PagerDuty: Digital Transformation Growth And Attractive Valuation

The digital transformation revolution is offering exponential opportunities for investors to profit in the years ahead. Unfortunately, many of the companies that capitalize on this massive growth opportunity are trading at relatively expensive valuations, and deservedly so in many cases. You can't expect to buy the best stocks in the market for bargain valuations.

But still, investors need to be especially careful with stock selection in this space because current valuation levels provide no room for error. When the stock is priced for aggressive growth expectations, the company needs to deliver in line or even exceed those expectations for the stock price to do well.

But PagerDuty (PD) could be a notable exception in this segment. The company is still relatively small, with enormous room for growth, and the stock is very reasonably priced in comparison to other names in the sector.

There is a reason why the stock trades at discount to peers, and this is that growth seems to be slowing down while competitive pressure is increasing. But the point is that these factors are already reflected in market expectations and hence incorporated in the stock price. If management executes well, PagerDuty stock has plenty of room for gains from current price levels.

High Risk And High Potential

Companies that benefit from the digital transformation revolution have been on fire lately. These companies are growing at full speed, and their stock prices have skyrocketed in many cases. Valuation should always be assessed for each specific case in particular, and the best companies in the world can still deliver outstanding returns form demanding valuation levels. Nevertheless, it is fair to say that valuation is arguably the main risk factor for investors in high-growth stocks in areas such as software in the near term.

PagerDuty is a different story. The company is facing increasing competition from Splunk (SPLK) and Atlassian (TEAM) with lower-priced products, and PagerDuty provided a fairly modest outlook in the most recent earnings conference call.

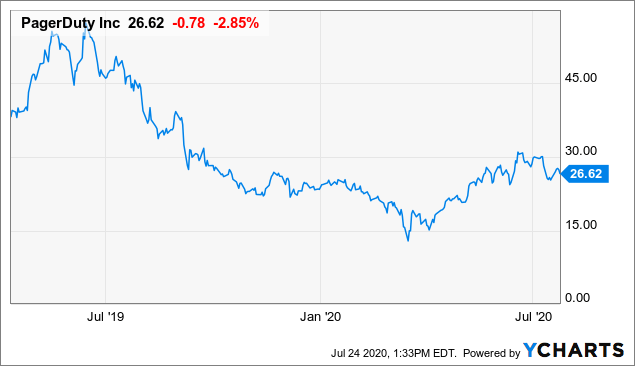

In this context, the stock price has underperformed other players in the sector, and the chart has languished in comparison to stocks benefiting from digital transformation during the pandemic.

Data by

Because of this, PagerDuty is currently trading at valuation levels that are relatively low by industry standards. The forward price to sales ratio is around 10, while many stocks in the sector are trading at valuation levels that are materially higher.

The table below shows revenue estimates, the implied sales growth, and the forward price to sales ratio for PagerDuty based on these estimates.

| Fiscal Period Ending | Revenue Estimate | YoY Growth | FWD Price/Sales |

|---|---|---|---|

| Jan 2021 | 208.21M | 25.16% | 10.46 |

| Jan 2022 | 254.08M | 22.03% | 8.57 |

| Jan 2023 | 319.20M | 25.63% | 6.82 |

Data Source: SeekingAlpha

With a revenue base below $210 for 2021, PagerDuty has enormous room for sustained growth in the next several years and even decades. If the company executes well, and this is a big if, the stock could deliver remarkably attractive returns for investors.

The Big Picture Looks Solid

PagerDuty is a market leader in cloud-based incident response services. As explained by the company in its annual report:

We act as the central nervous system for the digital enterprise. We collect machine generated data from virtually any software-enabled system or device, combine it with human response data, correlating and interpreting this data to understand issues and opportunities that need to be addressed in real-time. Using machine learning and automation, we bring together the right people with the right information so they can resolve issues and act on opportunities in minutes and seconds, not hours.

