Owens Corning Reports First-Quarter 2015 Results

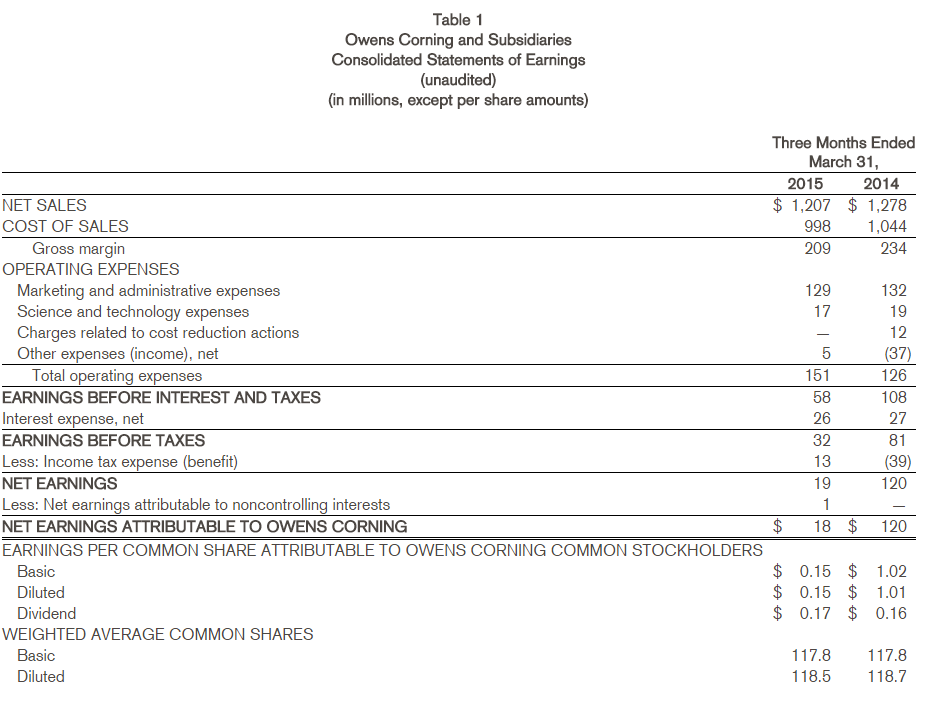

TOLEDO, Ohio--(BUSINESS WIRE)--Owens Corning (NYSE: OC) today reported consolidated net sales of $1.21 billion in the first quarter of 2015, down slightly from $1.28 billion in 2014.

