Only 2 Pot Stock Warrants Warrant Your Consideration

TM Editors Note: This article discusses penny stocks and/or microcap companies. Such investments are readily manipulated; do your own careful due diligence.

This article describes how warrants work, the advantages of owning those warrants with the right metrics and the 2 marijuana companies with warrants that have those metrics.

What are Warrants?

A warrant is a security giving the holder the right, but not the obligation, to acquire the underlying security at a predetermined (i.e. exercise) price and for a specified period of time (i.e. term or duration).

Why Bother Investing in Warrants

Warrants are priced 70% to 75% less, on average, than their associated stocks and, therefore, you are in an ideal position to leverage your dollars very effectively, i.e. it gives you the opportunity to earn more dollars (in percentage terms) with considerably fewer dollars at risk.

How to Buy (or Sell) Warrants

Warrants often have very thin markets (i.e. demand) and, as such, usually have a big spread between the bid (the price at which you are willing to make a purchase) and ask (the price at which you are willing to sell) price. As such, it is imperative that you place only “limit orders” when buying or selling warrants if you want to be in control of the buying or selling price in such a transaction as compared to "market orders" which are more concerned about the speed of the execution as opposed to the price..

- A limit order has a set price and may only be executed at the set price but, that being the case, it may never get executed because the market may move away from the set price. Those who use limit orders risk not having an order executed.

- A market order does not have a set price and is therefore executed immediately at the current ‘market’ price.

When to Exercise Warrants

The Exercise Price

It is important to note that if your warrants are “in the money”, i.e. the common stock is trading above the exercise price of the warrants, and the warrants are approaching the expiration date, you must take some action. Expressed differently,

- if a warrant has an exercise price of $2, for example, you have the right, but not the obligation, to acquire the associated underlying stock at $2 at some point in the future but until it reaches that price the warrant has no intrinsic value.

- If the company were to achieve major success and see its stock price soar to $6, the warrant would have an intrinsic value of $4, since it allows you to buy stock for $2 per share, which you could then sell for $6 per share.

- The closer the exercise price is to the current stock price, the more likely the warrant is to go in the money or to expire in the money, and the more it will be worth.

The Expiration Date

This is the date at which the contract expires. After the contract expires, neither the company nor the holder have any rights or obligations associated with the warrants. If a warrant expires “out of the money,” it is worthless.

The above being the case, the further in the future the expiration date is, the more time a company has to achieve success: and the higher the share price, the more the warrant will be worth. In other words, all things being equal:

- A 3-year warrant is worth more than a 1-year warrant and a 5-year warrant is worth more than a 3-year warrant.

- Most warrants issued have expiration dates 1 to 2 years in the future.

- It is rare that valuable 5-year warrants are issued by companies.

The Conversion Ratio

The conversion ratio of a warrant is the number of shares applicable to the warrant.

- Some warrants are good for one-quarter of a share, which is known as a quarter warrant. This means you need four warrants to buy one share.

- Some warrants are good for one-half of a share (you need two warrants for one share). These are called “half warrants.”

- Some warrants are good for a full share (you need one warrant for one share). These are called “full warrants.”

Obviously, a full warrant is better than half a warrant. You want warrants that can convert into as many shares as possible.

Based on the above outline of what makes for a potentially valuable warrant below are the 2 warrants that warrant your consideration: (All dollar figures are quoted in Canadian dollars - go here for currency conversion into USD)

