Oracle's House Of Cards In The Cloud: Dissecting Q3 2017 Results

Contributing Authors: Fred McClimans, John Freeman, Zach Mitchell

Why we are interested/what happened?

On 15 March 2017, Oracle (NYSE: ORCL) announced 3Q FY17 results. It posted EPS of $0.69, beating consensus by $0.07, and revenues of $9.2b (+2.1% y/y), missing by $60m.

Oracle's strong cloud performance was highlighted on the earnings call by co-CEO Mark Hurd, as he cited 280% y/y growth in ERP and 106% y/y growth in Fusion HCM. Cloud segments DBaaS (Database as a Service), PaaS, and Cloud Services grew 427% y/y, 375% y/y, and 300% y/y, respectively.

Total cloud revenues, including SaaS (software as a service), PaaS (platform as a service), and IaaS (infrastructure as a service), were up by $454m y/y (+62%) to $1.2b for the quarter.

ORCL also announced a dividend increase to $0.19/quarter, up from $0.15. The stock closed up +6.23% on Thursday.

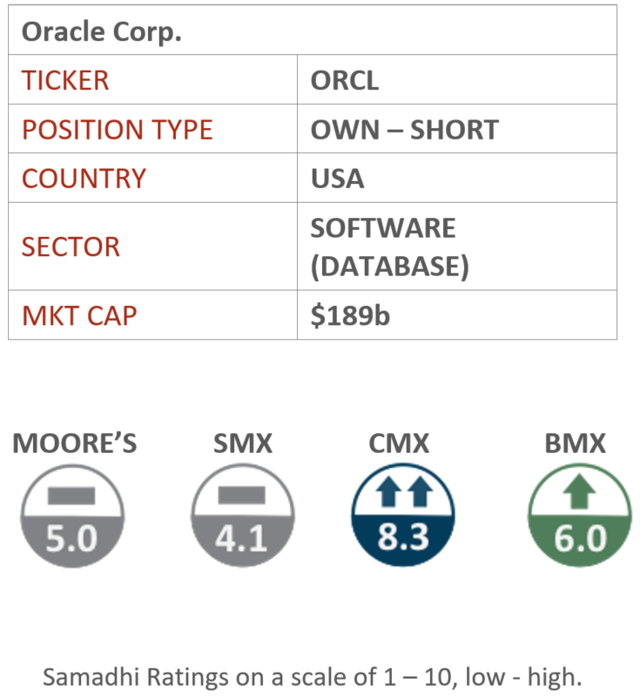

*An explanation of the Samadhi Index Ratings can be found here.

What we expect/what is the potential risk/gain?

ORCL's performance did little to change our short investment thesis. NetSuite, which ORCL officially acquired at the end of last quarter, reported $243.9m in revenues (+26.5% y/y) during its last public quarterly filing for the period ending 30 September 2016. About 90% of NetSuite's revenue is categorized as SaaS/cloud. Assuming hyperconservatively that NetSuite realized just 20% y/y revenue growth during ORCL's most recent quarter, it would have contributed $263.4m of the $454m (58%) cloud revenue increase ORCL touted.

We don't believe there's anything inherently wrong with acquiring growth, we are just cautioning that investors should be cognizant of where that growth came from. Further, cloud revenue gains were almost entirely offset anyhow by on-premise revenue, which declined 2.7% and accounted for 67.5% of ORCL's top line. We are not drinking the Kool-Aid.

As we have mentioned previously (and highlighted in the Death of the Commercial Database), we believe ORCL's core SQL database offerings are squarely on the wrong side of Moore's Law, and we anticipate revenue contraction for this product to occur over the next several years as enterprises continue to wean themselves off of ORCL's legacy products. We believe ORCL's shift to the cloud is too little and too late, highlighted by its hasty acquisition of NetSuite this past July that offsets revenue decline but does not offer an inflection point for new revenue growth.

As it relates to the quarterly numbers themselves, we believe the earnings beat loses much of its luster when coupled with a top-line miss due to the "maneuverability" inherent to the former. We would like to further highlight that ORCL settled in court last month with an ex-finance manager who blew the whistle after refusing to artificially inflate cloud sales numbers.

We interpret ORCL's dividend increase as a smart, but transparent, attempt to appease shareholders, a strategy that we do not believe management can sustain over time.

Our Recommendations

Despite ORCL's continual self-championing of its cloud performance, the company's 3Q results do not materially alter our long-term fundamental short thesis. With that said, we believe ORCL is more than capable of engendering optimism over its cloud growth prospects, given that its cloud business is still in its early stages and is, on paper, growing quickly. It's worth noting that ORCL is trying to maintain as many database licenses as possible, and has doubled-down on its strategy of porting licenses 1:1 for users shifting from enterprise to cloud implementations.

We entered an asymmetric straddle position (long calls and puts) on ORCL in January that was short-biased. However, our calls had much shorter expiries and jumped meaningfully on 3Q 2017 results. This morning, we exited the entire long portion of our straddle, and we reiterate our long-term short conviction. Samadhi Partners Subscribers may refer to our Portfolio and Position Updates section for more information on our investment actions.

Please subscribe to our email alerts for additional insights, at SamadhiPartners.com

Disclosure: I ...

more