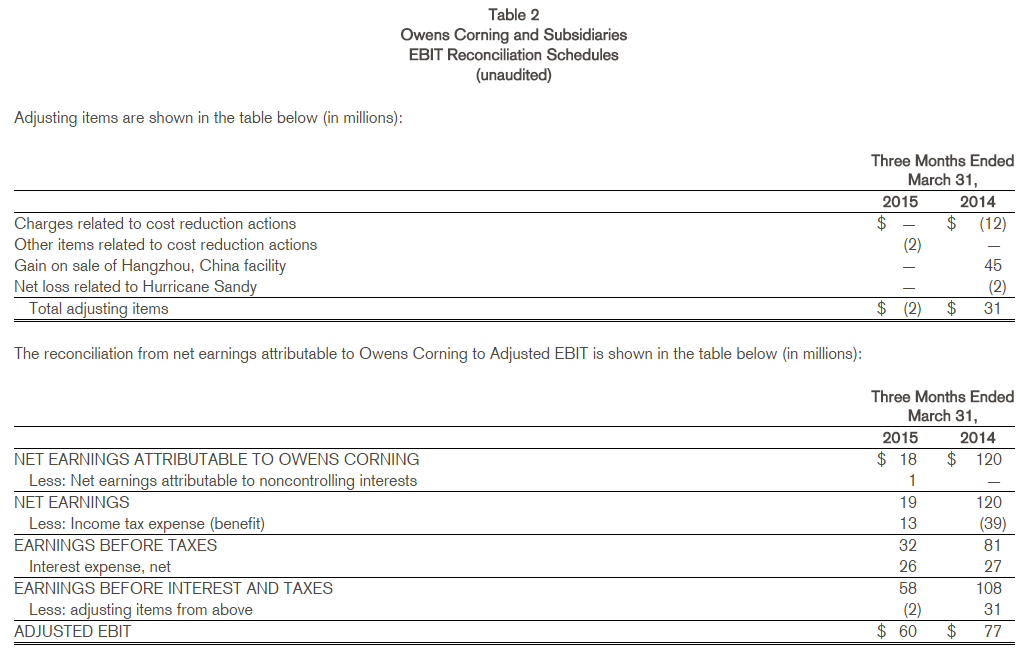

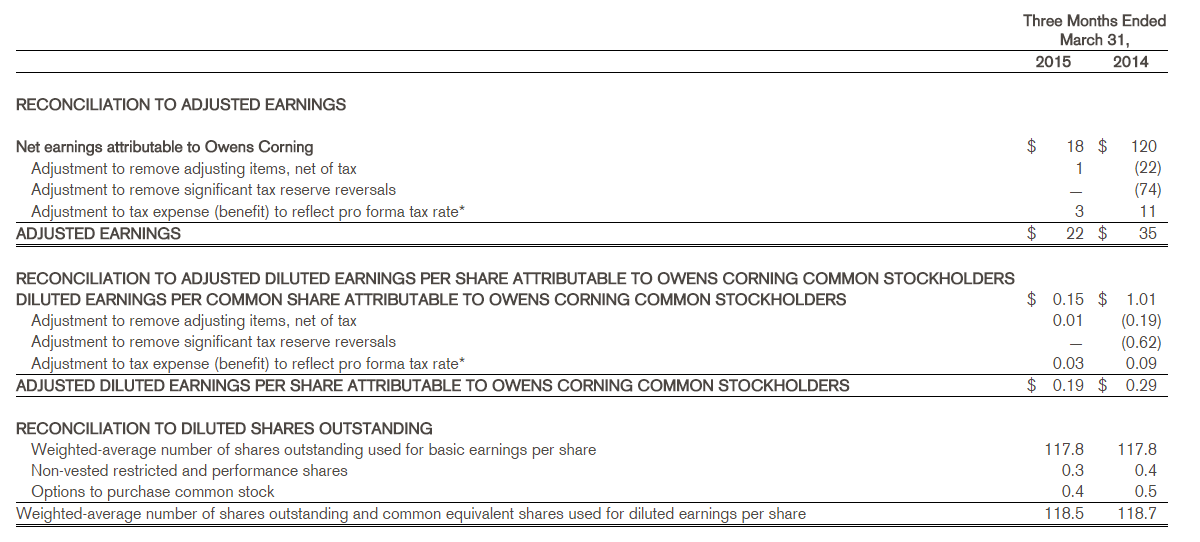

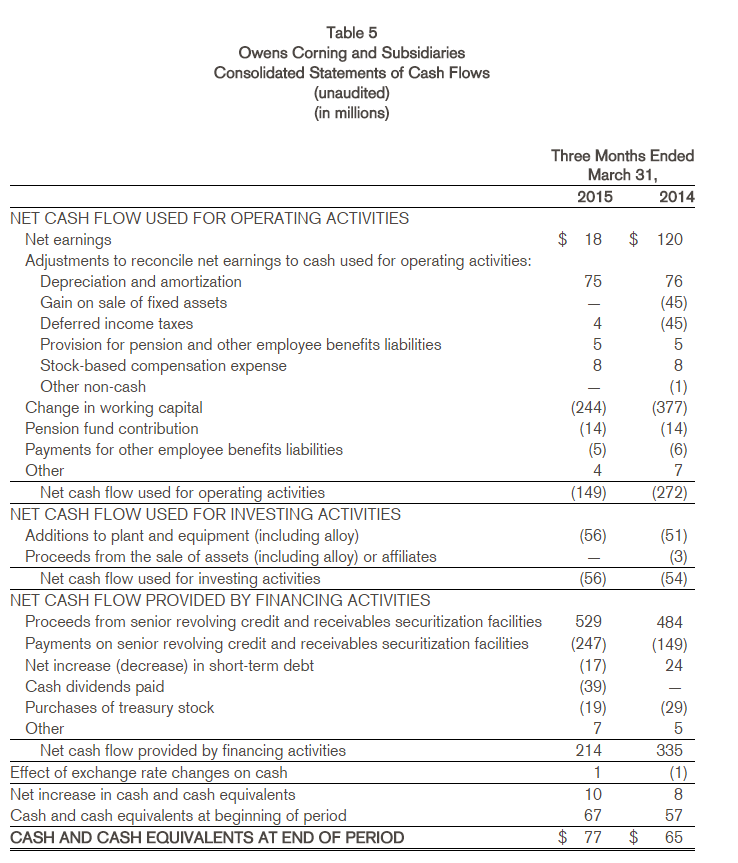

First-quarter 2015 adjusted earnings were $22 million, or $0.19 per diluted share, down from adjusted earnings of $35 million, or $0.29 per diluted share, in 2014. Net earnings in the first quarter of 2015 were $18 million, or $0.15 per diluted share, compared to net earnings of $120 million, or $1.01 per diluted share last year. (See Table 3 for a discussion and reconciliation of these items.)

