Organigram Q4 Financials Show Reduced Net Loss And Improved Adjusted EBITDA

TM Editors Note: This article discusses one or more penny stocks and/or microcaps. Such stocks are readily manipulated; do your own careful due diligence.

Organigram Holdings Inc. (OGI), a constituent in the munKNEE Pure-Play Pot Stock Index, is a seed-to-sale Canadian licensed producer. It announced its Q4, 2020 financial and operating results on Monday for the period ended August 31, 2020, as follows:

Q3 Financial Highlights

(All results are presented in Canadian dollars and compared to the previous quarter.)

- Revenue: increased 13% to $20.4M

- Gross Margin: improved 43% to $(28.8)M

- Adj. Gross Margin ($): $6.2M

- Adj. Gross Margin (%): 30%

- SG&A: increased 4.9% to $10.8M

- Net Loss: reduced 60% to $(35.6)M

- Adj. EBITDA: improved to $(2.7)M from $(24.7)M

- Cash/Equiv.: increased 67% to $74.7M

Q4 Operational Highlights

- In early July 2020, the Company announced it had reduced its workforce by 25% in an order to better align its production capacity to prevailing market conditions.

- The Company has revitalized its product portfolio with the launch of 40 new SKUs since July 2020 including:

- 3 new strains of high THC dried flowers,

- additional offering of value segment dried flowers,

- a line of value-priced, cannabis-infused chocolate bars,

- a line of value-segment vape offerings to complement its offering of products for the mainstream and the premium segment which will be completed by the end of Q1 2021.

- According to:

- research by the Brightfield Group the recreational cannabis beverage market in Canada is estimated to represent a $467M category opportunity and it is expected to increase by 15x its current market size over the next five years

- recent sales data in Colorado, cannabinoid-infused powders have rapidly risen to the top of the beverage category in popularity, representing 55% of the state’s beverage market sales. and

- a recent Organigram survey, 74% of current cannabis consumers would prefer to add cannabinoids to their beverages by themselves (vs. a pre-mixed beverage).

- To meet the apparent market demand, market potential and to fulfil the stated consumer preference Organigram:

- developed a proprietary nano-emulsification technology that generates extremely small droplets which provide improved absorption compared to traditional edibles and beverages and then

- launched an offering of Edison RE:MIX dissolvable cannabis powders subsequent to Q4.

- During Q4 the winding down of the final stage of the originally planned cultivation expansion (due to excess cultivation capacity versus the current demand in Canada) was completed although the company may potentially use the space for other opportunities if and when strategic and/or market factors dictate.

- The refurbishing of Organigram's facility was substantially completed in Q4 but the Company is continuing to work on the installation and commissioning of certain equipment in its edibles and extraction area including its hydrocarbon extraction equipment.

Outlook

The company:

- believes its 25% reduction in its workforce resulted in some meaningful missed revenue opportunities in Q4 Fiscal 2020 (and which will continue into Q1 Fiscal 2021).

- With substantial retail store growth in play, the Company is evaluating its processes and supply chain, including the benefit of gradually scaling up staffing, to help ensure improved order fulfillment rates and in turn, potentially realize greater sales opportunities.

- Further, as many of the Company’s product launches are recent and some are still to come, the Company believes it will still take time for the new products to reach their full potential and gain market share to drive meaningful sales growth.

- intends to cultivate at less than its full cultivation capacity for the foreseeable future partly to help increase THC potency in its plant, which is anticipated to result in a negative non-cash adjustment to cost of sales for unabsorbed fixed overhead costs.

- plans to continue to expand on Rec 2.0, which it believes will increasingly become a larger relative category in line with mature U.S. legal markets.

- expects some production inefficiencies to persist in the near term and impact gross margin while it continues to launch new Rec 2.0 products and optimize production.

- has identified a pathway for demonstrating compliance with the just amended quality standards for imported medical cannabis into Israel and has initiated a process which, if completed successfully, will allow it to continue to supply product into the Israeli market.

- continues to:

- monitor the potential move to U.S. federal legalization of cannabis (THC) and develop a potential U.S. THC strategy and continues to

- evaluate CBD entry opportunities in the United States.

Management Commentary

Greg Engel, CEO said:

- “...We continue to reinvigorate and diversify our product portfolio with new offerings aimed at delivering the attributes that matter most to consumers.

- Overall, we are very encouraged by the initial responses to our new products and the increased awareness and traction they are receiving against a backdrop of national retail store growth and a growing legal market that continues to displace the illicit market.

- Our team is more focused than ever on enhancing our agility and execution to capture top-line growth and we believe we have the capital resources and liquidity to support us.

- We have always operated with financial discipline to pursue profitable growth which is again reflected in positive adjusted EBITDA in full-year fiscal 2020 for the second year in a row.”

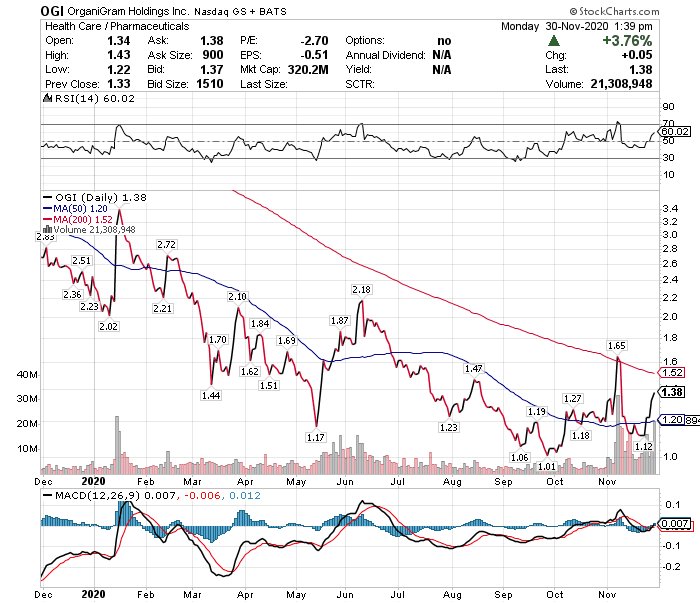

Stock Performance

Organigram is one of only 9 companies in the 25 constituent munKNEE Pure-Play Pot Stock Index that have not appreciated in price so far in 2020. Its stock price is DOWN 45.7% YTD albeit UP 26.7% in the last two months and UP 10.8% in the last month as illustrated in the chart below:

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more