Opportunities In A Volatile Market: Virtu Financial And High-Frequency Trading

It is no secret that 2018 was not the friendliest year for global markets. In fact, it was the worst year for the S&P 500 since the financial crisis over a decade ago. The index fell over 6%, as sectors from technology to financials were devastated by consistent bad news, ranging from rising interest rates to a U.S government shutdown. Fund managers, such as BlackRock and Vanguard, who championed passive investment products and who benefited strongly from the placid market environment of the previous few years, saw themselves crushed by the return of volatility (these types of fund managers saw their stocks fall 29% on average in 2018). Institutional investors also got singed as asset classes like commodities and bonds sold off sharply along with equities, leaving no safe haven to protect portfolios. Even hedge funds, long thought to be the smart money on Wall Street, were unable to navigate the new market conditions. However, while most players in the market desperately tried to fend off the storm of volatility, a certain industry saw it as a breath of fresh air. That industry is composed of the proprietary and high-frequency trading firms.

Generally when people think of proprietary and high-frequency trading the first images that come to mind are of professional day traders and ultrafast computers trading ahead of retail investors in public markets. To some extent that is true, however, these types of firms provide a valuable service in that they improve the efficiency and liquidity of those same public markets. They do this through their main business of market making. This business has been in existence almost since the beginning of the stock market and through advances in technology has been rapidly sped up and automated. Increasingly most of the market making is being done by controversial high-frequency trading firms. The question is why does this matter? The reason is because these firms were some of the only market players who saw the blow up in volatility last year as a good thing and saw a sharp improvement in their earnings. This presents an opportunity. To understand it though, one needs to understand how market makers and high-frequency trading firms make money.

In order for a financial market to function there needs to be liquidity, buyers must always be able to find seller and sellers buyers. When there are limited counter-parties to trade with, the market becomes illiquid and therefore difficult to maintain. In order to make sure that does not happen, exchanges often ask different banks and brokerages to continuously provide a bid ask spread to the market. With the “bid” being the price these firms will be willing to buy at and the “ask” price being the price they are willing to sell at. Essentially, these firms “make” a market in particular security and make sure there is always a willing buyer and seller available in the market. The spread between the “bid” and “ask” price that the market maker offers is called the market maker spread. This represents the profit a market maker makes from every trade in the security. This spread is usually only a few cents but due to the heavy volume of trading this few cents adds up. The less liquid or more volatile a security, the larger the market maker spread, the larger the spread the more money the market maker makes per trade.

Over the last 10 years high-frequency trading firms have increasingly taken over the business of market making. Their superior technology and speed have made the business much more efficient and have squeezed many other types of proprietary trading firms out of the market. High-frequency trading has been under scrutiny, especially after Michael Lewis published a damning review of the industry in his best-selling book “Flash Boys”. Most criticism of high-frequency trading revolves around the strategy of “order flow prediction”, where these firms try to predict the market orders of large institutional players and take positions ahead of them. Although that is a controversial trading strategy it is not the main strategy of high-frequency firms. Most of these firms have strategies that revolve around market making and increasingly execution strategies, which is where these firms act as brokerages and execute large orders for institutional players. In any case, market making and high-frequency trading require high trading volumes and volatility to generate strong profits. The lack of both leading up to 2018, translated into a sharp downturn for this line of business. It now appears as though market conditions are changing, which means the high-frequency trading industry could see a strong turnaround.