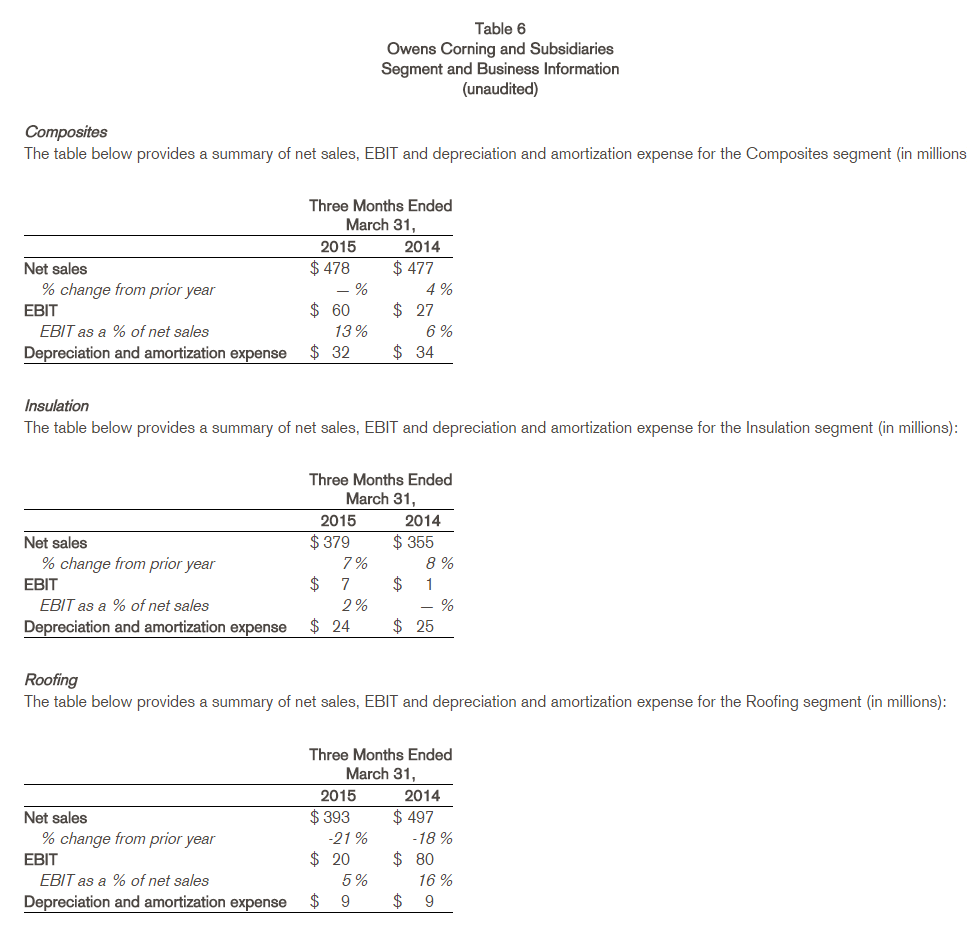

“Owens Corning had a good start to 2015. Insulation continues to benefit from growth in U.S. housing starts. Results in Composites reflect strong execution and operational performance. In Roofing, first quarter revenues and margins were weak. However, the Roofing business did not experience the discounting and inventory build in the channel that we saw in the same quarter last year, positioning the business to deliver higher volumes for the remainder of the year,” said Chairman and Chief Executive Officer Mike Thaman.

Consolidated First Quarter 2015 Results

- Owens Corning maintained a high level of safety performance with a Recordable Incident Rate (RIR) of 0.64 for the three months ending March 31, 2015, compared to an RIR rate of 0.49 in the same period a year ago.