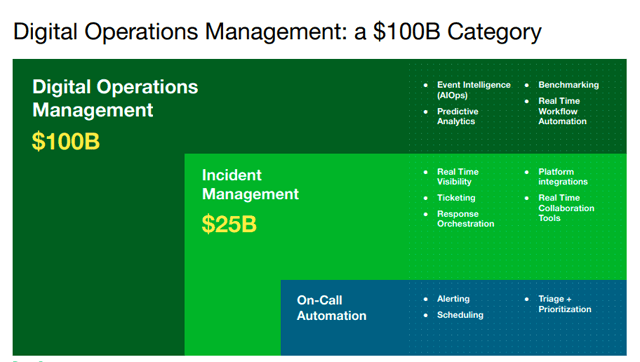

Management estimates that the total addressable market could be worth around $25 billion and growing. This is calculated on the basis of 85 million potential users multiplied by the company's average revenue per user.

These kinds of estimates should always be taken with a big grain of salt, but the point is that the company has a market penetration of less than 1% based on this estimate, and expansion into digital operations management could create enormous opportunities going forward. Growth opportunities are clearly enormous for PagerDuty at this stage.

Source: PagerDuty

The market for digital operations management is still very young and fragmented. Atlassian and Splunk have recently acquired Opsgenie and VictorOps in the segment, and they are offering these services for competitively low prices. This is arguably one of the main reasons for concern among investors in PagerDuty.

That said, PagerDuty still competes primarily against in-house solutions, manual processes, and software providers that may compete against certain components of its offerings.

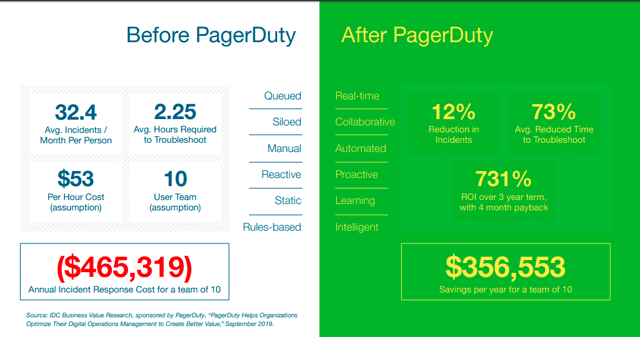

One of the main attractiveness of incident management is that the investment "pays for itself" when considering cost savings and productivity enhancements. Management claims that an investment in PagerDuty can generate massive returns on investments of over 730% by cutting costs and increasing productivity.

Source: PagerDuty

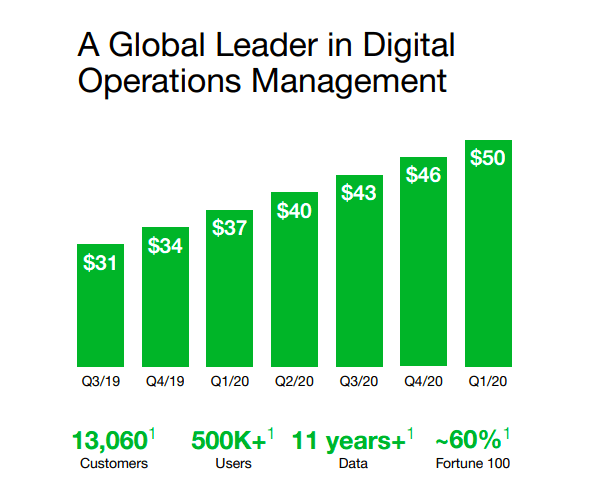

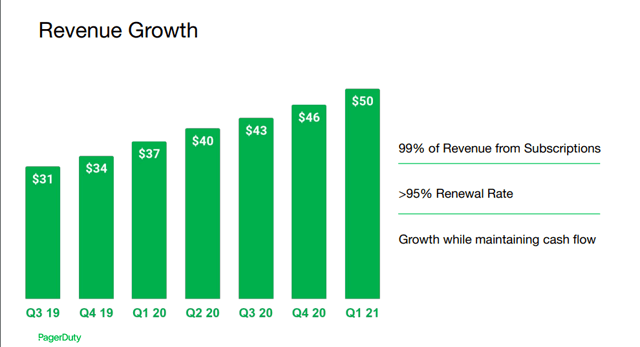

Revenue growth is decelerating lately, but the company has produced solid performance over the long term, and it counts 60% of the Fortune 100 as customers, which provides validation to the product.

Source: PagerDuty

Dollar-based retention rate currently stands at 120%, and the revenue growth rate was 33% year over year last quarter.

