAY) has recently announced that it will be changing PayPal (PYPL) for Adyen as its primary payments provider. This is understandably generating concerns among investors in PayPal, and shares of the digital payments provider are down by nearly 15% over the past few days. Is the separation from eBay a reason to sell PayPal or a buying opportunity?

How Important Is eBay For PayPal?

eBay purchased PayPal in 2002, and both companies were separated via a spin-off in July of 2015. Due to this close historical relationship, PayPal and eBay are closely related in investors' minds. However, a deeper look at recent numbers indicates that losing eBay is important, but not a game changer for PayPal at this stage.

According to management statements during PayPal's most recent earnings conference call, volume associated with eBay represented 13% of the total payment volume during the fourth quarter of 2017, compared to 16% for the fourth quarter of 2016, and 19% two years ago.

This means that eBay accounts for a sizeable share of total volume for PayPal, but that share is consistently declining in the past several years. Besides, it's not just about the percentage of payment volume coming from eBay, but what kind of impact it has on PayPal's revenue growth rates is even more important.

Total revenue for PayPal was above $13 billion in 2017, growing by 21% on a currency neutral basis. Revenue related to eBay market places grew 7%, while PayPal's merchants' service revenue grew by a much larger 24%.

In a nutshell, PayPal's merchants service revenue is growing at more than three times the rate of growth the company is getting from eBay. Measured in terms of contribution to revenue growth, eBay is not really a big growth engine for PayPal.

Besides, the current agreement between PayPal and eBay will remain in place until July of 2020. By that date, chances are that eBay will account for an even smaller share of PayPal's total buisness and growth opportunities.

PayPal Beyond eBay

Losing eBay will have a noticeable impact on revenue for PayPal, but it won't derail the company from its long-term growth trajectory. Looking at PayPal's financial performance and growth opportunities, the company still has a lot to offer over the years ahead, with or without eBay.

PayPal produced $3.74 billion in revenue during the fourth quarter of 2017, an annual increase of 26% on a constant currency basis. Operating profit margin expanded substantially, to 22.5% from 15.4% in the same quarter last year. Vigorous revenue growth in combination with expanding profit margins allowed PayPal to deliver a big increase of 30% in earnings per share during the quarter.

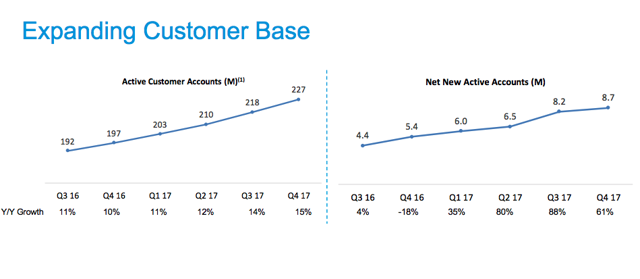

The key customer metrics are all moving in the right direction, and growth rates are even accelerating. PayPal ended the fourth quarter of 2017 with 227 million active customer accounts, growing by an impressive 61% versus the fourth quarter in 2016. The company gained 8.7 million new accounts during the quarter, a new historical record.

Image source: PayPal

Importantly, engagement metrics are also improving, which bodes well in terms of measuring user satisfaction and the company's ability to generate value for customers. The number of payment transactions per active account reached 33.6 last quarter, marking a new record for PayPal and increasing 8%.

International transactions are growing at full speed, with cross border trade increasing 20% during the quarter, the fastest growth rate in 10 quarters.

Mobile is a crucial growth driver in the industry, and the company doesn't leave much to be desired in that area. PayPal processed $48 billion in mobile payment volume in the fourth quarter of 2017, that represents a 63% growth rate year-over-year and 36% the company's total payment volume.

PayPal ended the quarter with over 80 million accounts in One Touch, up from 40 million a year ago. Venmo is also growing at full speed, with total payment volume during the quarter reaching 10.4 billion and growing 86% year-over-year.

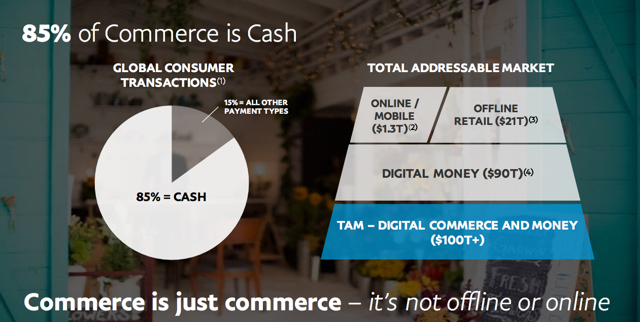

Looking into the future, it's important to note that approximately 85% of all commerce transactions around the world are still made in cash, and management estimates that the total addressable market for PayPal over the long term is worth nearly $100 trillion. In a nutshell, PayPal still has enormous potential for expansion over the years ahead.

Image source: PayPal.

Considering the risks, companies in the payments industry are always exposed to legal and regulatory uncertainty. Besides, the competitive landscape is quite dynamic, so investors need to closely monitor how different players in the payments sector interact with each other on order to make sure that PayPal remains well positioned to capitalize on its growth opportunities.

The stock is also priced at a forward price to earnings ratio of 32 times earnings expectations for 2018 and 27 times earnings forecasts for 2019. PayPal is an exceptional growth story, so it can easily justify above-average valuation levels. Nevertheless, current valuation makes the stock vulnerable to the downside in case there is any disappointment down the road.

In conclusion, the PayPal growth story remains intact in spite of the rupture with eBay. PayPal is delivering explosive growth and expanding profitability, and the company has abundant room for expansion in the years ahead. The lower the stock price goes, the bigger the opportunity for investors in PayPal.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PYPL over the next 72 hours.

This is the first I've heard of #Ayden. Would love to learn more about why #Ebay parted ways with #Paypal. What could have gotten them to have abandoned such a longstanding relationship?

It can't simply be a matter of lower processing fees or surely Paypal would have matched them.

I was initially surprised to hear that #eBay would no longer be using #PayPal as it's payment processor. But you've made an eloquent case showing that this will not be have a critical impact. My outlooks has shifted from planning to sell my shares, to buying more now that the price has dropped due to panicked shareholders. $EBAY $PYPL

While I agree that $PYPL will likely rebound in the short-term, in the long-term old-school ompanies like PYPL will go the way of the dinosaurs and be completely replaced with true digital currencies.

The change won't take affect until 2020. In the grand scheme of things these days, that's a long time away. By then #bitcoin could be the preferred method of payment for ebay purchases. $EBAY $PYPL #BITCOMP