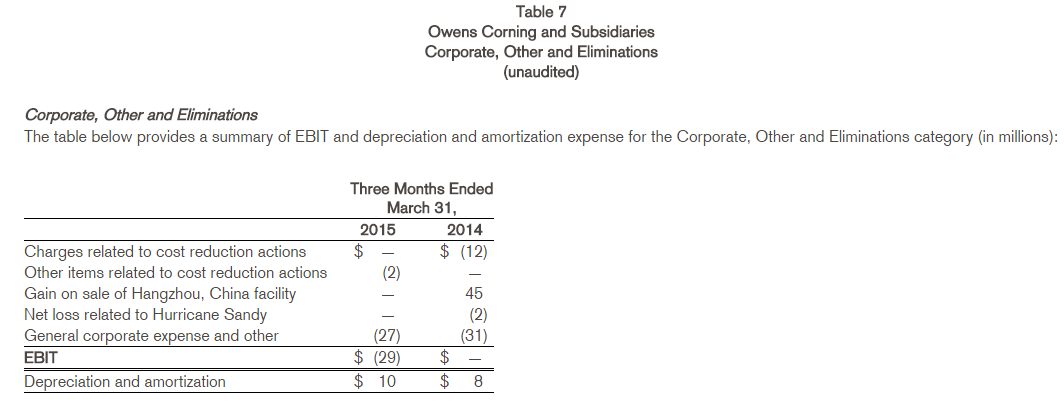

- Adjusted earnings before interest and taxes (adjusted EBIT) in the first quarter of 2015 were $60 million, down from $77 million in 2014. Reported EBIT for the first quarter was $58 million, compared with $108 million during the same period in 2014. (See Table 2.)

- To support growth in the North American mineral wool insulation business, the company’s Board of Directors has approved a $90 million investment in a new mineral wool plant, to be operational in late 2016.

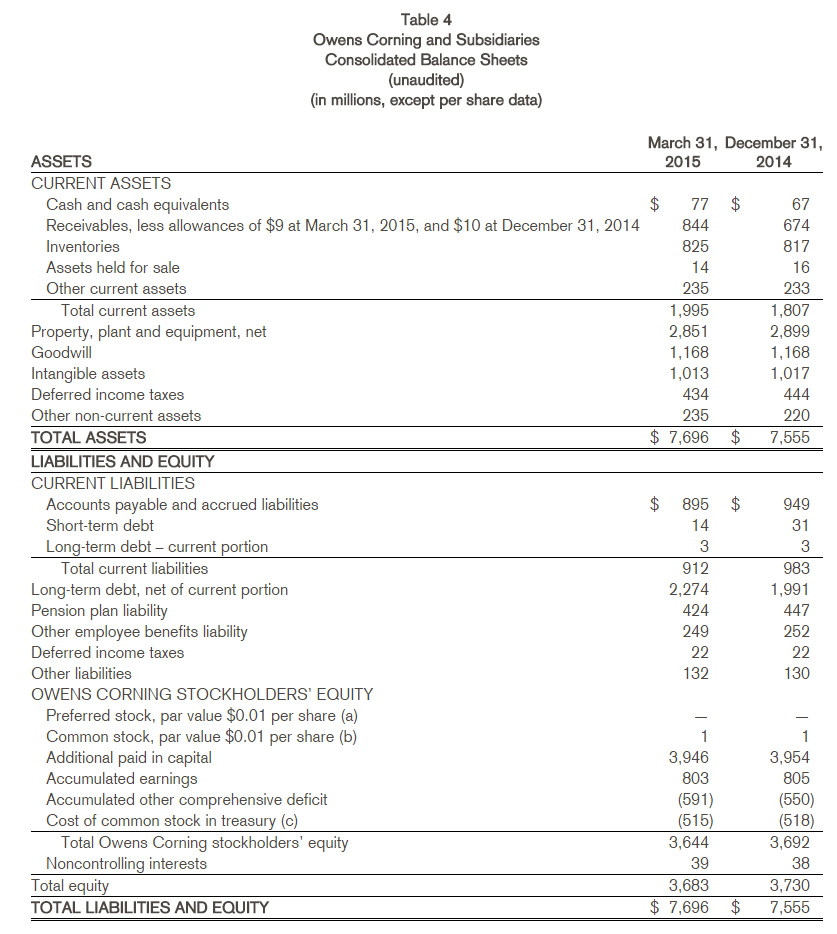

- During the first quarter, Owens Corning repurchased 0.3 million shares of the company’s common stock. As of March 31, 2015, 7.4 million shares remained available for repurchase under the company’s current authorization.

Outlook

The company continues to expect to benefit in 2015 from sustained improvement in the U.S. housing market and moderate global growth.

Insulation should continue to benefit from growth in U.S. residential new construction, improved pricing and operating leverage.

In Composites, the company previously expected EBIT improvement of $50 million less foreign currency impact of $20 million associated with a stronger U.S. dollar. Based on a strong start to the year, the company now anticipates a full-year EBIT improvement of up to $70 million less foreign exchange impact of $25 million at current exchange rates.

In Roofing, the company continues to expect the full year market demand to be in line with last year. Market dynamics in the first quarter positioned the business for stronger volumes at better margins for the remainder of the year.

