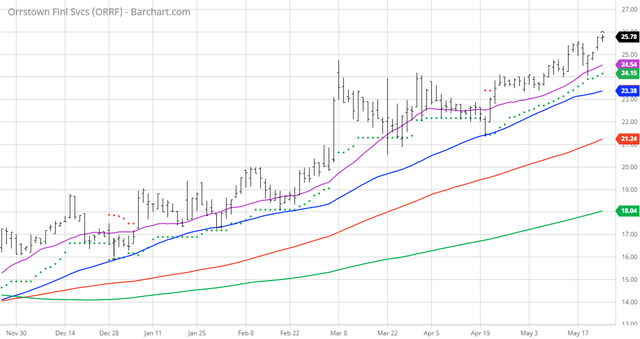

Orrstown Financial Services - Chart Of The Day

The Chart of the Day belongs to the northeastern bank holding company Orrstown Financial Services. (ORRF) I found the stock by using Barchart's screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 4/22 the stock gained 9.70%.

Orrstown Financial Services, Inc. operates as the holding company for Orrstown Bank that provides commercial banking and trust services in the United States. The company accepts various deposits, including checking, savings, time, demand, and money market deposits. It also offers commercial loans, such as commercial real estate, equipment, working capital, construction, and other commercial purpose loans, as well as industrial loans; consumer loans comprising home equity and other consumer loans, as well as home equity lines of credit; residential mortgage loans; agribusiness loans; acquisition and development loans; municipal loans; and installment and other loans. In addition, the company provides renders services as trustee, executor, administrator, guardian, managing agent, custodian, and investment advisor, as well as provides other fiduciary services under the Orrstown Financial Advisors name; and offers retail brokerage services through a third-party broker/dealer arrangement. Further, it offers investment advisory, insurance, and brokerage services. The company operates through offices in Berks, Cumberland, Dauphin, Franklin, Lancaster, Perry, and York counties, Pennsylvania; and Anne Arundel, Baltimore, Howard, and Washington counties, Maryland, as well as Baltimore City, Maryland. Orrstown Financial Services, Inc. was founded in 1919 and is headquartered in Shippensburg, Pennsylvania.

Barchart technical indicators:

- 100% technical buy signals

- 104.83+ Weighted Alpha

- 109.99% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 8.84% in the last month

- Relative Strength Index 68.09%

- Technical support level at 28.38

- Recently traded at 25.82 with a 50 day moving average of 23.38

Fundamental factors:

- Market Cap $290 million

- P/E 8.41

- Dividend yield 2.79%

- Revenue expected to grow .70% this year and another 1.70% next year

- Earnings estimated to increase 23.70% this year

- Wall Street analysts issued 1 strong buy, 2 buy and 1 hold recommendation on the stock.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ORRF over the next 72 hours.

Disclosure: The Barchart Chart of the Day highlights stocks ...

more