Pay Your Holiday Bills With These Monthly Dividend Stocks Going Ex-Dividend Soon

The general practice among dividend paying U.S. corporations is to declare and pay dividends quarterly, or four times a year. This contrasts with how we pay our bills and expenses. The credit card, mortgage, power, and other bills show up every month.

For an investor using dividend income to pay living expenses, this mismatch makes planning difficult. Thus, the appeal of the handful of stocks that pay dividends every month.

Outside of the swamp that is closed-end funds, there are about three dozen publicly traded companies that pay monthly dividends. This time of year, you may benefit from picking up shares monthly dividend stocks that will pay dividends in time to help pay off the holiday credit card bills and even monthly budgeting going into 2020.

Common stock dividends are declared by corporate Boards of Directors. There is no assurance that future dividends will be paid until an actual declaration has been released. Boards of Directors understand that investors expect and count on steady dividend payments. Most dividend paying corporations work to sustain and grow their common stock dividend rates.

A dividend declaration includes three pieces of important information. One is the amount or dividend rate. This is a per share payment amount. The other two are the record date and payment date. Payment date is when the dividend would be credited to your brokerage account. To receive the dividend payment, you must be a “shareholder of record” on the record date.

Now that you are smarter than the average investor about ex-dividend dates, here are three monthly dividends stocks going ex-dividend in the next few days.

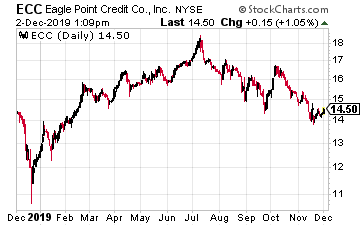

Eagle Point Credit Company, Inc. (ECC) has a primary investment objective to generate high current income by investing in equity and junior debt tranches of collateralized loan obligations (CLOs).

ECC pursues a differentiated private equity style investment approach, focused on proactively sourcing investment opportunities in CLO equities.

Management needs to be good, because CLO investing is a high-risk arena.

The company has paid a steady, $0.20 per share dividend since September 2017.

The next ex-dividend date is December 9 for payment on December 31.

Current yield is 16.8%.

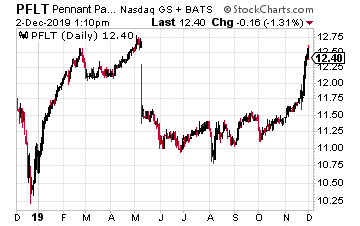

PennantPark Floating Rate Capital (PFLT) is a business development company (BDC) that provides primarily first lien debt.

PFLT invests in middle market companies located in the U.S., with proven management teams, competitive market positions, strong cash flow, growth potential, and viable exit strategies.

BDCs operate under special rules and tax laws that require them to pay out the majority of net income as dividends to investors. PFLT has paid a $0.095 per share monthly dividend since March 2015.

The next dividend will be declared this week, with ex-dividend as early as December 11. Payment will be on January 2. PFLT yields 9.2%.

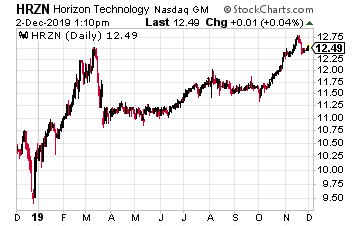

Horizon Technology Finance (HRZN) is another BDC with a focus on life sciences and technology venture capital funding. Horizon provides debt products to these types of start up companies.

Since 2004, Horizon has directly originated and invested more than $2 billion in venture loans to more than 235 growing companies.

The company has paid a $0.10 per share monthly dividend since October 2016. Next ex-dividend is on December 17, with the dividend to be paid on January 15.

The Board of Directors has also declared the February and March dividends.

HRZN currently yields 9.7%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more