Organigram Reports Impressive Q1 Financials - Stock Responds

Organigram Holdings Inc. (NASDAQ: OGI; TSX: OGI) results for the first quarter ended November 30, 2019, showed impressive improvement in almost all of its numbers from the previous quarter, as follows:

Key Commentary on Q1 2020 Results vs Q4 2019 (All currency figures are in Canadian dollars. Go here to convert into USD and are in comparison to the previous quarter.)

- Net revenue: increased by 54.6%

- comprised of about 66% of sales to the adult-use recreational and medical markets

- and about 34% to the wholesale and international markets

- Cash: decreased by 7.6%

- “All-in” costs of cultivation: decreased by 7.0% as yield per plant increased from 148 grams in Q4 2019 to 152 grams in Q1 2020.

- Cost of sales: remained relatively unchanged.

- Gross margin before fair value changes to biological assets and inventory: increased to 37% of net revenue

- Gross margin: increased to a positive $11.2M from a loss of $11.1M

- Adjusted EBITDA: increased to a positive $4.9M compared to loss of $7.8M

- SG&A: decreased 32%

- SG&A as a percentage of net revenue: decreased to 37% from 85%.

Liquidity and Capital

- had $34.1 million in cash and short-term investments at quarter-end.

- generated positive adjusted EBITDA of $4.9 million in Q1 2020.

- reported approximately $84.5 million in current and long-term debt as at quarter-end of which $30.0 million is still available.

- has a revolver of up to $25 million available to be drawn against specified receivables.

- On November 15, 2019, the Company amended its credit facility with BMO to:

- i) extend the final draw deadline of the term loan from November 30, 2019 to March 31, 2020;

- ii) postpone the commencement of principal repayments on the term loan to May 31, 2020; and

- iii) realign the financial covenants structure, effective November 30, 2019, to be more consistent with industry norms up to and including May 31, 2020, which will also provide the Company with greater flexibility around the timing and quantum of incremental draws which will

- iv) revert to the original structure on August 31, 2020.

- Included in the facility is an uncommitted option to increase the term loan and/or revolving debt by an incremental $35 million to a total of $175 million, subject to agreement by BMO and the syndicate of lenders and satisfaction of certain legal and business conditions.

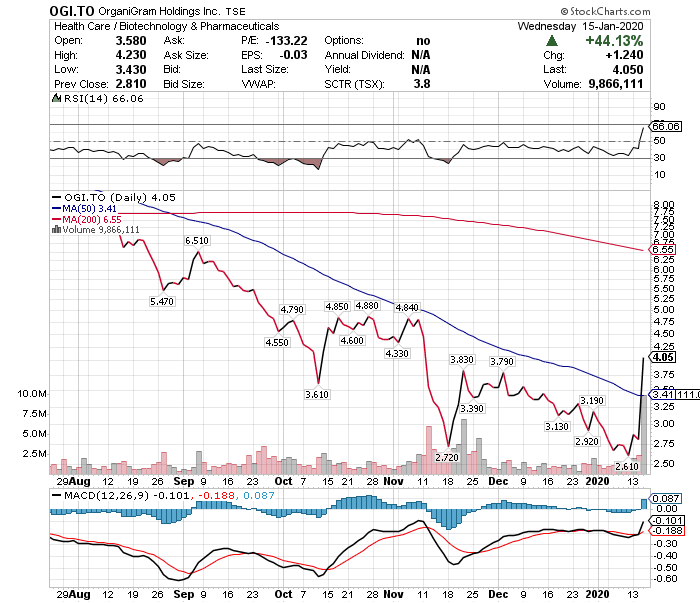

The market has been waiting for some time for the company to improve its operations and bottom line which would be reflected in its stock price so perhaps the Q1 report is just what was needed. Nevertheless, the stock price has a long way to go to get back to the highs it enjoyed in mid-March of 2019. Below is a graph of how poorly the stock performed in 2019:

(Click on image to enlarge)

This article discusses small-, micro and nano-cap stocks so do your own careful due diligence. Visit munKNEE.com (A ...

more