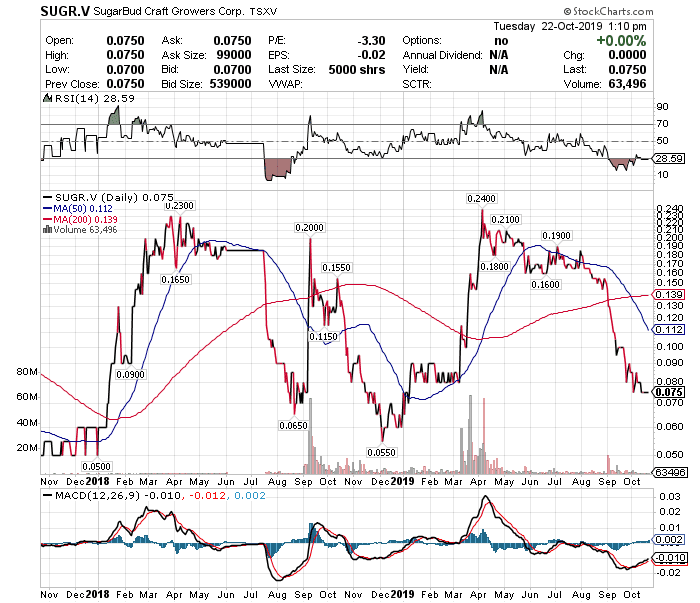

1. SUGARBUD CRAFT GROWERS CORP. (TSXV:SUGR.WT) - an Alberta based publicly traded cannabis company focused on growing hand-crafted, select-batch, ultra-premium bud. For more insights visit their website.

Warrant Details

- Expiration Date: Sept. 9, 2023 (47 months duration)

- Exercise Price: $0.10

- Current Warrant Price: $0.035

- Current Stock Price: $0.075

- Stock Price Increase Required To Reach Exercise Price: 33.3%

- Profit Realized If Warrant Bought At $0.35 and Exercised At $0.10: 185.7%

The above chart shows that the price of the SUGR stock is within striking range of the $0.10 exercise price having only dropped below that price within the last 2 months.

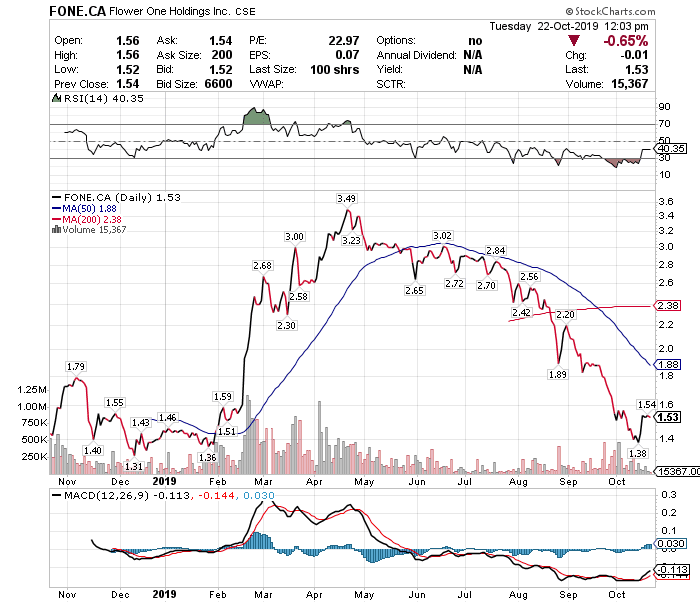

2. FLOWER ONE HOLDINGS INC. (CSE:FONE.WT; OTCQX:FLOOF) is the largest cannabis cultivator, producer, and full-service brand fulfillment partner in the state of Nevada producing a wide range of products ranging from wholesale flower, full-spectrum oils, and distillates to finished consumer packaged goods including flower, pre-rolls, concentrates, edibles, beverages, and topicals for the top-performing brands in cannabis. For more insights visit their website.

Warrant Details

- Expiration Date: March 28, 2022 (29 months duration)

- Exercise Price: $2.60

- Current Warrant Price: $0.50

- Current Stock Price: $1.53

- Stock Price Increase Required To Reach Exercise Price: 69.9%

- Profit Realized If Warrant Bought At $0.50 and Exercised At $2.60: 420%

The above chart shows that the price of the FONE stock is within striking range of the $2.60 exercise price having only dropped below that price within the last 3 months. That being said, can the price of FONE increase by 69.9% within the next 5 months?

While there are an additional 23 warrants trading, they all have expiration dates of less than 24 months so they are not listed in this article as such warrants could well expire before their respective exercise prices are met.