Source: PagerDuty

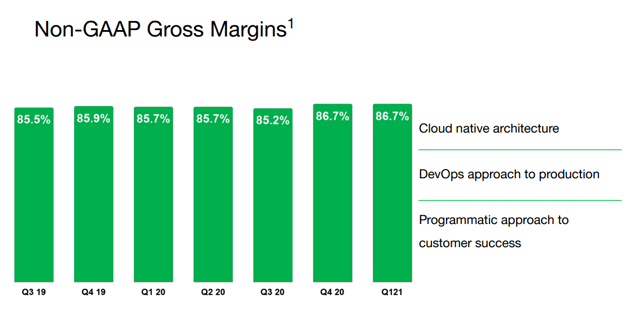

Operating cash flow is roughly break-even, and profit margins are moving in the right direction over time.

Source: PagerDuty

Management Team

When investing in these kinds of relatively small high-growth companies, the quality of the management team is of utmost importance, and it can make all the difference in the world for investors.

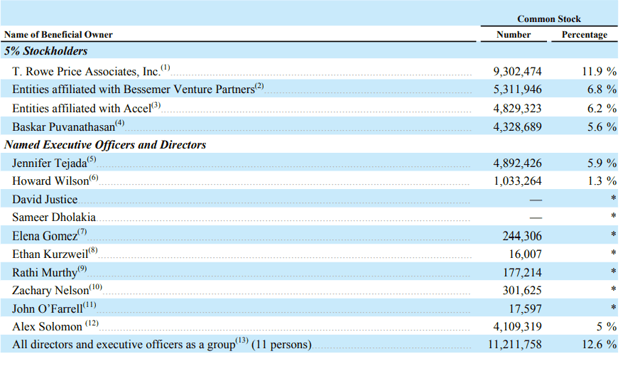

PagerDuty was founded in 2009 by Alex Solomon when he was an engineer at Amazon (Nasdaq: AMZN), and he was disappointed in the fact that the process of identifying and fixing bugs was too inefficient, so he created PagerDuty.

Mr. Salomon is now the company CTO, and the CEO position is occupied by Jennifer Tejada, who previously was CEO of Keynote Systems, a company that was acquired by Dynatrace (DT).

The company's insiders own 12.6% of the stock, so their incentives are clearly well-aligned with those of shareholders.

Source. SEC filings

PagerDuty has received several awards based on its culture and leadership, including the American Business Awards Gold Stevie Winner for Customer Service, Best Places to Work in the Bay Area, Great Place to Work certification, and Parity.org's inaugural Gateway Award for gender equality in leadership.

The company's executive leadership team is 50% composed of women, and approximately 44% of management roles are held by women. PagerDuty has a Glassdoor rating of 4.7 out of 5 and an exceptionally high 100% employee approval rating for the company's CEO.

Risk And Reward Going Forward

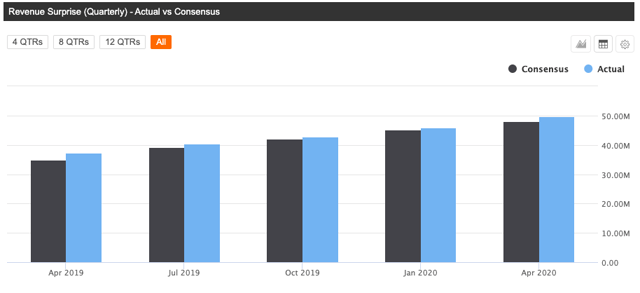

Guidance for the second quarter is for revenue of $50 million to $51 million, representing a growth rate of 24%-26% year over year. Even assuming a deceleration in growth, there is a good chance that management was too conservative with this guidance. PagerDuty has a relatively short track record as a public company, but it has delivered revenue above expectations in the past 5 quarters in a row.

Source: Seeking Alpha

In any case, it is good to know that expectations have been set at very achievable levels for PagerDuty in the near term. The returns from stock don't depend on financial performance alone, but rather on financial performance in comparison to expectations, and modest expectations are easier to beat.

It will be important to monitor financial performance in the coming quarters. If the numbers are underwhelming, this could mean serious execution problems or perhaps losing market share versus the competition. On the other hand, better-than-expected growth rates could be a powerful tailwind for the stock at current prices.

The risk is high, but so is the upside potential. With a market capitalization value of only $2.17 billion and trading at valuation levels below industry standards, PagerDuty has plenty of room for appreciation if the thesis plays out well.

Disclosure: I am/we are long PD, AMZN.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more