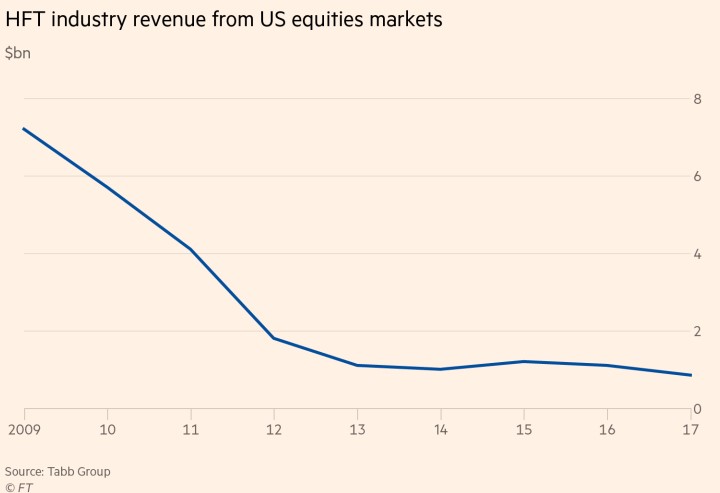

Chart showing High-Frequency Trading Revenue from 2009-2017. Industry revenues have fallen along with volumes and volatility.

High-frequency trading firms have been some of the biggest losers during the tranquil market period of the last few years. In 2009 industry revenue, according to consultancy Tabb Group, was $7.2 billion, in 2017 total revenue for the industry fell below $1 billion. This corresponded to a steady fall in trading volumes in the U.S. According to the Wall Street Journal Market Data Group, 8.31 billion shares a day were traded in 2010, by 2017 that number had fallen to 6.43 billion. Similarly, market volatility as is measured by the CBOE volatility index (VIX) continued to average lower and lower levels. According to Harvest Volatility Management, the VIX had an average level of 16.68 in 2015. It averaged 15.85 and 11.1 in 2016 and 2017 respectively. For reference, the average level of the VIX since 1995 is estimated to be between 18-21. In fact, 2017 showed the calmest market conditions in decades. The absolute daily percentage change for the DOW in 2017 was 0.31% while for the S&P 500 it was 0.30%, those were the smallest daily percentage changes since 1964. At the same time monthly market volatility was lower than any point since 1970. This caused a significant headache for short term traders like high-frequency firms, which suffered from fewer opportunities to trade due to falling volumes. As well as shrinking profits per trade due to low volatility. These factors coupled with increasing data costs and competition put the industry under pressure.

However, with all that being said, historical trends show that it is very likely that the market environment of the last several years was an anomaly. In 2018 volatility returned with a vengeance. The VIX soared 157% last year, as fears grew about slowing global economic growth, an ongoing trade war, and rising interest rates. Intra-day swings for the S&P 500 averaged 1.2% in 2018 and the higher volatility increased trading volumes by 11% to 7.2 billion shares daily. This change in conditions gave life to the suffering high-frequency trading industry and as expectations of an upcoming recession intensify along with political headwinds it appears as though the volatile conditions are here to stay.

Chart of CBOE VIX index from 1990-2018. Volatility has been steadily falling since the Great Recession but has soared recently. Long term average level for the index is 21.

Most companies in the high-frequency trading space are private, making it nearly impossible to get a detailed glimpse into the finances of the industry or benefit from its good fortune. Thankfully, one of the largest players in the space is public and gives investors a good opportunity to benefit from the high-frequency trading comeback. That company is Virtu Financial (VIRT).

Virtu Financial is a high-frequency trading firm with a current market cap of $4.9 billion that trades in over 25,000 different securities at over 235 venues in 36 countries. As the only public high-frequency trading firm (whose IPO was nearly derailed by the publication of Michael Lewis’s book “Flash Boys”), the company has become a poster child for the industry. Indeed the company offers investors a rare glimpse into the fortunes of this once secretive sect of the financial services sector. Unsurprisingly, those fortunes have not been great in the pre-2018 market environment. From its IPO in July 2015 to the beginning of 2018 Virtu stock fell 21% while the broader market rallied nearly 30%. Over that period of time adjusted EBITDA fell from $352.4 million in 2015 to $251.4 million in 2017. Net income, meanwhile, fell from $272.8 million to $92.1 million. This is against a 25% rise in revenue, about $800 million in 2015 to just over $1 billion in 2017. Even this was not a result of actual business growth but rather an effect of Virtu’s merger with, fellow hhigh-frequencytrading pioneer, KCG Holdings.