The company estimates an effective tax rate of 30 percent to 32 percent, and a cash tax rate of 10 percent to 12 percent on adjusted pre-tax earnings, due to the company’s $2.2 billion U.S. tax net operating loss carryforward.

The company expects general corporate expenses to be $120 million to $130 million in 2015. Capital expenditures in 2015 are now expected to total approximately $380 million, a $25 million increase over the prior estimate due to a portion of the cost for the construction of the new mineral wool plant. Interest expenses are expected to be about $110 million.

Next Earnings Announcement

Second-quarter 2015 results will be announced on Wednesday, July 22, 2015.

About Owens Corning

Owens Corning (NYSE: OC) develops, manufactures and markets insulation, roofing and fiberglass composites. Global in scope and human in scale, the company’s market-leading businesses use their deep expertise in materials, manufacturing and building science to develop products and systems that save energy and improve comfort in commercial and residential buildings. Through its glass reinforcements business, the company makes thousands of products lighter, stronger and more durable. Ultimately, Owens Corning people and products make the world a better place. Based in Toledo, Ohio, Owens Corning posted 2014 sales of $5.3 billion and employs about 15,000 people in 26 countries. It has been a Fortune 500® company for 60 consecutive years. For more information, please visit www.owenscorning.com.

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are subject to risks, uncertainties and other factors that may cause actual results to differ materially from those projected in these statements. Such factors include, without limitation: economic and political conditions, including levels of residential and commercial construction activity; competitive and pricing factors; levels of global industrial production; demand for our products; relationships with key customers; industry and economic conditions that affect the market and operating conditions of our customers, suppliers or lenders; foreign exchange and commodity price fluctuations; our level of indebtedness; weather conditions; availability and cost of credit; availability and cost of energy and raw materials; issues involving implementation of new business systems; international economic and political conditions including new legislation or other governmental actions; our ability to use our net operating loss carry forwards; research and development activities and intellectual property protection; interest rate movements; labor disputes and litigation; uninsured losses; issues related to acquisitions, divestitures and joint ventures; achievement of expected synergies, cost reductions and/or productivity improvements; defined benefit plan funding obligations; and, factors detailed from time to time in the company’s Securities and Exchange Commission filings. The information in this news release speaks as of April 22, 2015, and is subject to change. The company does not undertake any duty to update or revise forward-looking statements except as required by federal securities laws. Any distribution of this news release after that date is not intended and should not be construed as updating or confirming such information.

Owens Corning Investor Relations News

For purposes of internal review of Owens Corning’s year-over-year operational performance, management excludes from net earnings attributable to Owens Corning certain items it believes are not the result of current operations. The adjusted financial measure resulting from these adjustments is used internally by Owens Corning for various purposes, including reporting results of operations to the Board of Directors, analysis of performance, and related employee compensation measures. Although management believes that these adjustments result in a measure that provides it a useful representation of its operational performance, the adjusted measure should not be considered in isolation or as a substitute for net earnings attributable to Owens Corning as prepared in accordance with accounting principles generally accepted in the United States.

Table 3

Owens Corning and Subsidiaries

EPS Reconciliation Schedules

(unaudited)

(in millions, except per share data)

For purposes of internal review of Owens Corning’s year-over-year operational performance, management excludes from net earnings attributable to Owens Corning certain items it believes are not the result of current operations. The adjusted financial measures resulting from these adjustments are used internally by Owens Corning for various purposes, including reporting results of operations to the Board of Directors, analysis of performance and related employee compensation measures. Although management believes that these adjustments result in measures that provide it a useful representation of its operational performance, the adjusted measures should not be considered in isolation or as a substitute for net earnings attributable to Owens Corning as prepared in accordance with accounting principles generally accepted in the United States.

A reconciliation from net earnings attributable to Owens Corning to Adjusted Earnings and a reconciliation from diluted earnings per share to adjusted diluted earnings per share are shown in the tables below:

*For 2015 we have used a pro forma effective tax rate of 31%. For comparability, in 2014, we have used an effective tax rate of 30% that excludes the resolution of a significant uncertain tax position and the reversal of a valuation allowance recorded in prior years against certain European net deferred tax assets.

(a)10 shares authorized; none issued or outstanding at March 31, 2015, and December 31, 2014

(b)400 shares authorized; 135.5 issued and 118.0 outstanding at March 31, 2015; 135.5 issued and 117.8 outstanding at December 31, 2014

(c)17.5 shares at March 31, 2015, and 17.7 shares at December 31, 2014

Disclosure: None