Overall those are hardly impressive statistics, but the turnaround in Virtu’s results as volatility returned to the market, show how the company could provide a hedge against rising volatility. In the first 3 quarters of 2018, Virtu showed $1.44 billion in revenue compared to about $563 million in 2017. Based on Virtu Financials preliminary 4thquarter 2018 results, total adjusted EBITDA for 2018 was just over $600 million, compared to $251.4 million in 2017, an increase of about 130%. Total adjusted net-income in 2017 was $92.1 million while in 2018 it is estimated to end up being $346.6 million. As a result ,Virtu stock soared 47% in 2018, what a difference a change in volatility makes.

However, despite this surge in stock price, Virtu financial is still valued at a similar multiple that it has been in previous years. Presently with a market cap of $4.9 billion, the stock is priced at about 8x its trailing twelve month (TTM) adjusted EBITDA and 14x TTM normalized adjusted net income. In January 2018, Virtu had a market cap of $3.5 billion, meaning the stock was valued at about 14x TTM adjusted EBITDA and 38x TTM adjusted net income. At the same point in 2017, the stock was valued at 8.32x and 16.4x respectively. In 2016 those numbers were at 8.5x and 11x. In other words despite the surge in the stock price, based on earnings the stock is still valued fairly.

An added bonus to Virtu Financial is that the company continues to expand into the lucrative brokerage business through its recent purchase of Investment Technology Group (ITG) for $1 billion. Although the deal still needs the approval of the regulators, if it closes, it will diversify Virtu’s business and deepen its move to trade for institutional clients. Virtu also stands to benefit from the wave of consolidation that has hit the high-frequency trading industry. The poor trading conditions of the previous years, as well as rising costs, have forced many mid-sized players to sell out to stronger competitors. It is now expected that the industry will be dominated by a few large firms, which have the advantage of trading larger volumes and a multitude of different strategies. Virtu Financial is set to be one of those firms. However, the main opportunity in Virtu is the company’s success in capitalizing on periods of volatility.

(Click on image to enlarge)

Chart overlay of Virtu Financial stock and VIX from January 2017 to January 11, 2019. Virtu stock tends to be positively correlated to volatility.

As the chart above shows, Virtu stock seems to be positively correlated to the VIX. This makes sense given the company’s reliance on volatility to generate strong earnings. As such Virtu stock allows investors to bet on increased long-term volatility without being forced to endure the violent daily moves of the actual VIX. As to where volatility is going, historical data as well as macroeconomic trends seem to point to continued market choppiness.

From a historical basis, the market calm that existed prior to 2018 appears to be a rare occurrence. The average long-term daily change in the S&P 500 is estimated to be around 0.66% twice as much as the daily move in 2017. Although that level is lower than the daily swing in 2018, it seems to indicate a return to the extreme calm markets for a sustained period of time is unlikely. Meanwhile, the VIX averaged between 16-17 in 2018, below the estimated average of 18 to 21. That means even though volatility seemed to “blow up” in 2018, on an annual basis it still remains below its average.

When looking at macro-economic trends, it also seems that heightened volatility is here to stay. A survey of economists, conducted by Bloomberg, showed that fears of a recession occurring within the next 12 months is at 6 year high. Nearly 25% of participants see an economic slump occurring within that time period. In December a similar Bloomberg survey put the percentage at 20%, clearly, the market slump in December changed some minds. Median projections for 2019 U.S economic growth have edged down to 2.5% from a previous 2.9%. The continued U.S government shut down, which President Trump has threatened to continue for years, also adds to uncertainty. Besides the fact that it is a drag on economic growth, it also delays the release of government data such as retail sales, which investors and analysts use to make decisions.

A short-term recent rally in stocks aside, the medium and long term pictures for the U.S economy and the market appears to be cloudy. This likely means that volatility will remain heightened, which will result in strong earnings at Virtu Financial and other high-frequency trading firms. This provides investors a great opportunity to hedge some risk and to own a stock that is likely to outperform as the rest of the market enters into a storm.

Disclaimer: This material has been distributed for informational purposes only and is the opinion of the author, it should not be considered as investment advice.

Fascinating, thanks for bringing this area to my attention.